Boredom is escalating in epidemic proportions.

Why can’t people still themselves without injections from the outside world?

Much of the blame goes to the clutches of our third hand – the smartphone. Social media apps, purposefully constructed to steal our attention, are at the heart of the issue. After all, boredom is simply a lack of attention.

We can’t pay attention to anything unless it creates a dopamine rush of epic proportions. Observe drivers at red lights, shoppers waiting in store lines, or people strolling down the street. It’s almost as if somebody has passed a law declaring it’s illegal to be alone with your thoughts. That somebody isn’t anonymous. They are the trillion-dollar Tech mogul overlords dominating our corporate landscape.

Aversion to boredom is all-encompassing but especially acute among our teenagers. There’s a reason young people have tremendous difficulty reading a book or watching a video lasting for more than thirty seconds.

The N.Y. Post targets this phenomenon in their article: The Kids Are Not All Right.

The numbers don’t lie.

According to the stats, 45% of high school seniors responded that they “agreed” or “mostly agreed” with the statement “I am often bored” in 2021, while 21% of eighth and 10th graders agreed. From 2014 data, those figures are up 37% for 12th graders and more than 13% for eighth graders and high school sophomores.

Devices are training our youth that incessant stimulation is a birthright.

Constant access to personal devices and screens — which feature “content designed primarily to capture a child’s attention and engage them as long as possible” — teach kids that “they don’t have ever to be bored,” he added.

Curiosity didn’t kill the cat; smartphones did.

Teens eventually grow up and become investors. An embedded lack of attention span is kryptonite to the iron rule of wealth creation – compound interest.Investing is simple, not easy. A precept that epitomizes this concept is a quote from Ken Fisher: Time in the market beats timing the market.

The bells and whistles that captivate young people on TikTok and other platforms are deadly for long-term investment results.

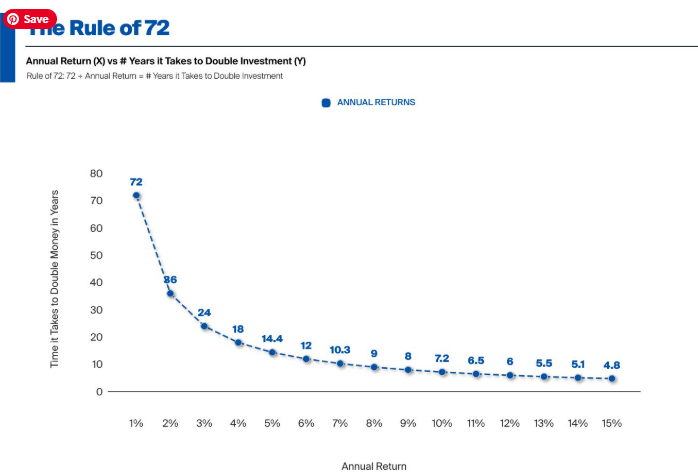

Take the rule of 72. This rule illustrates how long it takes investors to double their money based on various market returns. All one has to do is divide 72 by the expected return, and Viola, you have an idea of when your $ 5K morphs into $10K.

Newsflash: this doesn’t occur overnight, despite what some influencers may tell you.

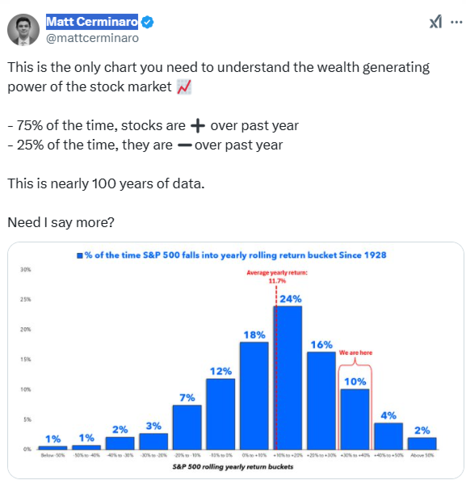

Investing is all about years and decades, not momentary stimulation. My colleague, Chart Guru Matt Cerminaro, constructed this excellent chart displaying the realities of risk vs. reward and the importance of an appropriate time horizon.

Stocks go up over the long term. Betting on daily market swings is a crap shoot. Don’t get me started on hourly or God Forbid- minute-by-minute shenanigans. We have a century of data backing up the virtue of taking the Longview. Unfortunately, slowly becoming a millionaire is boring.

Here’s some more brilliance from Matt.

Wealth creation is about delaying and compounding present pleasures into the future, not constant stimulation and engagement.

It’s OK to be bored sometimes. Here’s something most influencers won’t tell you. It might even make you rich.