We seek refuge in all the wrong places.

The stock market is a prime example. Clinging to continuous change isn’t a good look.

Everyone searches for happiness while avoiding pain. Don’t listen to your tribe. We’re more alike than people think.

We are constantly searching for dopamine hits in bad neighborhoods. Temporary pleasure increases desire, never resulting in the goal of lasting happiness.

Worshipping at the altar of drugs and alcohol is at the top of the list. Others find comfort in food or serial shopping. Likes and followers on social media don’t do the trick. They’re more unsatisfactory options out there in a wasteland of suffering. None work because they’re all temporary and impermanent states. Selecting any of these choices leads to the opposite result, increased pain and reduced pleasure.

Look no further than the insane stories from Johnny Depp and Amber Heard. Celebrity lives differ significantly from ours, but their desires are the same. Wealth and wrong choices make the outcomes worse.

Madonna’s quest for relevancy isn’t going well. Attachment to youth provides no solace.

Viktor Frankl sagely points this out. When people can’t find a deep sense of meaning, they distract themselves with pleasure.

It’s easy to be simple but not simple to be easy.

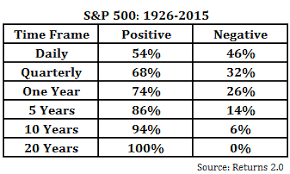

The stock market is a terrible place to find refuge. The shorter the time frame, the worse the outcome.

Determining happiness using the market’s daily movements provides a coin’s flip chance of fulfillment.

We’re renters of wealth, not owners. Death doesn’t discriminate.

Can we find any permanent refuge in our finances?

A properly constructed financial plan provides such a haven. A real financial plan is built based upon the only factor we can rely on – change.

Carl Richards gets it. Financial plans should be written in pencil, not carved in stone.

Financial plans are a form of creative destruction, serving as a compass, not a map. The changing nature of the planning process creates an ideal location to seek refuge.

Constant change is the law of nature.

Why do we assume it doesn’t apply to retirement planning?

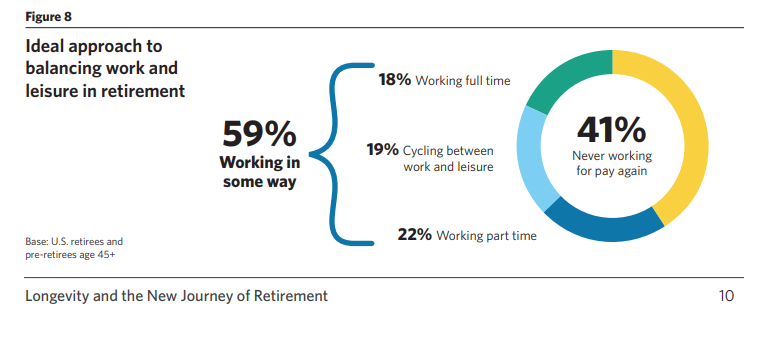

Many believe Americans’ concept of retiring is outdated. We need to retire more and at younger ages.

Laura Carstensen elaborates on this topic.

We need to retire more often—to come in and out of the workforce. We work way too hard in the middle of life while we’re raising children and often taking care of older relatives. It’s also a time when we’re in managerial roles or clients are depending on us. We need more flexible models of work, where we work for fewer or more hours at different phases in our lives.

Most people no longer die at sixty-five. Longevity increases altered the dynamics. The conversation needs to change – right now.

Source: Edward Jones

A valuable financial advisor asks the right questions. More importantly, listens to the answers.

Incorporating these concepts into a financial plan is vital for a successful retirement, no matter how often retirement occurs.

Find comfort in change, not wealth.

Create a plan that fits your lifestyle, not an outdated relic of the past.