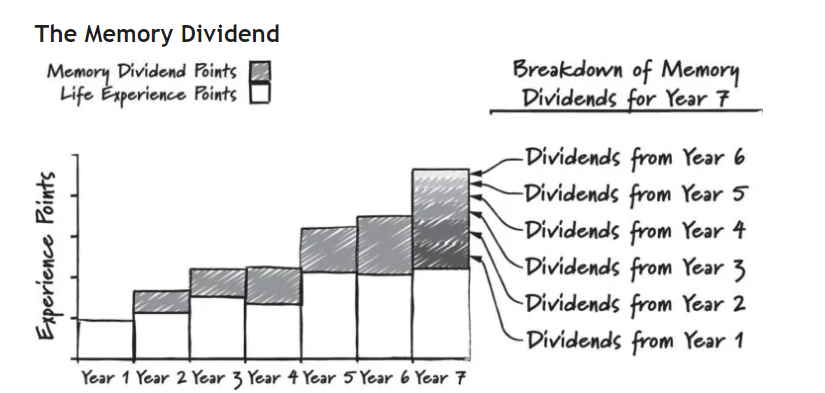

Don’t neglect to compound your memories.

Compound interest is the fuel, and maximizing life’s experiences is the fire.

There’s a simple equation to sum up, what’s important.

Life Fulfillment = Time + Health + Money.

Apply this equation to creating meaningful experiences. Rinse and repeat.

Money isn’t last in the formula by accident. A billion dollars isn’t enough to overcome poor health and to starve yourself of meaningful experiences. Conversely, a modest sum of money goes a long way, combined with optimal health and strong social connections.

Many investors ignore this logic at their peril. Obsessing over money and letting it supersede time and health is the path to anxiety and disappointment, no matter how “rich” a person is perceived.

We see this time and time again regarding inheritance and health care.

Many parents wait until their demise to bequeath their assets, ignoring the vital components of time and health. It’s difficult to understand the logic of leaving money to sixty-year-old plus children and forfeiting the enjoyment of gifting earlier when all parties can partake in the bounty. Life fulfillment takes a big L to implement this strategy. The graveyard is a poor location for observing the application of one’s legacy.

The same goes for healthcare. Many retirees sacrifice a fulfilling life to hoard funds to finance end-of-life care. At first glance, this appears to be the responsible way to proceed. On closer examination, not so much.

Using one’s life savings to finance the lowest quality of life possible eradicates the life fulfillment formula. Too many resources are sacrificed, and the opportunity costs are savage.

No one is saying to throw caution into the wind by ignoring this possibility. There are two better ways to soothe anxiety.

Long-term care insurance can cover the expenses at a fraction of the cost of hoarding your life savings to protect this singular goal. While policies aren’t cheap, they can keep the memory dividends compounding rather than anxiously awaiting the unpredictable certainty of your health declining.

Source: Investment Moats

Preventative medicine is a better strategy. Bill Perkins elaborates on this point in his book, Die With Zero.

It is much easier to spend your healthcare money on the front end to maintain your health and try to percent disease than to pay it in the future when you get a lot less bang for every buck you spend.

How many retirees skimp on pricier healthy food, nutritionists, and professional trainers to save for a period guaranteed to produce the lowest life fulfillment?

Too many retirees possess more money than they will ever spend but spend their time worrying about unpredictable short-term market volatility. In contrast, precious time and health depreciate at a steady, unrelenting pace.

There is a multitude of reasons for this destructive behavior. One could look no further than the typical personal finance book.

Derek Thompson points this out in his Atlantic piece, All the Personal-Finance Books Are Wrong.

A prime example is maintaining an equal savings rate during one’s youth and prime earning years.

The future is unknowable, and religiously maintaining a double-digit savings rate through life’s worst storms is not of the utmost importance. Having that special dinner with friends at 23 is, for instance, more valuable than having a couple of hundred extra dollars in your retirement fund at 73. By this logic, building a budget that makes you comfortable and happy in the short term, even if that means varying your savings rate from decade to decade (or year to year), is the better approach.

Thompson hits it out of the park in his conclusion.

Those who spend a lifetime delaying gratification may one day find themselves rich in savings but poor in memories, having sacrificed too much joy at the altar of compounding interest.

Money’s purpose is to purchase the maximum amount of fulfilling experiences possible for every age.

Don’t let anyone or a book tell you otherwise.