It’s not easy doing Nothing.

Despite what many people think, not changing a thing can be the solution to attaining health and wealth.

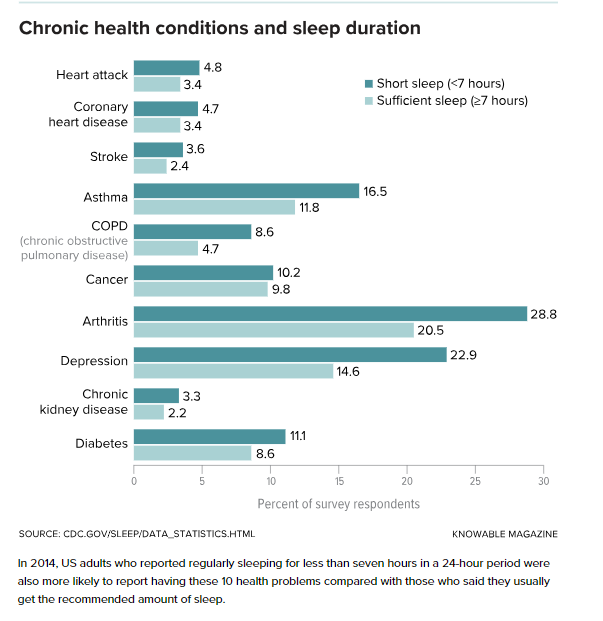

Take a look at sleep. While exercise and diet are vital wellness ingredients, the best-laid diet and workout program collapse like a house of cards without proper rest. Sleep is essential for physical and psychological health.

Sleeping pills aren’t the answer. There’s a vast chasm between proper rest and sedation.

Millions of Americans suffer from insomnia and other sleep disorders. According to the Centers for Disease Control and Prevention, about one in three adults in the United States reported not getting enough rest or sleep daily.

Insomnia doesn’t just harm those suffering from its effects. As many as 1.550 deaths and 40,000 personal injury accidents find drowsy drivers as the culprits.

Surprisingly, despite the siren song of advertised sleep aids, there’s an unconventional solution for those afflicted with a lousy night’s sleep—Do Nothing.

Dr. Matt Walker recently discussed this counter-intuitive technique on Andre Huberman’s podcast. (You can listen to the whole podcast here. This post is just the Cliff-Notes version)

When people have a crappy night’s sleep, they tend to change their behavior the following day radically. Solutions include drinking prodigious amounts of caffeine, taking a mid-day nap, or going to bed earlier than usual the following night. These strategies seem to make sense, but Dr. Walker says they’re worsening a bad situation. Your body needs to reset to get back to normal. These tactics interfere with your Circadian rhythm and prolong the problem by throwing your system out of whack.

Doing Nothing but gutting out your day will help you reset and get back to normal—yet another simple but not easy solution to a complex problem.

Speaking of simple but not easy, let’s examine how this strategy applies to sound investing.

Bad things happen in our world, and they always will. Winston Churchill agrees. “The story of the human race is war except for brief and precarious interludes. There has never been peace in the world, and before history began, murderous strife was universal and unending.”

Why would you think your portfolio is immune to the ceaseless carnage?

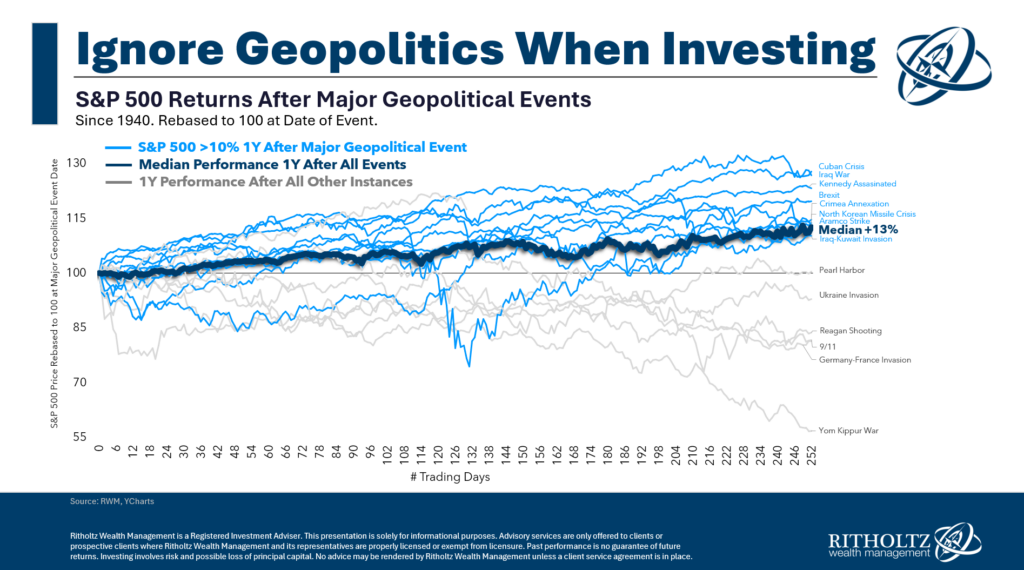

My colleague Michael Batnick provides the answer.

The bottom line is that The world is scary—it always has been and always will be. Do not let that come between you and your portfolio.

The Middle East is a smoldering tinder-box of ethnic and religious hatred. Unfortunately, terrible events explode out into the open, as we have observed over the last year (And the previous 70)

When this bloodletting occurs, it’s perfectly normal to want to change your investment portfolio dramatically. While a nap after a rough night’s sleep may feel good temporarily, it’s sabotaging the long-term goal.

The same goes for changing your financial plan based on disturbing Geopolitical events.

Here is the paradox: It’s harder to leave plans unchanged while others scream the world is on fire. Taking action is easy; doing Nothing takes work but provides long-term rewards.

As Michael Batnick opines, Volatility is a necessary evil.

Unlike trying to correct a stormy night’s sleep, in this case, your best choice is taking a nap and ignoring the temporary hysteria.

When in doubt, default to a less is more strategy regarding your retirement portfolio.

Doing Nothing doesn’t feel good.

Temporary discomfort beats chronic portfolio pain.