“The wise man accepts his pain endures it but does not add to it.” Marcus Aurelius

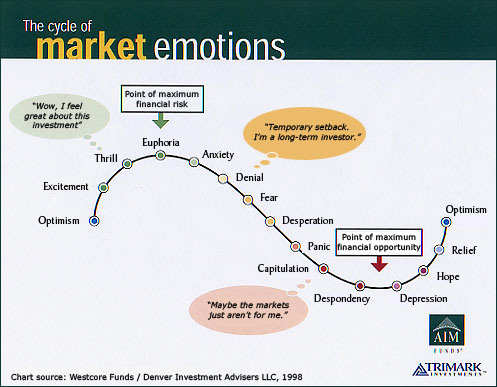

Imperfect markets are beyond your control.

How you react to them isn’t.

Panic makes the pain disappear.

Unless you’re a Cyborg, reacting negatively to bad events is a feature, not a bug of human nature.

Humans are just humans.

Establishing rules before inevitable market crashes are imperative.

Reflexive responses destroy more wealth than the bear markets.

We think so much but understand so little.

Cure your drama addiction.

Lee Snead, the general manager of the NFL’s Los Angeles Rams, prioritizes anti-panic.

Panic rules apply to situations both on and off the field.

This isn’t just an on-field thing. As a GM, Snead has to have panic rules too. Like when a player gets in trouble when there is a controversy, when a tempting high risk, high reward player hits the waiver wire when somebody wants to renegotiate a contract when he’s being savaged in the press. If you don’t have panic rules… you’re liable to make panicked decisions. You’re responsible for doing something emotional, something short-term, something that violates your principles and hurts your cause.

The simpler the rules, the better.

Sound familiar?

Inflation, Fed tightening, and COVID-19 variants simultaneously emerged from their slumber.

Pity the investor without a panic plan.

Delete becoming chum for the hysterical shark-infested financial media.

What should you do?

How about turning to West Point for some practical solutions?

Nate Zinsser runs the performance psychology program at our most prestigious military academy.

Cadets face immense stress grinding through the four-year program.

Zinsser’s tips are indespinsable.

As a bonus, they’re user-friendly for skittish investors.

- Manage your fuels: Managing energy by regulating emotional states and sleep are the antidotes to surviving volatile markets. Zinsser states, “A campfire burns out because it runs out of fuel.”

- Shift into joy: Negativity burns life-sustaining oxygen. Focus on those not suffering from first-world problems like a 10% market decline. Give and volunteer. Fixating on irrational Markets In Crisis financial media nonsense isn’t wise.

- Train yourself to relax on cue: Focusing on your breath is better than spotlighting on temporary market shudders. Learning how to meditate or apply other relaxation techniques is your most valuable asset class during these periods. Feelings aren’t facts.

- Take micro-rest breaks: This advice is precious for all the Type A’s out there. Find time to step away from your hectic work schedule, no matter how brief. Don’t waste your most valuable asset by checking your portfolio and further compounding your stress.

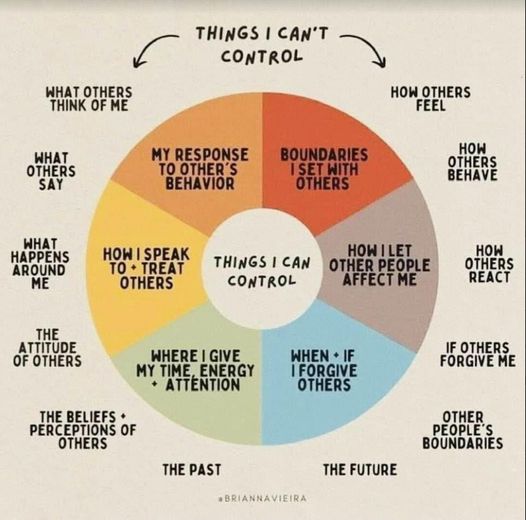

- Be greedy with your energy: Focus on what you can control. Your fuel tank shouldn’t include wasting energy on a steep decline in your emerging market ETF. Wasting one iota of precious fuel on external events is an extinction-level event for both your portfolio and your mental health.

- Assert your needs: Do what you need to do to attain what works for you. Everyone is different. Make sure it’s a healthy choice. Exercise, reading, and other positive hobbies are perfect. Drowning your sorrows in alcohol is not.

These tips are good enough for West Pointers soon facing life and death decisions.

Why wouldn’t they work for your market phobias?

Learn not to see different things but to see things differently.

The worst plan is not having one.

Don’t mistake the waves for the ocean.

Mind your mind with a panic plan.