Don’t confuse easily measured things with importance.

Is it fair to assume that a person living in a million-dollar home in the suburbs has an enviable existence?

Maybe

Home value doesn’t equate to a superior quality of life for many.

Despite all the perks and luxuries of suburban living, isolation is becoming the rule, not the exception.

For one thing, there is no center. Everywhere you have to go, you need a car. It’s no wonder people have turned to companies like Amazon for most of their purchases—the friction in purchasing something as simple as a milk carton makes us more home-bound than ever.

Crowded parking lots filled with road-ragers tend to act as an effective deterrent.

The cycle goes like this:

Consume more

Walk less.

Drink and Vape recklessly

Replace people with phones and computers.

Judge and compare.

Binge on Netflix and Junk food

Limit social interactions

Watch our home values increase and wonder why this doesn’t move the needle.

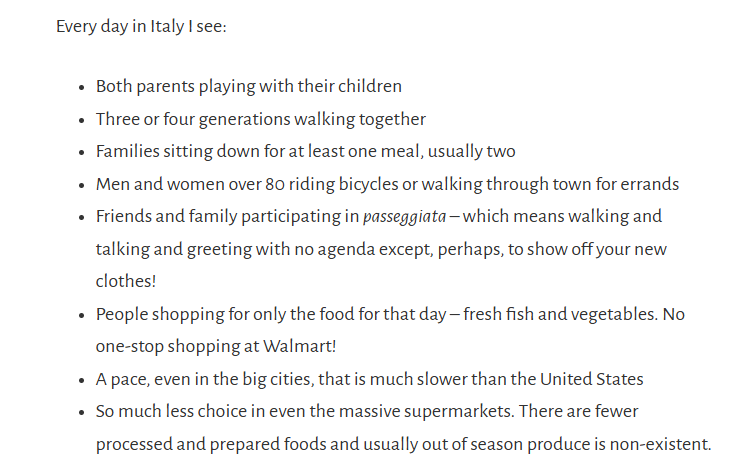

Contrast this to life in Italy.

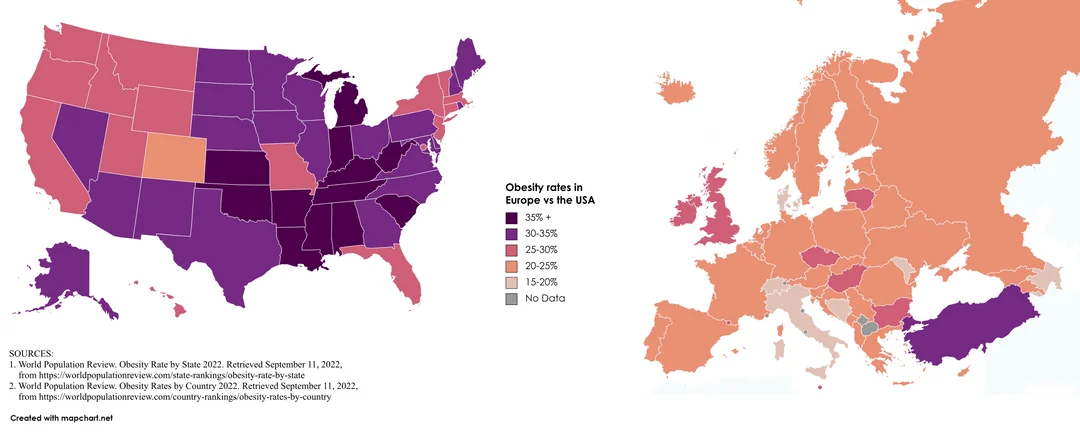

Many homes are a fraction of the size of our McMansions, yet the populace is much happier and healthier than their counterparts in the States.

Maybe this has something to do with it?

Source: Livology

In Italy, the Piazza is the center of life. Italians have little incentive to binge on TV or eat poisonous food. All the action takes place a few minutes’ walk away. Cafes, restaurants, bars, shopping, or people-watching are easily accessible. Bicycles are the preferred mode of transportation.

