Most goals don’t cross the finish line.

There’s a good reason why 80% of New Year’s resolutions fail.

Why does this occur?

Choosing the wrong goals is a large part of the problem.

Creating objectives we have no power over is a terrible strategy.

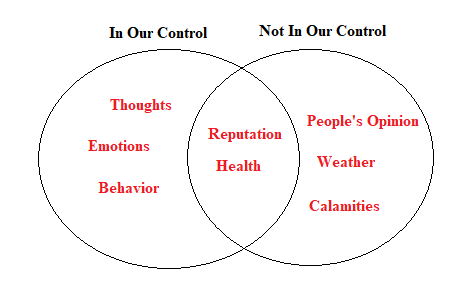

Take a look at The Trichotomy of Control.

It consists of three categories.

- Things we have complete control over.

- Things we have no control over.

- Things we have some but not complete control over.

For the minority who set goals, guess which one they tend to embrace?

Here are some examples of how this works.

We have total control over our value system.

We have power over what goals to choose but not over their outcome.

For example, instead of setting a goal of winning a tennis match, change the context.

Giving your best effort is an attainable goal. Victory is far from certain.

Choosing internal goals as the focus of energy is superior to making success dependent on external factors.

Protip -Don’t rely on others for outcomes.

Is receiving a raise an example of a well-constructed goal?

Making more money at work might depend upon an unreasonable boss.

Doing your job to the best of your ability is far more attainable.

Setting a goal of getting an A in class might be problematic.

Changing it to doing your homework and paying attention is a better course of action.

Setting internal goals helps to create a higher probability of achieving them.

Being a hard-working employee gives you a decent chance at earning more money.

Adding doing homework and paying attention to the list should result in better grades.

Marcus Aurelius once said, “Nothing is worth doing pointlessly.”

Spending time and energy that does not affect the outcome falls under this category.

How does this connect to our finances?

People consistently set the wrong type of external-driven financial goals.

I want a high-paying job when I graduate from college.

I want to retire early.

I want to be rich.

What do three goals have in common?

They are all based on external factors.

Graduating from college into recession is beyond your dominion. Picking the right major and getting your degree in four years is a better option.

Early retirement relies on many variables. Starting saving as early as possible isn’t dependant on the kindness of strangers.

Becoming materially rich means many different things. Having the right value system and putting good into the world is a treasure we can all pursue.

Setting goals based on daily processes is the way to direct energy.

How we spend time is the most precious of financial resources.

Allocating attention to the right parts of the trichotomy is critical.

Focus attention on these things. Spending and savings rates, proper insurance, asset allocation, and investment fees fall under this category.

Stop wasting energy on things you have no oversight for —short-term market performance and current events are prime examples.

Look inside yourself for the answers.

Spending time on setting the right goals is a financial plan.

Everything else is a crapshoot.

Don’t allow outside forces to breach the walls of your contentment.

Source: A Guide To The Good Life by William Irvine