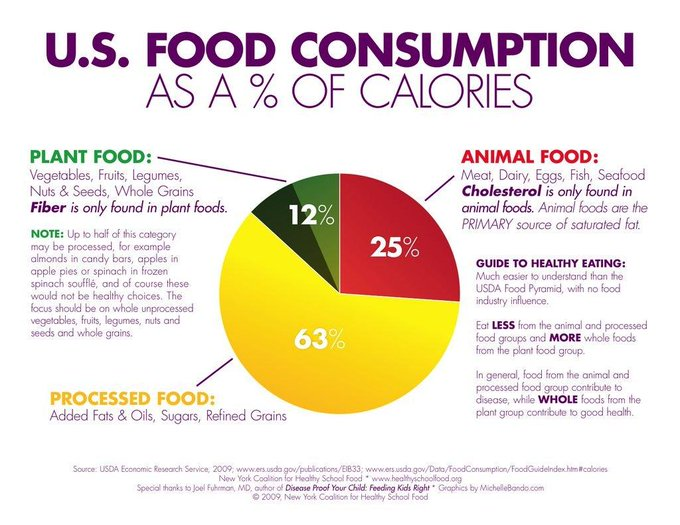

Too much junk has no place in your body or portfolio.

Empty calories are an enormous waste of energy.

When consuming food containing little or no nutritional value, the body compensates by eating more.

There’s a reason it’s easy to wolf down copious amounts of chips or donuts. Your body fails to receive the nutrition it needs and overcompensates by eating more and more food.

The problem is compounded by food engineers who load these products with fat, salt, and sugar to sabotage your taste buds. These injections turbocharge eating. Combining nutrition-deficient food with sugar, salt, and fat is empty-calorie heaven.

Empty calories can be described as irresistible taste temptations bereft of nutritional substance. They are calorie imposters while satisfying the plate but contribute little or no essential vitamins, minerals, or essential macronutrients to the body. Their monetary pleasure isn’t worth the long-term pain of chronic disease.

While living in the Savannah, a sweet tooth served us well. Sugar cravings motivate humans to eat healthy fruit. In modern times, not so much. Weaponized sugar creates false feelings, telling us something is good when it’s not good for us.

There’s a reason why people aren’t compelled to eat a dozen bananas or five pounds of spinach. We stop because our bodies’ needs are satisfied by these nutrient-dense foods. This is the exact opposite of what happens with empty calories, where satiation is almost impossible.

Our nation is suffering from an obesity epidemic fueled by empty calories. The trend is not our friend.

Unfortunately, many investors gorge on products and advice that provide little substance but heaps of long-term pain. The following nutrition-deficient financial habits are a recipe for chronic financial misery.

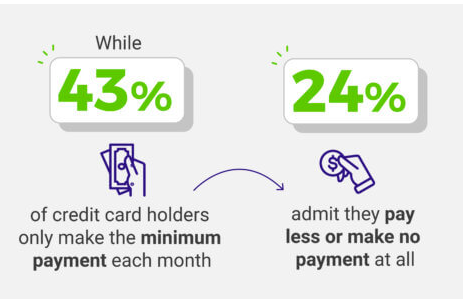

- Paying Only Minimums: Making minimum credit card payments leads to accumulating high-interest debt over time.

- Neglecting Savings: Failing to prioritize saving money for emergencies or future goals.

- Ignoring Budgeting: Operating without a budget is similar to indulging in financial junk food without mindful portion control.

- Gambling or Risky Investments: Engaging in speculative investments without proper research or risk management.

- Frequent Late Fees: Paying bills past due dates leads to unnecessary penalties and wasteful expenditures.

- Ignorance of Financial Literacy: lack of knowledge and understanding of personal finance, preventing wise financial decision-making.

- Keeping up with the Lonses: Spending to impress others or maintain a particular lifestyle even if it strains your finances.

- Living on Borrowed Money: Relying heavily on loans and credit leads to a debt cycle and financial instability.

- Overusing Subscriptions: Accumulating numerous subscription services without fully utilizing them, wasting money on underused resources.

- Impulsive Spending: Splurging on unnecessary items without considering their long-term value or impact on financial goals.

Source: study finds

Empty calories generate momentary satisfaction but lack nutritional value. Immediate financial gratification through mindless spending, borrowing, or speculation has the same detrimental impact on your long-term economic well-being.

Conflicted financial salespeople serve the same masters as empty-calorie food engineers. Their profits are your losses.

Eliminating junk food and bad financial habits from your life is addition by subtraction.

Take heed of these wise words from the OG of health and fitness, Jack LaLanne:

An empty portfolio provides zero retirement nutrition.