It’s often not what you do. It’s when you do it that counts.

This advice applies to your health and wealth.

Time-restricted eating fits into this category.

In a nutshell, the main point is restricting food intake to certain times of the day. Many find an 8-12 hour window compelling. An example of this schedule is eating between 10 a.m. and 6 p.m. The remaining 16 hours is your fasting period.

There are numerous health reasons for following this protocol. Limiting consumption to specific hours decreases calorie consumption, the key component for weight loss.

Eating before bed agitates sleep patterns. Time-restricted feeding can be part of the remedy for sleep disorders. Not eating three hours before sleep lowers body temperature, a powerful component of a good night’s rest.

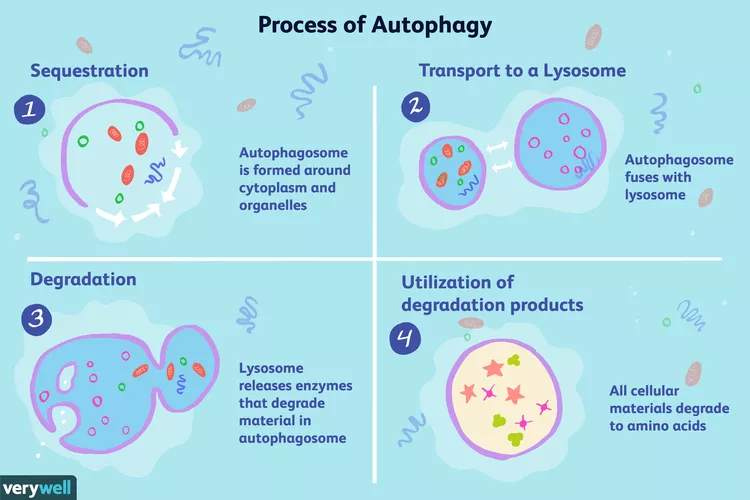

Fasting allows the body to go into a state of autophagy. Instead of focusing on digestion, the body can “self-eat.” Cleaning up dead cells and repairing damaged ones is vital for optimal health. Eating all day long blocks the process.

Andrew Huberman discussed a groundbreaking experiment on his podcast. Two sets of mice were given a diet consisting of fat and sugar-laced food. The difference was that one group was allowed to eat incessantly . Feeding time was restricted to a few hours a day for the second group.

Despite eating the same amount of calories with equivalent nutritional content, the mice permitted free reign became obese and developed health issues. The time-restricted group remained disease free and maintained their weight. It’s just as important when you eat as what you eat.

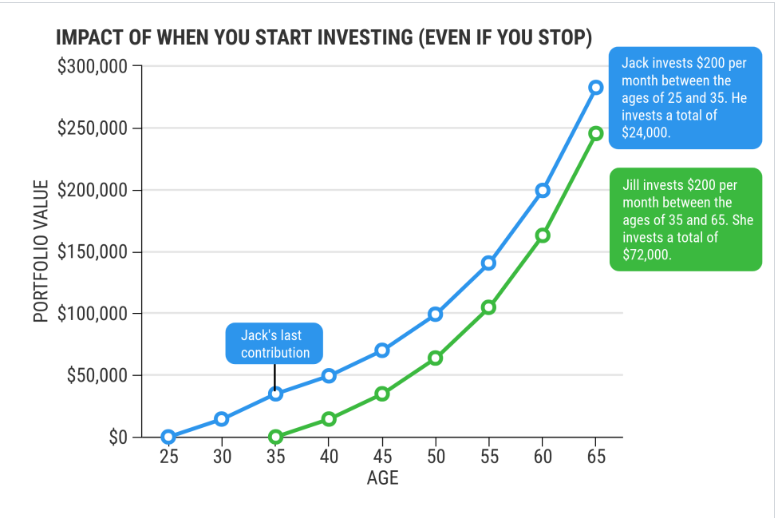

Your finances work the same way. It’s more important when you start saving than how much you’re stashing away.

Please take a look at our favorite billionaire Warren Buffet. Mr. Buffet is currently worth about $80 billion, give or take a few hundred million, depending on what the stock market did the previous day.

$70 billion of his empire rolled in after he qualified for social security.

Did Buffet become a genius when he became eligible for senior discounts?

Nope, Morgan Housel explains his secret formula:

Buffett began seriously investing when he was 10 years old. By the time he was 30, he had a net worth of $1 million, or $9.3 million adjusted for inflation.

But what if he was a more normal person, spending his teens and 20s exploring the world and finding his passion — and, by age 30, his net worth was, say, $25,000?

And let’s say he still went on to earn the extraordinary annual investment returns he’s been able to generate — 22% annually — but quit investing and retired at 60 to play golf and spend time with his grandchildren.

What would a rough estimate of his net worth be today?

Effectively all of Buffett’s financial success can be tied to the financial base he built in his pubescent years and the longevity he maintained in his geriatric years.

Wealth and health compound in similar ways. Embarking early and developing the proper habits doesn’t bear fruit over weeks or months. Success is measured in decades.

If you’re interested in healthspan rather than lifespan, you must start caring for your body right now.

Like optimum health from sound habits, wealth doesn’t sprout overnight.

When you embark determines where you finish.