If you don’t know who the sucker is at the poker table – it’s probably you.

College Admissions is a high-stakes poker game. It’s one of the few industries where consumers purchase a product but don’t know the final price.

Schools offer two types of aid, need-based and merit. Need-based aid is based on a formula considering parent income and assets. Merit is another story. Everyone is eligible for Merit Aid, but the rules are unclear.

Secret Algorithms based on the school’s revenue projections determine how much each applicant receives, if anything. The algorithm changes yearly, making it hard for parents to decide on their financial aid package and raising the stakes for uncomfortable conversations and disappointment if expectations aren’t met.

Schools post net-price calculators on their websites, but many leave much to be desired.

Colleges deny the game is rigged.

According to the Wall Street Journal:

Schools often try to limit confusion and negotiation by making their best offer first.

“At Marquette, we try to be clear and upfront and not create a game,” said Dean of undergraduate admissions Brian Troyer. Marquette’s website says less than 2% of financial-aid appeals are accepted.

Lori Greene, Butler University’s vice president for enrollment management, echoed that sentiment in an email: “Our best aid offer is provided upfront.”

Parents beg to differ.

What’s the best way to deal with the lack of transparency in higher education admissions?

Negotiate.

An appeal is the preferred verbiage to play nice and increase the chances of schools doling out money. You’re not buying a used car, always be respectful. According to Collegedata, about 1/3 of students without need received a merit award totaling around $23,500.

Playing poker with the Devil isn’t as complicated as it seems if you know the rules. College is a buyers market except for the elite schools, with many struggling to fill their first-year classes.

Rule#1 – Don’t accept their first offer despite what schools might say. For 90% of schools, submitting an appeal with competing offers from similar schools is the way to go—no downside with much upside.

How should you formulate an appeal strategy?

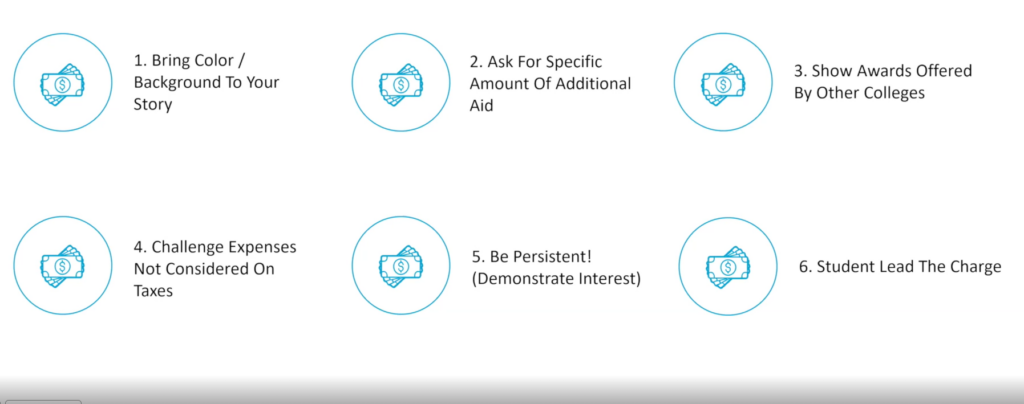

Source: College Aid Pro

Attaching competing offers to the email is the first step. Facts and numbers never hurt your cause. It’s essential to involve the student in the process. Letting your child craft the email makes the appeal more authentic. Colleges want the student to love them.

Schools want to make sure you accept their offer, so stating why this particular college is your first choice makes a big difference. Good storytelling is an underrated superpower. There are few better places for a young person to hone this skill than creating a college appeal letter.

Chances of success increase extensively dealing with private colleges with large endowments compared to more Spartan state schools. Keep this in mind when deciding to appeal.

Be specific in your ask. This shows the thought put into the process and the seriousness of your appeal. Don’t forget to mention any unexpected expenses that may have come up since colleges only go by the FAFSA form, which looks at two years prior taxes.

If you’re appealing a Merit Aid award, contact the Office of Admissions. Needs-based requests should be sent to the Financial Aid Department.

Few pay the sticker price for college admission. Brookings elaborates- First, we need better information regarding college costs specific to individuals’ financial circumstances. The focus on sticker prices is perhaps understandable since institutions are required by law to report it annually. Net prices are specific to the individual, and generating that information is difficult. Finding better ways to report and track net price is sorely needed.

Despite conventional wisdom, the Devil doesn’t always win.