Hedge Funds are the gifts that keep on giving.

Many endure chiefly to finance the purchase of some partner’s sixteenth mansion in Palm Beach.

Come for the underwhelming performance and stay for the high fees.

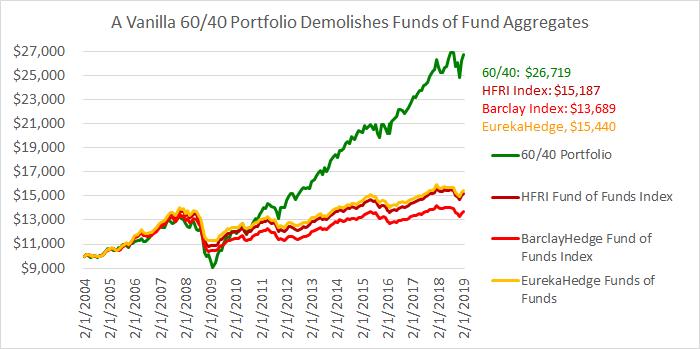

Source: Seakingalpha.com

Further proving the adage, you get what you don’t pay for.

Most pricey hedge funds don’t beat a low-cost portfolio comprising simple indices.

Exceptions do exist, but good luck finding and investing in them.

What’s worse than paying 2 and 20% for an underperforming investment?

Having greed dominate the conversation regarding career advice ranks near the top of the list.

The Atlantic recently published a terrific story about a particular hedge fund.

A Vulture Fund has its quirks.

Picking at the carcasses of bankrupt companies dominates their workflow.

What’s this particular funds specialty?

To start, gutting the staff of local newspapers. The business model entails selling the real estate, jacking up subscription prices, and wringing out as much cash as possible.

The unintended consequences of weakening democracy aren’t part of the bonus pool calculations.

Rinse and repeat.

In comparison, Goldman Sachs is doing God’s Work.

It gets worse.

The article details an exchange between the fund’s founder and his young son.

In a 1980’s interview with D Magazine, the boy asks his Dad why he works so hard.

“It’s a game,” The father explains to his son.

“How do you know who wins?” the boy asks.

“Whoever dies with the most money.”

WRONG!

Unless believing winning is losing defines claiming victory.

This strategy is as old as the hills.

The results are examples of timeless advice on how not to live.

Ryan Holiday opens up a can of whup-ass on this hedgie.

Despite his conquests of most of the known world, Alexander the Great was poor. Because he could only think of the next campaign, he notes that money rarely makes us rich because all it does is give us a craving to earn more.

Playing a game requiring dying to win isn’t optimal.

Neither is being the wealthiest person in the graveyard.

Keep this image in your head if expiring with the most chips in your pocket is your goal.

Blaise Pascal observed: “The last act is bloody, however fine the rest of the play. They throw earth over your head, and it is finished forever.”

The best advice, don’t play a lose-lose game.

Depleting your fortune by purchasing happiness for yourself and others is more desirable.

There’s no hedge stopping the Grim Reaper from turning up at your doorstep

Defying mortality is a fool’s game.

Dying with zero is the antidote for your fears.