We can only be happy, not become happy. – Sam Harris

The crux of our joy deficit is we crave permanent bliss in a world of change.

Denying reality leads to an epidemic of dissatisfaction.

Our conventional sources of glee are unreliable. Shifting conditions guarantee disappointment, and clinging to a pleasant experience always fails.

The secret is knowing what it’s like to want nothing – easier said than done.

We seek pleasure in numerous ways, including solving problems, defending opinions, and running errands.

The problem is that there are no rest stops; no matter how hard we try, we never arrive at our final destination. We crave stories instead of accepting flow. In the words of Sam Harris:

Our well-being depends upon the shifting sands of experience and the tales we tell ourselves.

There is always a task to accomplish, and waiting for our problems to disappear is a surefire path to life dissatisfaction.

The hit HBO series White Lotus provides examples of all of the above in spades.

The lavish vacations of the mega-rich are supposed to provide the antidote to daily stress, but they often prove to be anything but.

Lavish meals, pampering attendants, and exotic settings generate more problems than they solve.

Deviant sexual behavior fueled by drugs and alcohol provides no lasting happiness. Bankruptcy, broken relationships, and death are the side effects of searching for the ultimate rest stop at the Port of Permanent Joy.

Euphoria through uber-pleasure is a poor substitute for seeking present peace. The answers lie in the space between stimulus and response, not on a massage table in Thailand.

The financial markets aren’t immune to the disconnect between our perceptions and the true nature of reality.

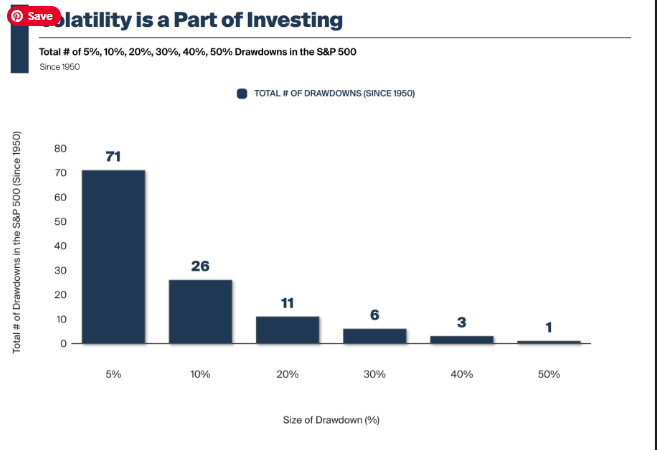

The stock market is a verb, not a noun. Incessant change is the rule, not the exception.

The reaction to the recent, typical 10% correction is a case in point. After two years of 20%+ returns, nobody should be surprised by this respite on the long-term upward trajectory.

Yet, due to our cravings for stories of permanent attachment to the good and the bad, many investors conclude the markets will never go up again despite copious amounts of evidence refuting their entrenched opinions.

In the words of Phil Knight, when you see only problems, you’re not seeing clearly.

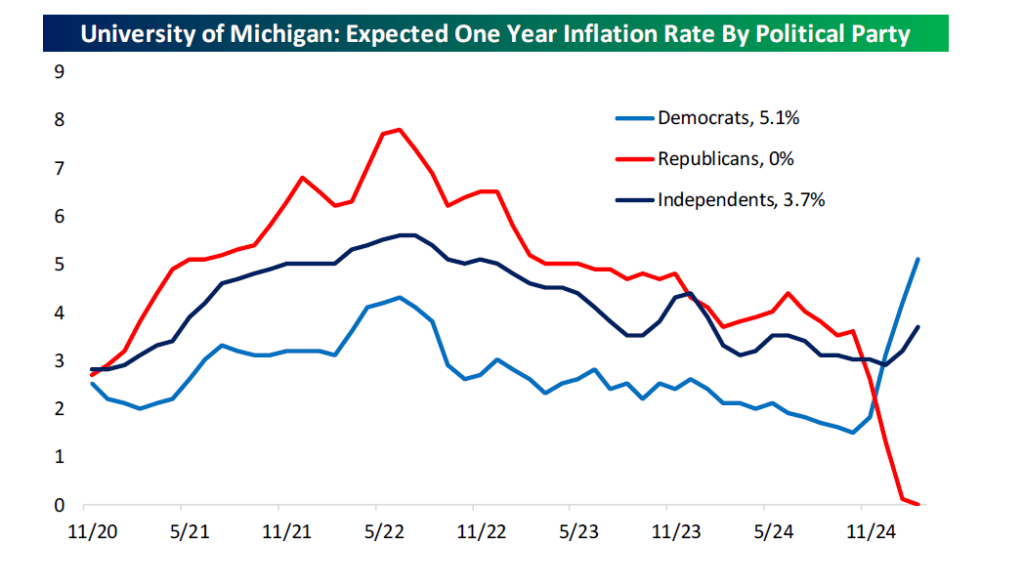

Compounding our deluded view of reality is the injection of partisan politics. Political beliefs reinforce our fixed views with a vengeance. Is it any wonder that if you ask a Republican compared to a Democrat for an assessment of fundamental economic issues, their responses are as wide as the gap when Moses parted The Red Sea?

Jason Zweig warns of the perils of mixing money with politics. Furthermore, stock prices aren’t driven exclusively by presidential policy. Inflation, interest rates, commodity prices, dollar value, wars, natural disasters, and changes in other nations’ policies are among the countless factors that can knock stock prices up or down. U.S. presidents have some control over some of those forces but total control over none.

Source: Bespoke

Relying on ever-changing markets to offer permanency in either direction is a broken strategy.

Dividends from Bull Markets arrive in the form of false happiness. The same goes for the perpetual gloom when the inevitable Bear shows its fangs. The enduring flux of financial markets and life prevents our desire for certainty to apply to our lives or portfolios.

Be grateful for what you have and take things for what they are.

Understanding the journey is all that matters and is a giant leap into reality.

Take the advice of my colleague Ben Carlson:

There are opportunity costs if you don’t invest enough for the future and opportunity costs if you don’t enjoy the present.

Make a conscious choice to be happy instead of becoming happy.

Permitting the markets to determine your well-being is forfeiting your agency over a good life.