It’s not what you spend; it’s what you spend it on that matters.

Recently, we flew to California for the FutureProof Festival sponsored by our firm.

The trip going was a non-event. The return flight was a game-changer.

For the first time in thirty years, I flew Business Class.

I didn’t realize how crappy the commoners like myself are treated until now.

A water bottle, pillow, blanket, and compression socks were waiting. This was just the start. Orange Juice, Salad, Dinner, Ice Cream, and Cookies soon followed. This didn’t encompass copious amounts of alcohol, which my distant neighbor took full advantage of.

Never mind that a skinny person could survive twenty days without food, but I digress.

Having my ass kissed on a plane brought mixed emotions. I found it disturbing how the attendants fawn over their wealthy clients while some people in the back of the aircraft could die, and their corpses might not be noticed until landing. It didn’t stop me from taking in the whole experience.

The flight attendant had an easy time. The complimentary water bottle lasted the whole flight, and I brought my snack. The spacious seating overwhelmed all creature comforts. It was all I could focus on. Everything else was playing with house money.

It was a fantastic experience. It won’t be easy to quit this habit.

The cost for the upgrade was a remarkable deal of $200. Honestly, it was worth five times as much.

This experience is piggy-backed on what I constantly tell clients. “If you don’t fly in style, your children certainly will.”

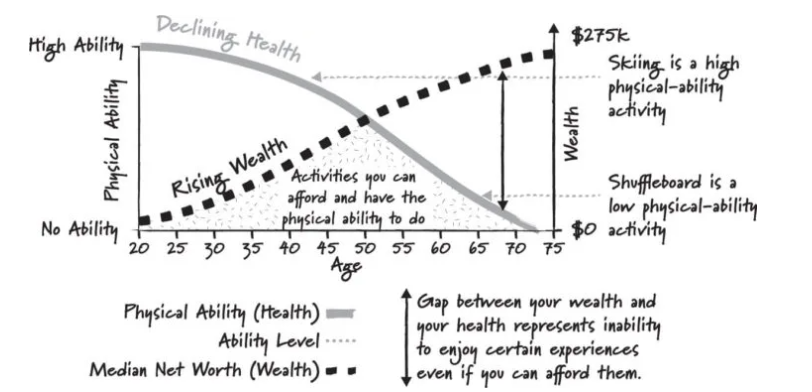

As we age, our wealth tends to grow, but our time shrinks. Maximizing time must be the priority.

Source: Die With Zero by Bill Perkins

Six Bravo says it best. For most people, money isn’t the goal but instead, being able to spend our limited number of days as we deem best and with those we love most.

Turning seven hours into pleasure rather than misery is an optimal example. We’re playing a game where we can’t see the clock. Making up your own rules is the only logical strategy.

At the top of the list are upgrades that exponentially increase enjoyment.

On the other hand, too many people ignore creature comforts and decide to spend their funds on investment management while they fly in the steerage.

Talk about a misallocation of resources!

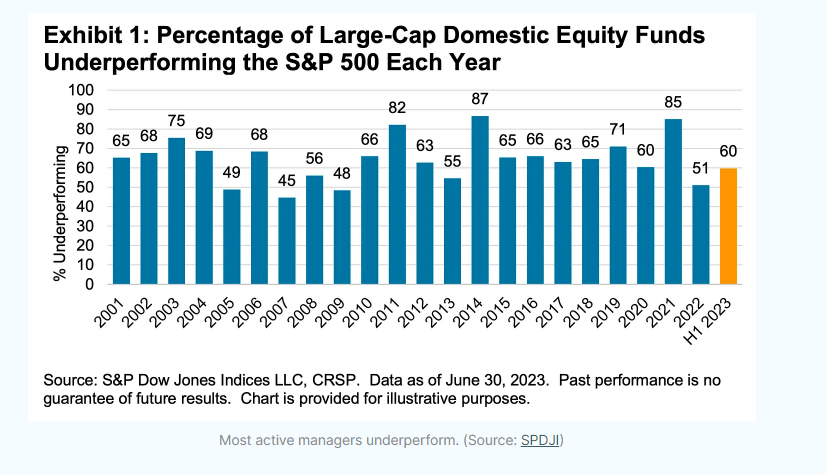

SPIVA comes out with an annual report that analyzes the pros and cons of active vs. passive investments, like low-cost index funds.

Unlike flying business class, you get what you don’t pay for in investing.

Most active managers underperform most of the time.

Most institutional managers underperform most of the time.

The tendency for underperformance typically rises as the observation period lengthens.

These conclusions are robust across geographies.

When good performance does occur, it tends not to persist. Above-average past performance does not predict above-average future performance.

Source: TEBI

Finra came out with another study with not-so-surprising results.

Investors who give high self-ratings to themselves regarding their investing acumen pay more in fees than those with less self-confidence and more self-awareness.

On average, investors rated their investing knowledge at 5.43 on a scale of 1.0 to 7.0 and paid 4% or more in fees, while those who placed their investing knowledge at a lower level paid less. For example, those who put their knowledge at an average level of 4.96 reported paying fees of under 0.5%.

“This new study gives us even more evidence that bolstering investing knowledge, while also helping investors understand the potential limits of their knowledge, is vital to improving investors’ outcomes,” said Gerri Walsh, president of the Finra Foundation. “As the financial landscape becomes more complex with product offerings and investment choices, it remains important for investors to understand the relationship between fees and returns.”

Unfortunately, many investors sacrifice relatively minor guaranteed pleasures while ignoring long-term significant costs that compound over time.

Going to Starbucks daily is much cheaper than owning a highly-priced, actively managed fund that is almost assured to underperform a cheap market index fund over long periods.

Remember, one size fits one. Justification isn’t necessary if something gives you joy and adds value to your precious time.

Spend wisely while you still can.