Goals and habits are two different animals.

This philosophy is valid in all facets of life.

When I taught Middle School, Back to School Night was more of a dog-and-pony show than anything else. What meaningful things can you say about education in 12 minutes?

The key to success was speaking for the entire time. Random questions often had the effect of lobbing a hand grenade into a tense mob. You’d be surprised regarding the inappropriate topics that could tossed out there.

Trying to make the most of repeating the same spiel five times called for a new trick.

Parents obsess about grades. By missing the forest and not looking at the trees, they often impart a disregard for a love of lifelong learning into a cheap dopamine high of a high quiz grade on their hormonal impressionable children. Just get the answers right—by any means necessary.

Emotions overwhelm common sense. I needed to throw a Hail Mary to calm their anxieties about their eighth-graders 85 average, which was sabotaging their often delusional dreams of attending Harvard.

Surprisingly, this got their attention.

If your child comes to class every day properly prepared, asks questions or attends extra help, does their homework, and refrains from most distractions regarding discovering the opposite sex, the grades will take care of themselves.

Inverting their fears provided agency. Follow proper standards and let nature take its course.

The following applies to many aspects of life. If you lift weights three times a week, walk 8-10k steps daily, get proper sleep, hydrate, and consume a gram of protein daily for your ideal body weight, the weight loss will take care of itself. Standards win again.

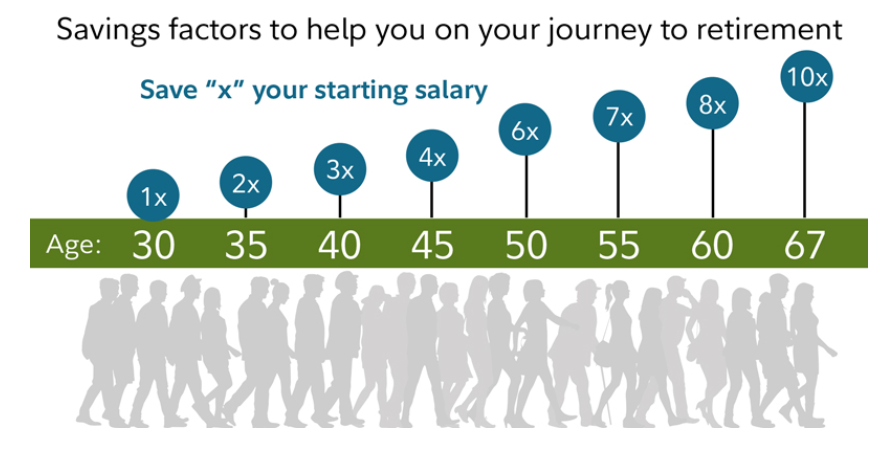

Personal finance is no different. Everyone wants to be a millionaire, but unfortunately, they put the cart before the horse. Following some basic standards is a far more efficient strategy than obsessing about how much money you should have according to your age according to a chart.

Source: Fidelity

Here are some simple guidelines to follow.

- Don’t lose all your capital. Your brother-in-law’s restaurant idea might sound enticing, but there’s an excellent chance you’ll end up with a large tax-writeoff, not compounding wealth. Markets recover, but emotional money decisions do not.

- Hang around growth-minded, positive people. It’s challenging to get ahead when surrounding yourself with bitter, angry individuals who enjoy your failures to make themselves feel better about their unsatisfactory lives.

- Set a regular savings schedule and increase it by 1% annually. Start by saving 5% of your income; in 5 years, you will double what you stash away. Success breeds success, and this will likely become a lifelong habit.

- Acquire skills. It’s hard to save money on a low income. The more technical skills you possess, the more people will compensate you.

- Set aside some fun money. When temptations arise, limit their damage. Sports betting, Meme Stocks, Crypto—these seductions will never disappear. Make sure whatever funds go into these distractions is money you can afford to lose. (You’ll probably lose it all.)

- Don’t sweat the small stuff. Starbucks isn’t keeping you poor. Things like paying too much in taxes or having a high-expense retirement plan are more likely the culprits of wealth destruction. Focus on big-picture items, not coupon clipping.

- Stay Optimistic. There’s no point investing long-term if you don’t believe in a brighter future. There will be many ups and downs, but having faith in human ingenuity is a winning bet.

What you do every day is more important than lofty goals on a piece of paper.

Consistently doing the right things is an unstoppable compounding machine.