The highest form of wisdom is seeing things as they are, not what you desire them to be.

What if I told you markets aren’t reality-based?

After the obligatory expletives, the rational response is – It’s plenty accurate. Where the hell did a quarter of my investment account go?

How you perceive reality makes all the difference. Understand this and save yourself a boat load of anxiety.

Let’s dig deeper.

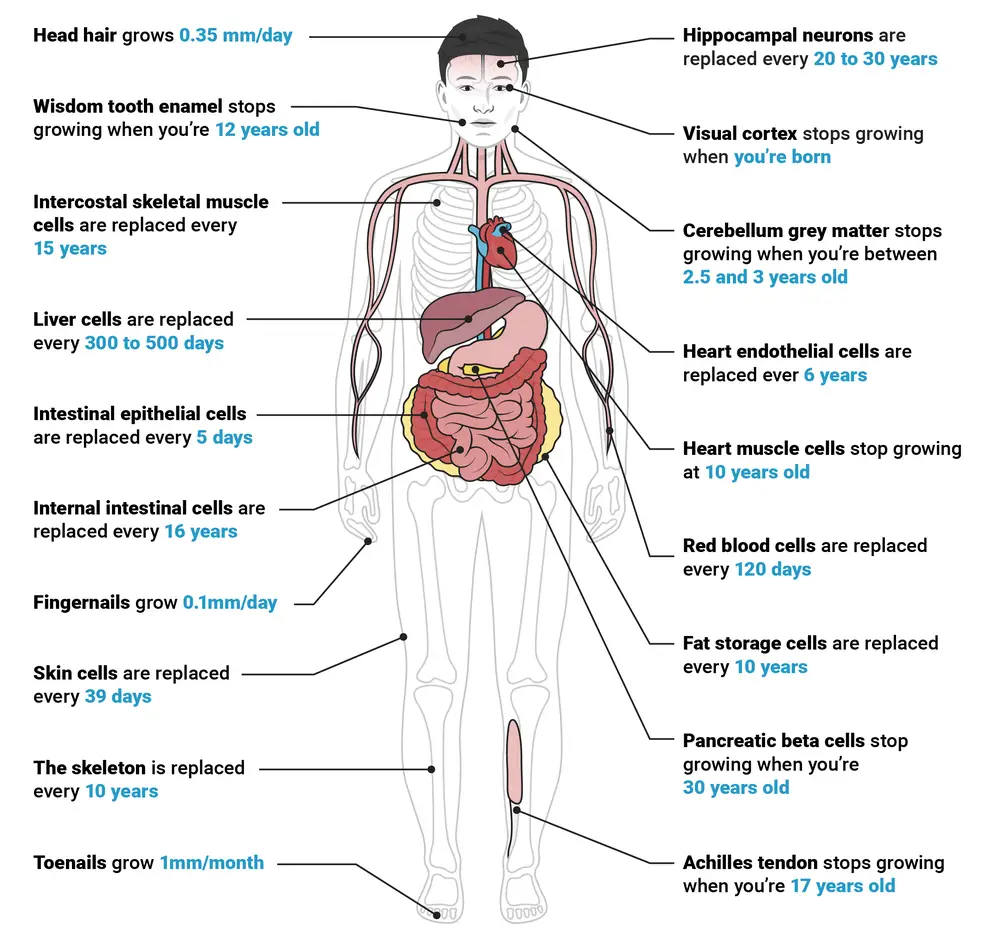

Tony doesn’t exist. He’s just a concept. The name Tony makes it easier to call him when the Linguine and Clam sauce is ready. In reality, he’s just a mixture of constantly changing sub-atomic particles, dying cells, and autonomously functioning organs. My colleague Josh Brown summons his inner Buddha when he states; I remember reading that the average lifespan of a cell in our bodies is roughly seven years, so that in seven years, we are wholly and entirely a new person.

Source: Charles Sturt University Ontario

Let’s take that one step further. We’re different from a millisecond ago.

Like the picture created from a jigsaw puzzle, It’s nothing without the individual pieces.

We call something a river, but it’s only flowing water. The river exists solely dependent on conditions.

Tony, Rivers, and Jigsaw puzzles are valid designations – nothing more. Parking spaces help us get through life.

The same line of reasoning applies to the stock market.

Markets are a concept, a valuable designation for keeping score. In reality, you can’t touch, smell, taste, hear or see a market.

The same goes for governments and corporations.

Financial markets are composed of a multitude of different pieces.

These include but aren’t limited to:

The decisions of billions of global consumers.

Corporate strategies and business plans

Monetary and Fiscal Policies.

Government oversight and regulation.

Irrational human emotions

These have one thing in common- they’re constantly in flux, just like our bodies. Markets are a bookmark, like some financial hologram. Their center is an empty void. Trying to fill it with angst won’t make it whole. It will just make you crazy.

Nothing can be relied on or deemed as a permanent state.

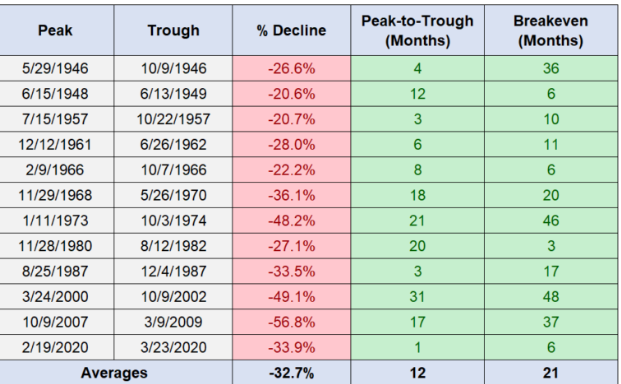

My colleague Ben Carlson wrote an excellent post about how long it takes for stocks to bottom in a Bear Market. Ben’s research is meticulous, but he admits it has no particular predictive value concerning our current unpleasant state of affairs.

Unfortunately, some use the data to make unreliable forecasts.

Bhikkhu Bodhi accurately describes these people. Ignorance is not a mere absence of knowledge, a lack of knowing particular pieces of information. Ignorance can co-exist with a vast accumulation of itemized knowledge.

Our perceptions shape our views. Nobody ever equated individual perceptions of events with reality. We observe the same concepts but make radically different conclusions based on our limited personal experiences. We are all inhabitants of the Planet Delusional.

What I’ve experienced as an investor is different from what you’ve experienced, even if we’re from the same generation. And the generation and country you’re born into, the values instilled in you by your parents, and the serendipitous paths we all wander down are out of our control. Morgan Housel

Viewing markets as foam from ocean waves is healthier than chasing unreliable investment returns motivated by FOMO.

Why would any rational person constantly attach their mental health to unreliable variable components in a state of flux?

Seeing things as they are isn’t easy. We need stories and concepts to make sense of our unpredictable world.

On the flip side – Nothing easy is worthwhile. Try observing things as they are not the permanent state you desire them to be.

Non-attachment makes a bear market a bit more tolerable.

Detonate your version of psychic dynamite to break down the walls of misperception.

You would never try to hold on to foam at the beach.

Don’t make the mistake of attaching yourself to constantly disintegrating financial flux.