Your thoughts are your worst enemy.

The bad news: Data suggests we have 10,000-20,000 thoughts daily.

The good news: We forget about 99% of them.

George Mack gives a terrific analogy.

When you hear transient thoughts in your head, it’s easy to take them seriously, especially negative ones. The human thinking experience is like meeting 10,000-20,000 people per day and worrying about each interaction, but then barely remembering anyone the next day.

Using this knowledge to your advantage is imperative. Getting caught in rumination is not.

When stressing over the constant drumbeat of anxiety and negativity in your brain, it’s important to step back and take a deep breath.

Your superpower involves one question.

Will you remember this thought tomorrow?

Comfort yourself with the answer- No.

Why do we have so many competing thoughts racing through our minds?

James Low has an interesting theory.

Something is missing in our lives and we don’t quite know what it is, but we keep looking and looking to find the missing part. We can look for in terms of possessions. We can look for it in terms of the form of our body, trying to change it through dieting or hairstyle or whatever. You can look in terms of friends. Anything. And this keeps us very, very busy.

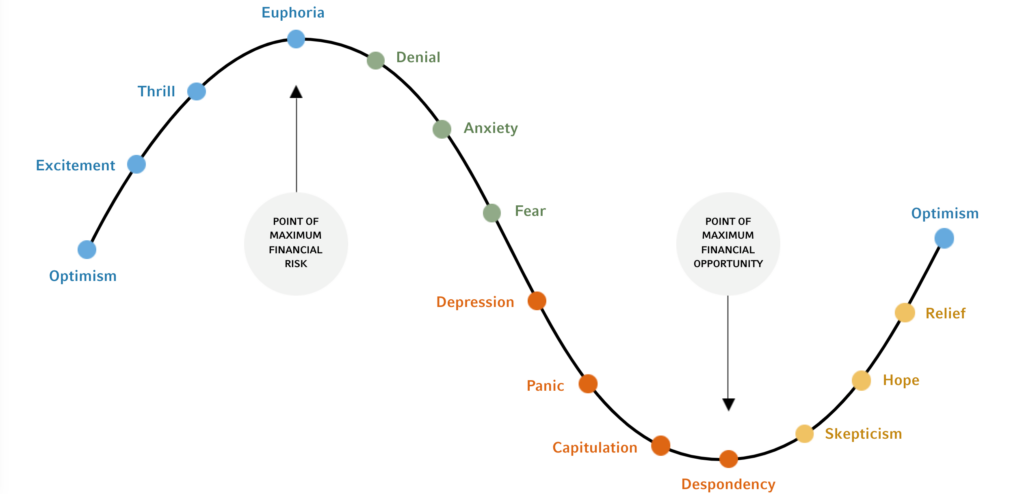

Few things are worse for wealth creation than having a distracted, hyper-active mind.

Some of those 20,000 random thoughts often focus on:

Monthly Economic Stats that will be revised numerous times.

Quarterly earnings report with massaged numbers to meet analyst’s expectations

Conflicted viewpoints on 24/7 financial media stations

Following Billionaires’ latest investments even though their time frame and goals are in a different stratosphere than yours.

Looking at the latest and greatest for instant wealth creation

Waiting until the world becomes “peaceful” to allocate resources

Investing money motivated by inflamed political passions.

Taking market predictions seriously

Wasting money on market newsletters focusing on scaring the crap out of you.

Social Media is a feeding ground for our worst impulses. The Contessa Counts throws out ways our infinite thoughts sabotage our finances.

There are a bunch of things we don’t know and can only plan for in the sense of building as much flexibility as possible into our finances: things like what will happen with the economy and our individual job security. Who the next Speaker of the House will be (eye-roll) and whether that will impact our taxes or civil liberties. What the planet will look like in twenty years. How many years we have left to do all the things we want to do? How the financial markets will behave and whether they will repeat the patterns of the past.

The best antidote for our monkey minds is our inherent forgetfulness.

If we put a 24-hour pause on our immediate impulses, we allow compounding time to do its thing.

Misplacing car keys and forgetting phone numbers are a tiny price to pay for wealth growth and preservation.

Be thankful we fail to remember our thoughts.

It may be the only thing keeping us from going insane or bankrupt.