Ignoring a problem is an indisputable method to fail a stress test.

Metabolic flexibility is the body’s ability to adapt to a change in eating habits. Strong metabolic flexibility is a sign of exceptional health.

For example, what this signifies in the real world is the capability to work out in the morning without ingesting any fuel. A second marker is handling over-the-top high-fat/sugar foods without becoming ill.

Kelly and Juliet Starrett summarize things in their invaluable book, Built To Move.

Choose the best possible fuel whenever possible. But we are also built to be omnivores and able, when necessary, to eat what’s available. The body is not as sensitive as you might think.

The Starretts recommend The Frappuccino Test as a means to measure metabolic resiliency. Frappuccinos are a sugar bomb. A twenty-four-ounce cup has 59 grams. Certain flavors go beyond this obscene amount.

After consuming a sugary liquid, glucose levels spike. The Pancreas responds to stress by sending insulin to clear glucose from the blood and help it enter other body parts where it’s used as energy. In a healthy body, this lowers glucose levels, and the body returns to normal functioning.

If you fail this stress test, your glucose levels remain high, a sign of insulin resistance. Your pancreas responds by pumping out more insulin, which loses its effect over time and eventually results in type 2 diabetes.

Someone who fails the test will feel irritable, nauseous, jittery, or spacey. These are signs of metabolic inflexibility. You are most likely metabolically flexible if you can resume normal activities without any issues.

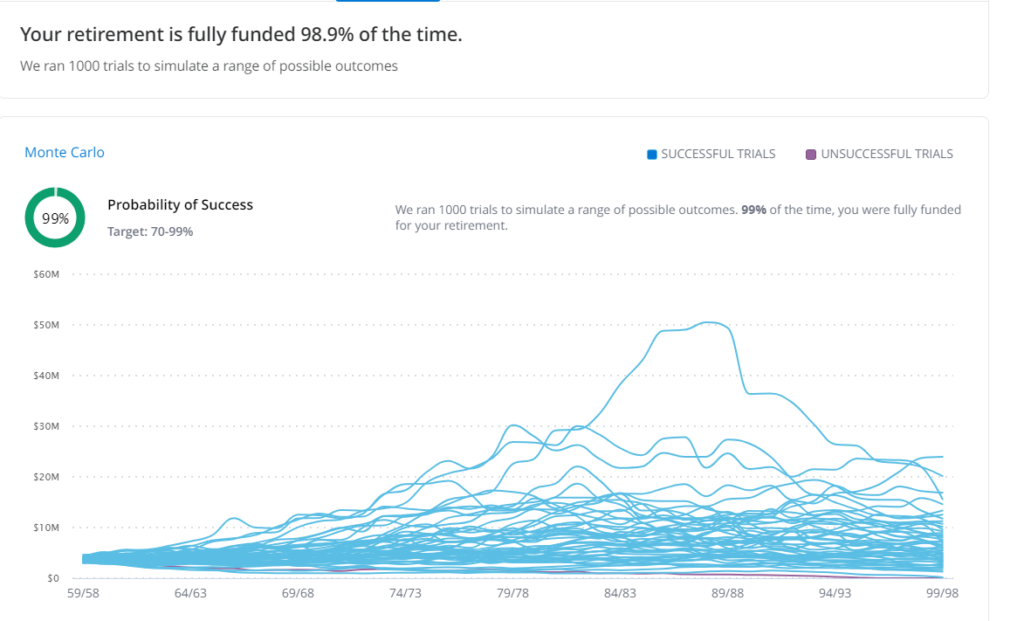

Investors can expose their retirement portfolios to a financial version of the Frappuccino Test. It’s called a Monte Carlo simulation.

A Monte Carlo stress test defers a portfolio to numerous market environments. This is significant because so-called “average” returns are a rare event. After cycling through hundreds or thousands of various market conditions, it gives a probability success rate regarding achieving an investor’s goals. A high score signifies success, while a depressed score means you must ramp back spending, increase savings, or go further out on the risk scale to attain long-term objectives.

While this strategy isn’t perfect, it provides vital data to choose the right portfolio for a goals-based financial plan.

These include:

- Risk Assessment and Management: By running through numerous simulations, investors can get a firmer grasp of the expected range of outcomes. This data is indispensable for adjusting strategies to mitigate potential losses.

- Realistic Performance Expectations: Assuming constant market returns is unrealistic and precarious when constructing a financial plan. Injecting volatility into the equation furnishes greater accuracy in future return projections. Clarifying possible future market environments increases the chances of investors sticking to a long-term strategy rather than bailing out at the worst possible moment.

- Tailored Asset Allocation: Monte Carlo simulations enable investors to try different models before committing to a strategy. It serves as a wake-up call for those who formerly considered themselves risk-averse or vice-versa.

As Paul Bamikole once said: “Adversity is the poison that cleanses the system, making it stronger.”

Stress now or stress more later.

The choice is yours.