One of life’s hidden secrets is focusing on what’s controllable.

Unfortunately, many believe in predictive abilities over lotteries or the financial markets. Spoiler alert – Find another strategy.

One thing we can influence is our healthcare coverage during retirement, Medicare. While vital to our health and wealth, Medicare is an intricate beast to tame.

Some mistakes in the process are irreversible and haunt retirees until death. Trying to make sense of Medicare is a perplexing undertaking. This post is a starting point, not an endgame.

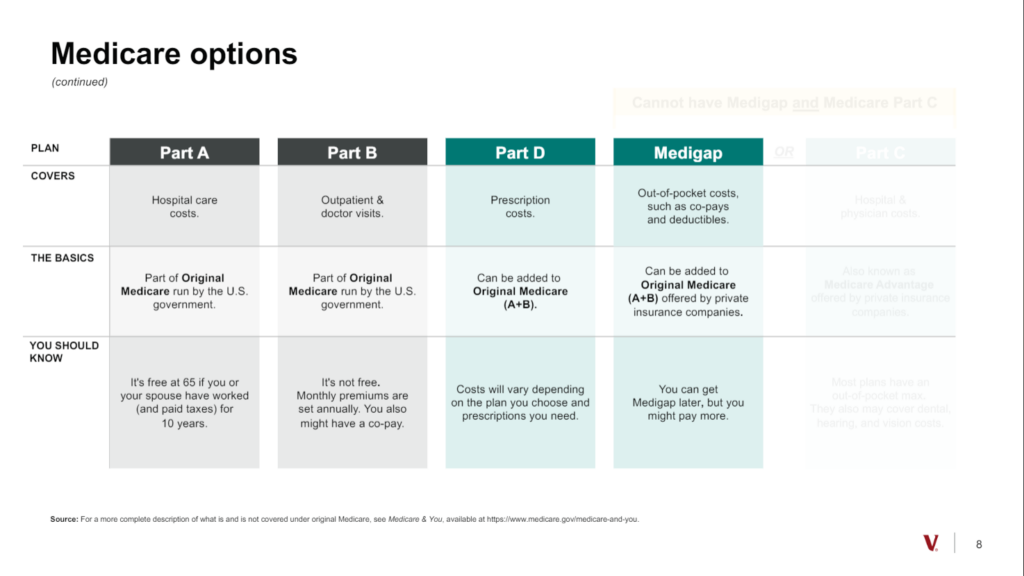

Source: Vanguard

- Medicare is composed of four parts, A-D. Part A covers hospital costs and requires no premiums. You pay the first $1,600 for services, and Part A covers the first 60 Days. Days 61-90 feature $400 per day charges. After this, there is a lifetime reserve of 60 days at $800 daily. Beyond this, you’re on the hook for the total price.

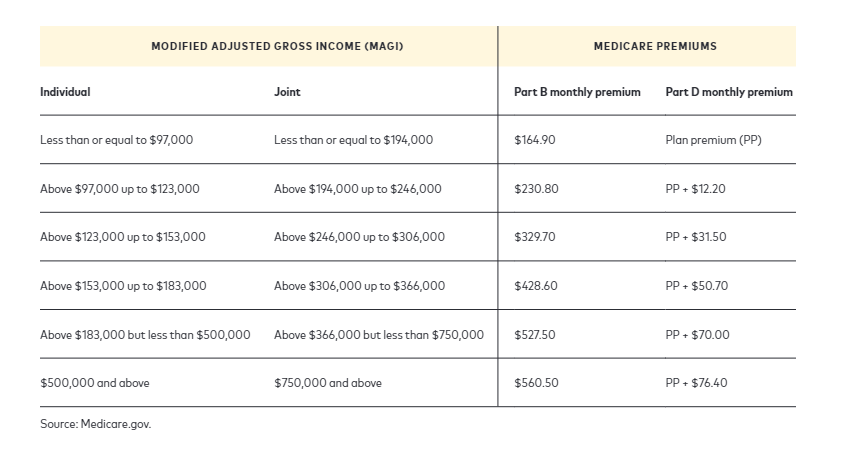

- Part B covers outpatient visits like doctors, outpatient surgery, diagnostic testing, durable medical equipment, and ambulance services. The premium is $164.90 monthly but includes income surcharges for high-earners. You are responsible for the first $226 of expenses; after the deductible, you owe 20% of the bill.

- Part C, or Medicare Advantage, is a private plan that provides both A and B benefits. These bundled plans are priced similarly to the part B premium. The caveat, you’re only eligible to receive care from Doctors operating inside the HMO or PPO network. Limiting care options isn’t always in your best interest.

- Part D is an optional prescription drug plan in Medicare Advantage and stand-alone programs. Premiums vary based on available drugs and typically range from $12 to $76 monthly. Costs increase for higher-income individuals.

- Medigap is the glue that holds the plan together. These private policies cover costs not included in Parts A and B. Medigap plans flow from A through N. The Medigap G plan is considered the gold standard, with Part N coming in second regarding the best additional coverage.

- Regardless of your plans, you must enroll a few months before turning 65. October 15 through December 7 is the enrollment period. You are aut0-enrolled if you take social security at 62. There’s a 10% lifetime penalty if you neglect to sign up for Part B when eligible. The exception is if you have credible coverage issued by a large company. Check with your employer about exemptions from the mandatory sign-up period.

- The average annual costs, including out-of-pocket expenses, are $4,200-$6,600 per person. Premiums vary based on residence and income levels.

- Contrary to popular belief, Medicare doesn’t cover long-term care expenses. It only pays for nursing home or rehab facility costs for 21 days. After that, the price skyrockets to $200 daily. If you deplete your assets, Medicaid, the program for low-income individuals, will cover nursing home expenses.

- If you retire before 65, you will need to find other sources of coverage. These include your former employer’s retiree health benefits, Spouses’ health plan, COBRA, ACA Marketplace, or direct private insurance.

- IRMAA or Medicare’s additional premiums on high-income individuals kick in using a graduated scale at Modified Adjusted Gross Income levels of above $97,001 for individuals and 194,001 for couples. The costs increase substantially for individuals above $500,000 and couples at $750,000

While convoluted, it’s important to remember that millions of people undergo this process annually. Do your homework on all the pieces. The reason this is so perplexing is each letter has its nuances. Combine this with Medigap, and one can see why it’s easy for retirees to choose a less-than-optimal plan regarding their health insurance. In other words, there’s a ton of homework.

Don’t let the byzantine process overwhelm you. Let us know how we can help.

Focusing on what they can control is what real financial planners do.

Miss Cleo need not apply.