Trying hard is an abysmal investing strategy.

The more we do, the more money we burn.

We can look at the human body for answers to the most efficient methods for allocating energy.

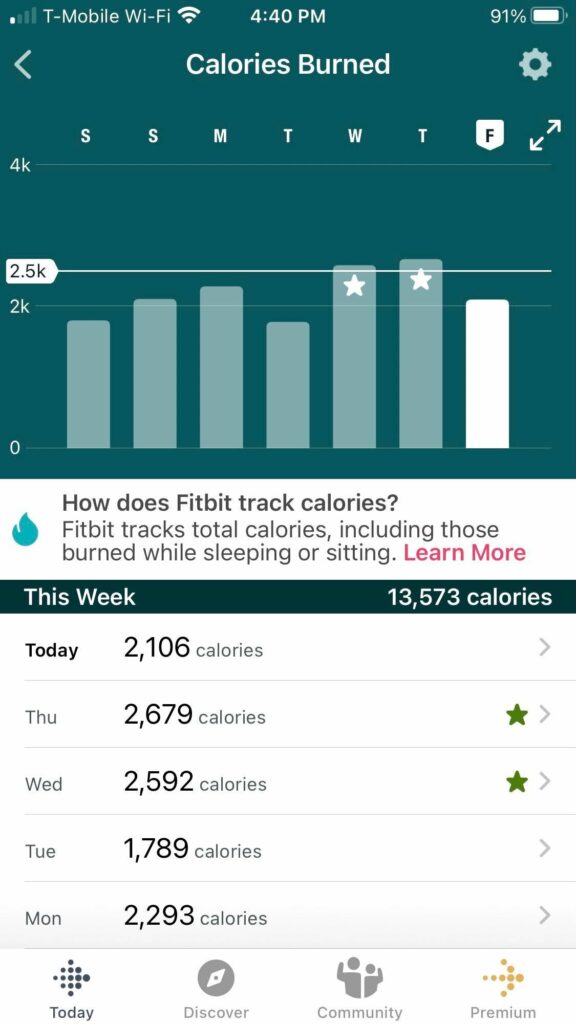

We are constantly burning energy, whether we move or not. The hard work goes on subconsciously. Forget about the gym. The real effort is slogging through behind the scenes. Different names categorize background energy. This includes, amongst others, basal metabolic rate (BMR), basal energy expenditure, and resting energy expenditure.

These definitions refer to the energy your body burns when there is no physical work or digestion. Your brain accounts for about twenty percent of BMR though weighing less than three pounds. Ninety-Nine percent of the brain’s work occurs outside of conscious experience.

Exercise is a small component of calorie burning. Focusing energy on movements that are rounding errors in BMR’s world won’t shed pounds.

Herman Pontzer sums up our situation.

BMR makes up most of the energy burned each day, so if you have a good estimate of BMR, you’ll have a reasonable estimate of total daily expenditure.

What about exercise?

The bottom line is that your daily activity level has almost no bearing on the number of calories you burn daily.

Most of us burn between 2,000 -3,000 calories daily based on our size, regardless of our physical activity.

Understanding what’s happening behind the curtain is vital for weight loss. It turns out that designing the perfect fitness regimen pales compared to taking in fewer calories than you burn. Math wins again. Accurately measuring our food intake and comparing it to our BMR is the path to a lean body. Everything else is noise.

Exercise is vital for physical and mental health. Weight loss, not so much.

A final note from Herman Pontzer is a dagger in the heart. Faced with increasing daily physical activity, the body adjusts, saving energy elsewhere to keep daily energy expenditure in check. Any lasting increase in daily expenditure is matched by increased intake, nullifying the potential for weight loss.

What does this have to do with investing?

Many spend their days looking for an edge and wasting energy on low-probability strategies, like trading stocks and chasing the latest fads.

My colleague Josh Brown has seen this happen again and again.

I’ve spent 25 years watching, trading, and investing in the stock market. The repetition of patterns is amazing. In every generation, we see new bubbles, which form when a new innovation comes along, and everyone gets excited about the future. The crowd gets swept away on a wave of madness, fueled by the recent gains they’ve seen for themselves (or for others), and all other considerations go out the window. Get me in; I don’t care how; I can’t miss out on this.

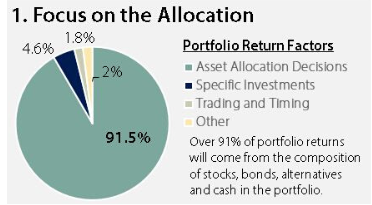

Most ignore what matters, what goes on in the background. Asset allocation is the BMR of your portfolio. Everything else is, at best, a fringe improvement or, at worst, a money-vaporizing debacle.

Source: Missionwealth

The CFA Institute pulls no punches regarding what influences investment returns the most.

Roger G. Ibbotson points this fact out.

One study suggests that more than 91.5% of a portfolio’s return is attributable to its mix of asset classes. In this study, individual stock selection and market timing account for less than 7% of a diversified portfolio’s return.

A widely cited study of pension plan managers said that asset allocation explains 91.5% of the difference between one portfolio’s performance and another’s.

Our body’s efficient use of energy is no accident. Attempts to control the outcomes fall short. The same applies to your portfolio. Determine the proper asset allocation based on your risk level and time horizon, and let it do its thing.

Cutting calories is the secret to losing weight. Asset Allocation is integral to investment returns.

Violating either of these principles isn’t advisable.

No matter how hard you try.

Source: Burn by Herman Pontzer