It’s impossible to acquire real wealth if you’re unhappy.

The reason for much of our misery is we spend too much time playing multi-player competitive games.

For example, we’re often motivated by what others think. The reality is that most people are too concerned with themselves to care much about your problems.

In the words of Charlie Munger, “Never, ever tell anyone your problems. Ninety percent of the people don’t care. The other 10 percent are glad you have them.”

Do you work out to look buff for others or gain physical and mental health?

Is your job about making as much money as possible, or is it something you enjoy doing?

Did you buy a big house to impress your friends, or was it the best location to raise a happy family?

Only you can define what truly makes you happy. Happiness is the ultimate single-player game. Since external validation is nonexistent, you compete against yourself.

Many people are so caught up in others’ opinions that they’ve forgotten how to play single-player games. They expend all their energy competing against others, leading to situations where people cannot find peace and contentment in their lives, no matter how enormous their portfolio is.

Naval Ravikant dives into why multi-player games are one of life’s biggest follies.

The reality is that life is a single-player game. You’re born alone, and you’re going to die alone. All of your interpretations and memories are alone. You’re gone in three generations, and nobody cares. Before you showed up, nobody cared. It’s all single-player.

We find things to distract ourselves to avoid facing this cold, hard reality.

It doesn’t have to be this way.

Many become materially wealthy by acquiring knowledge of the long-term effects of compounding while consistently investing in a diversified index-based low-cost portfolio.

Some amass a knowledge base about acquiring income-producing real estate properties. Others ripen skills needed for developing entrepreneurship and starting a business.

Proper habits generate material wealth. The same formula works for happiness.

Happiness is a learnable skill.

Building good habits is integral.

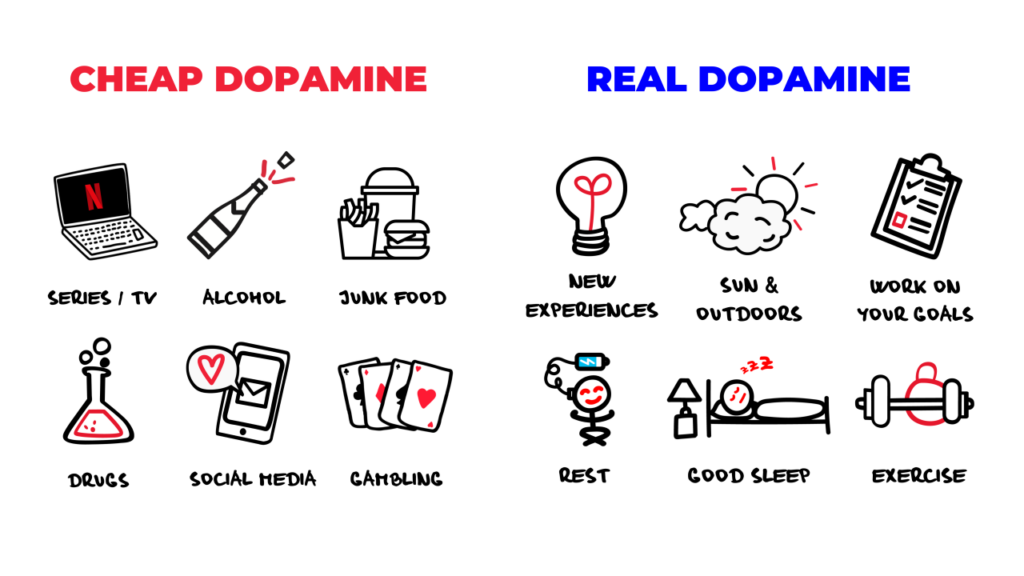

Start by eliminating short-term dopamine hits.

Source: Adela Schicker

Your mood determines your happiness. Sugar, alcohol, social media, and video games are short-term happiness boosts. Long-term wellness depends on limiting these activities to stabilize your psyche.

It’s not easy, but a materially rich but spiritually poor person can turn things around by dedicating themselves to single-player rather than multi-player games.

Ravikant summarizes the game plan.

Essentially, you have to go through your life, replacing your thoughtless bad habits with good ones and committing to being a happier person. At the end of the day, you are a combination of your habits and the people you spend the most time with.

Meditation, music, exercise, and getting outdoors are a terrific start.

Thinking more stuff brings joy flies in the face of all the data regarding hedonic adaptation. The good news is that studies show that hedonic adaptation is more potent regarding manufactured things (Houses, Clothes, Money) than natural things. (Nature, Exercise)

Don’t consider this a selfish exercise. If you’re unhappy, the people you spend the most time with will suffer equally.

Competing against yourself is pivotal for attaining real wealth.

Don’t let others entice you into playing a game with no victors.