You are what your coping mechanisms say you are.

Bad things happen; what matters is how you react to them.

Learning to cope with personal and financial turmoil is worth more than a four-year college degree.

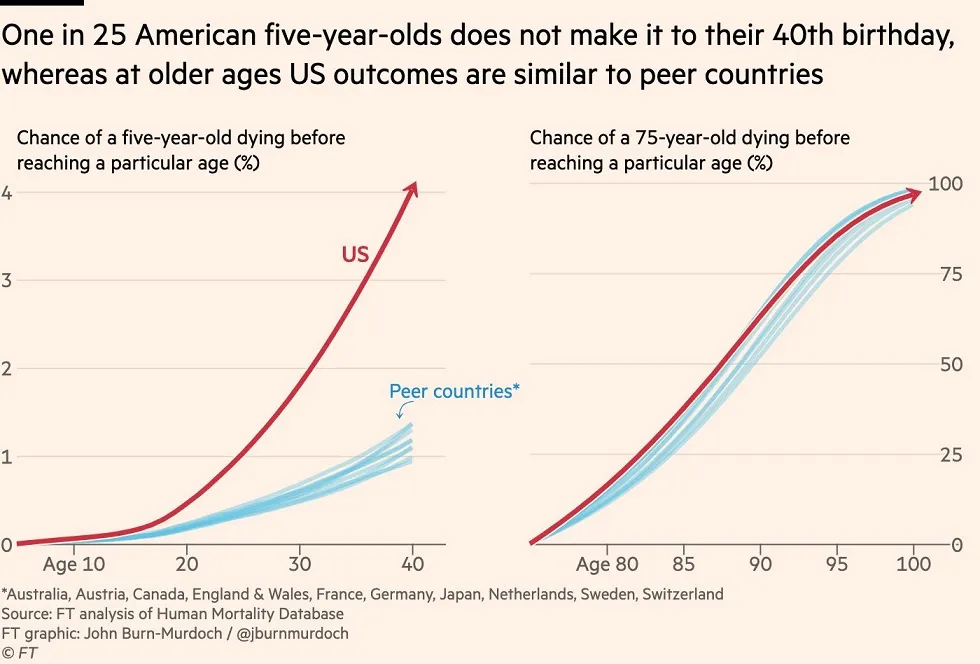

Americans suck a coping. In comparison to other wealthy nations, Americans die a lot younger. Surprisingly, this gap is generated by a surprising source- Young People. Our nation’s youth expire more than their peers in comparable countries.

According to Noah Smith, an American 29-year-old has a chance of dying that’s a startling four times higher than a British 29-year-old.

Smith has an interesting theory for this sinister statistic.

What makes Americans die at much higher rates? It’s pretty simple to break down the international mortality differences into specific causes. The answer boils down to some combination of:

- Obesity-related diseases (cardiovascular disease, diabetes, etc.)

- drugs and alcohol

- smoking

- suicide

- murder

- car accidents

We choose horrendous ways to cope with our anxiety from life’s inevitable setbacks.

Americans have an unfortunate habit of viewing suffering as something unique to them. This creates many problems. Consuming various intoxicants as a temporary pain reliever is pervasive. Blaming others for the inevitable downswing of life also falls into this camp.

We can partially point at modern technology for our unhealthy ways of coping with suffering. The level of physical comfort generated by technological breakthroughs in every aspect of our lives has made suffering much less visible. Instead of viewing suffering as a standard component in the game of life, we tend to view it as something that’s gone awry.

Somehow, we’ve evolved into believing that we have some contractually assured right to happiness. Anything that violates this code is seen as a s system failure.

God forbid our seat warmers in our car fail in winter!

We blame these glitches on the government, the educational system, parents, dysfunctional family life, etc.

Suffering isn’t an anomaly. It’s the way it is. This may not make transitory problems feel better, but it will lead to healthier coping choices.

What does this have to do with your finances?

Imagine looking at market corrections as a standard component of the financial markets. This attitude is a game-changer regarding making costly emotional decisions regarding your retirement portfolio.

Delaying purchasing life insurance because you don’t want to Jinx Yourself becomes laughable when you accept suffering as part of the game, not bad luck.

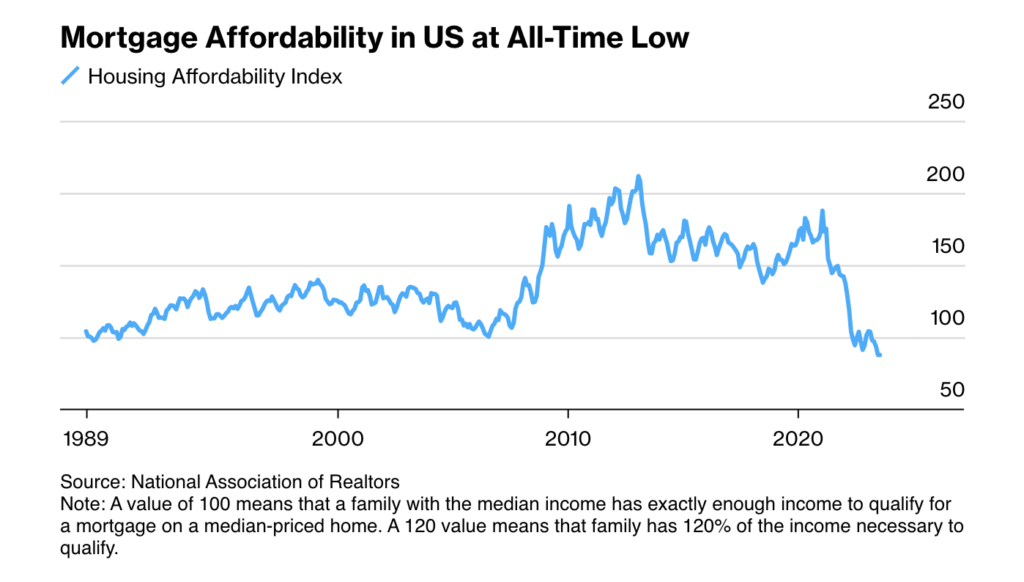

In 2023, many young people will be shut out of purchasing a home due to high-interest rates and exorbitant housing prices due to low inventory.

This is a real problem and shouldn’t be taken lightly. It’s terrible that young people can’t purchase a home to raise their family.

The question becomes how should they cope with it.

Blaming the Federal Reserve, Baby Boomers, and the President might feel good, but will it help solve the issue?

Accepting that Interest Rates will stay high FOREVER is an unproductive strategy. Doing nothing but complaining or feeling sorry for yourself won’t fix the problem.

Instead, perceiving this as a normal phase of a long-term economic cycle is a healthier way to cope.

Increasing savings while waiting for the eventual easing cycle, exploring creative financing options like family loans, or looking for more affordable states to live in are not ideal solutions. Still, they’re a far healthier alternative than raging at the machine or denouncing yourself for a cyclic situation beyond your control.

Accepting the inevitable Time-Bombs of life isn’t easy, but the alternative is worse.

C.S. Lewis once said The Gates of Hell are locked from the inside.

Learning healthy ways to cope with life’s inescapable problems is the ultimate wealth generator.