People interact and form connections that don’t involve likes or followers. Movement coops sedentary lifestyles. How many people do you know who’ve told you they visited Italy, ate a ton of pasta and Pizza, and still lost weight??

American suburbs contain a deep void. The same applies to financial portfolios. Most investors and many Financial Planners have it backward. Concentrating on the investments before discussing goals is a recipe for disaster.

It’s easy to see why the average investor falls victim. Monitoring success by numbers fluctuating on a screen is far less burdensome than constructing a well-thought-out lifestyle.

The reasons for many conflicted brokers and insurance salespeople posing as advisors are more nefarious. Selling the sizzle of trendy investments is child’s play compared to understanding what makes a client tick and helping them plan a life catered to their needs and wants.

Collecting commissions and focusing on the fringes instead of diving into the financial center of someone’s soul produces profits, not client satisfaction.

Wham! Bam! Thank You, Ma’am!

Bitcoin, Nvidia Stock, and Hedge Funds offer entertainment but fail to answer the question on every retirement investor’s mind: Am I going to be all right?

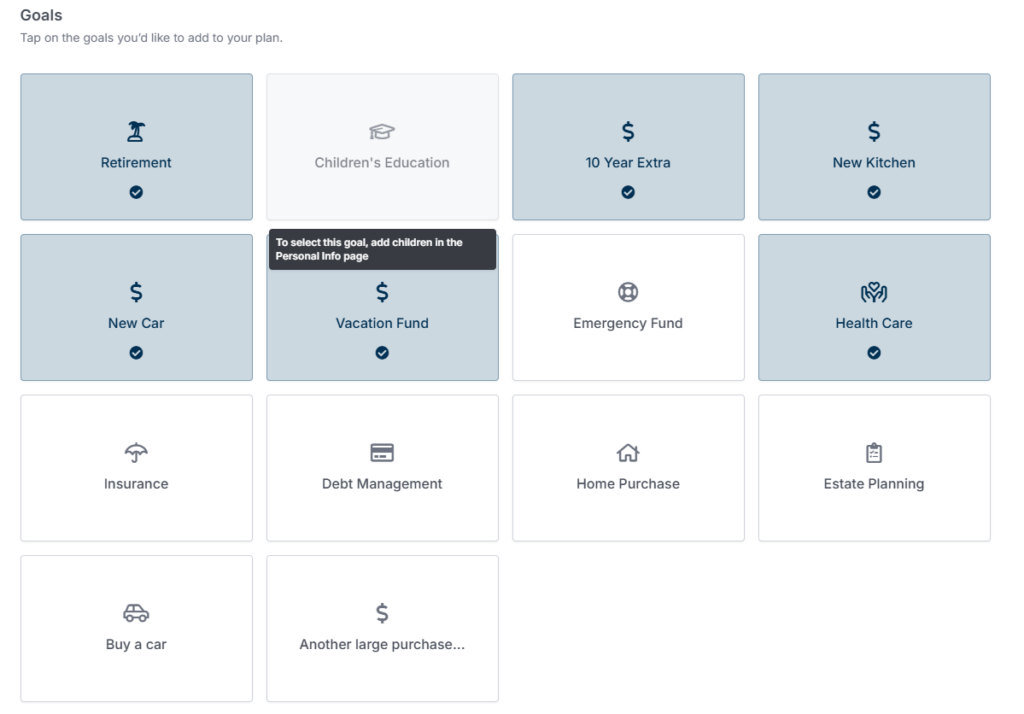

Goals are the north star of any financial plan. If your current advisor hasn’t bothered to discuss your goals or, more importantly, how to fund them, it’s time to find another advisor.

Getting caught up in market noise is nothing but a dangerous distraction.

How do you want to spend the rest of your life, and what will it cost to get there?

It’s impossible to decipher the answers to these questions if you don’t know where to look.