Not all projections are evidence-based.

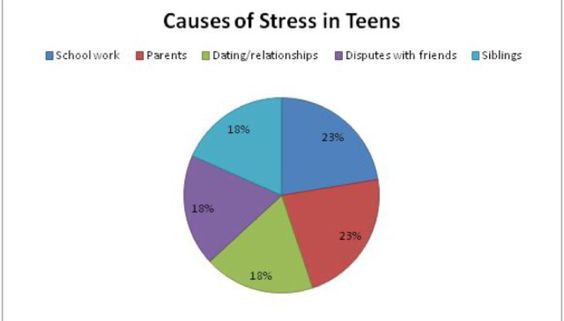

Parenting is a case in point. Too many parents project their failed dreams onto their offspring. There are many reasons why childhood anxiety and depression rates are soaring. Along with Covid restrictions and social media FOMO, unrealistic parental demands are at or near the top of the list.

Source Abbigail Singer

I witnessed the genesis of the epidemic during my last few years of teaching.

Teens signing up for multiple college-level Advanced Placement courses lead to academic war crimes. BTW, to make the schedule work, why not subtract lunch?

What could go wrong with students wolfing down their meals during the middle of calculus?

Throw in five hours of homework to defy human biology. Limiting growing teen brains and bodies to a few hours of sleep contradicts everything we know about adolescent physiology.

Putting icing on the cake, many young people play the same sport year-round. Inflamed by parent projections, personal coaches, and expensive travel teams, psychological and physical injuries mount.

A typical parent complaint is that my kids don’t show passion for anything!

How could they? There’s no place in the time slot between speed coaches’ and Mandarin tutors’ appointments.

Parents projecting their arrested development onto their children is an accident waiting to happen.

James Hollis, P.H.D. offers critical insight into this disturbing trend.

How often do we see the burden placed on the child to emulate the parent’s values and achieve some goal, be it attending the right school, marrying the right person, or finding the right career? If the child does otherwise, they frequently feel contaminated by failure or guilt, and if the child complies with the parents’ stated or implicit choices, they have been diverted into living someone else’s life.

Heads parents’ projections win, tails kids’ sense of self lose.

Turning your child into a tiny deranged ambassador of yourself isn’t a good look.

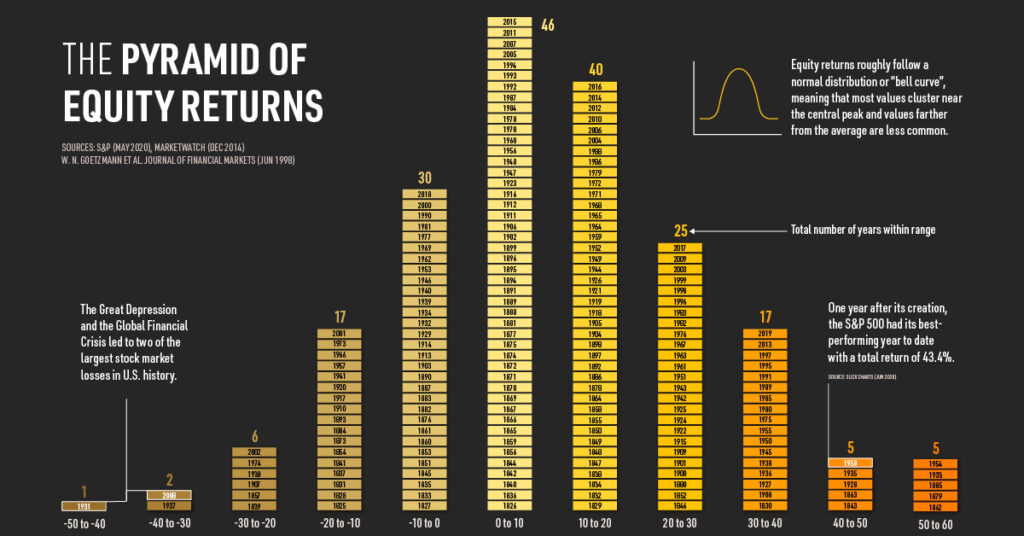

We see the same phenomena occurring with investment expectations.

Investors project their fear and greed into their anticipated portfolio returns.

Historical returns are what they are. Markets don’t care about our insecurities, mental models, or arrogance.

We see this play out all the time.

Investors playing catch up due to a lifetime of underfunding retirement accounts throw all their chips on the table, looking to hit the mother lode.

Predictably, this ends in tears, with concentrated positions in risky investments blowing up at the worst moment.

On the other side of the spectrum, many investors project their scars from past investment traumas onto the present.

Every year isn’t 2008, the tech bubble, or this year’s debacle in the bond market.

While the scars are accurate, the opportunity costs of staying out of the markets are a devastating antidote to long-term wealth creation.

What can we do to prevent these types of destructive behaviors?

The first step is taking action back and looking inside yourself.

Suppose you are not internally comfortable and possess numerous unresolved emotional and financial issues. Do you feel you’re in the right mind to guide your children or your financial future?

Get help. You’re not going to find the answer in this blog post, but a good therapist and a fiduciary evidence-based advisor will aid the healing process.

Projecting irrational expectations onto your kids and finances is a dangerous game.

Everyone has issues. The difference maker is the self-awareness to know what they are.

Heed the words of slave-turned-philosopher Publilius Syrus, “If you are to have a great kingdom, rule over yourself.”