Martial Arts and personal finance have heaps in common.

Success in either relies on discipline and adherence to a personal philosophy through both thick and thin.

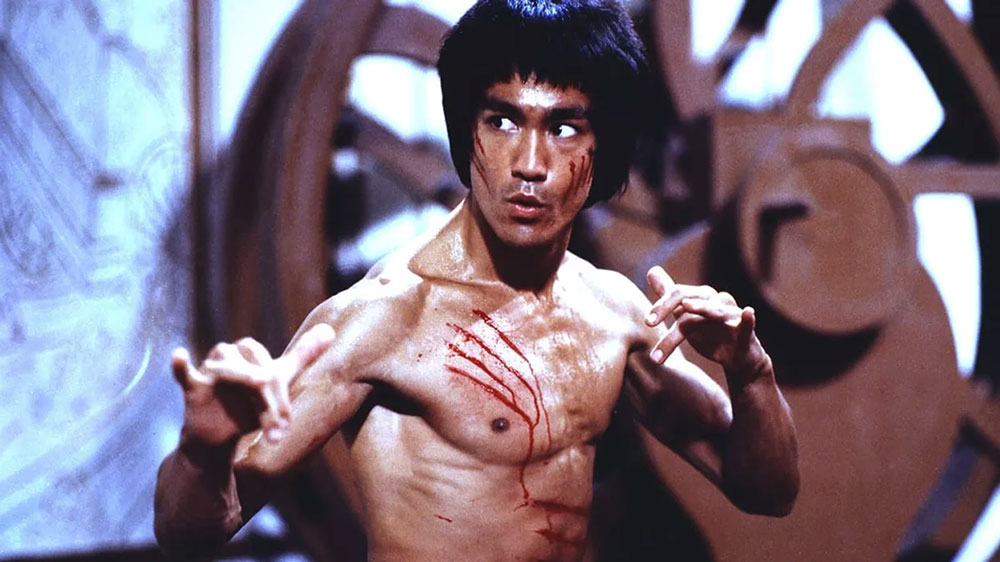

Despite passing away at 32, Bruce Lee became a cultural icon that is still revered today.

Lee’s breakout role was as Kato in the TV show The Green Hornet. Later, Bruce became an international superstar through his roles in films such as The Big Boss, Fists of Fury, and Enter the Dragon.

As a young boy, the first movie I saw on cable TV was Enter the Dragon. It was an incredible experience. Lee’s acrobatics and shrieks burned imprints into my young brain.

Lee created his martial arts style based on practicality, efficiency, and directness. He named it Jeet Kune Do.

It’s thought-provoking how Lee’s martial arts world melds seamlessly into personal finance.

Striking Thoughts, Bruce Lee’s Wisdom for Daily Living provides examples in spades.

Here are ten quotes to ponder:

Knowing is not enough; we must apply what we have learned. Willing is not enough: we must do. Save a little, and you will end up with a little. Applied knowledge is the only option for building wealth.

Learning is never cumulative; it is a movement of knowing that has no beginning and no end. If you don’t move forward, you’re moving backward. Not keeping up with tax, estate, and other finance topics destroys wealth.

The method for health promotion is based on water, as flowing water never grows stale. The idea is not to overdevelop or over-exert but to normalize the body’s function. Investing is one aspect of life where the harder you try, the less satisfactory the results are.

Self-education makes great men. Schools fail miserably in teaching students about money. Wealth Building is often a self-study program that provides enormous benefits to those willing to sacrifice to learn its building blocks.

The best techniques are the simple ones executed right. This quote illustrates the most significant reason index funds outperform stock picking over the long term: Simple almost always beats complex in personal finance.

The poorer we are inwardly, the more we try to enrich ourselves outwardly. The Hedonic Treadmill should never be part of your investment portfolio. Too many people measure their wealth on a spreadsheet instead of what fills their hearts.

Humility forms the basis of honor, just as the low ground forms the foundation of a high elevation. Overconfidence is a more significant threat to your portfolio than the worst bear market.

Prosperity is apt to prevent us from examining our conduct, but adversity leads us to think properly of our state, which benefits us. While not common knowledge, how investors behave during market pullbacks is critical to wealth creation. Investors sow Future profits during bear, not bull, markets.

Empty heads have long tongues. Media prophets of doom seek attention by scaring the crap out of you. Please don’t listen to them.

The oak tree is mighty, yet a mighty wind will destroy it because it resists the elements. The bamboo bends with the wind, and by bending, it survives. Diversification lets your portfolio bend in down markets but not break. Surviving to fight another day is a guiding principle of long-term wealth creation.

Though Bruce Lee’s life was cut tragically short, the finest aspect of timeless wisdom is that it never dies.

Yield, adapt, and be fluid. These precepts bode well for both your finances and personal life.

Be water, my friend