Contentment is the new black.

Don’t look on Instagram. It’s not trending on Twitter. You won’t find it on someone’s Facebook story.

It’s hard balancing need with greed.

Too many of us are failing at this essential task.

Do you want to increase your Wealth I.Q.?

Start by enjoying what you already have.

There’s the old story of The Hungry Ghost.

The ghost has a huge swollen body, a pencil-thin neck, and a minuscule open mouth. It’s on a never-ending journey. Trying to get enough food down its skinny neck, never satisfying the needs of a huge gut.

There’s no balance between needs and wants.

Imagine having eight things when we desire ten. Not so bad. Problems arise when we possess eight and feel we need twenty.

The less we need, the richer we become.

We all know people who:

Purchase a huge home with little intention of spending much time there.

Possess a state-of-the-art Kitchen but never cook.

Own 250 pairs of sneakers.

Fly into private parties on a helicopter. (I don’t know someone but thought of this guy)

This isn’t meaning to dunk on people who enjoy these things. If they bring joy, nobody has a right to judge.

The problem is for most people; they don’t. Instead, they serve the purpose of impressing others, satisfying insecurity, or making people feel bad about their lower status.

These types of attachments are akin to licking honey off a razor.

We too often spend money like throwing darts without knowing the board’s location.

There’s a reason why consumer spending comprises 70% of our economy. Newsflash – It’s not the efficient allocation of resources.

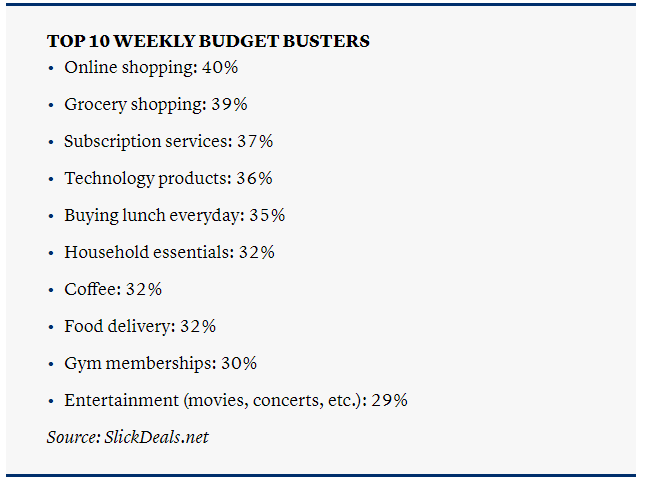

Consumers overspend by an average of $7,400 annually.

Consumerism is a toxic side effect. Many work jobs they hate so they can buy things they don’t really want or need.

Benjamin Disraeli once said:

Most people die with their music still locked up inside of them.

Think of all the people that could have done amazing social good and bettered the world. Instead, they took a job just for the money to buy things that will never provide them with lasting happiness.

This doesn’t age well. I know a young person who is paid an enormous salary but despises her job. It’s tough to quit when you have huge fixed expenses like a big mortgage.

The problem occurs when we imagine we need more than we really do.

Try scoring higher with your Wealth I.Q. The test isn’t easy, but it’s well worth the trouble.

It’s all about our relationship to money.

This determines whether we perpetuate the good or strengthen evil.

Ponder these questions:

Do you use money or abuse it?

Do you possess money, or does it possess you?

Can you strike a workable balance between need and greed?

The answers determine your future self’s happiness.

Running on a hedonic treadmill is the quickest path to nowhere.

It’s delusional to think we can find lasting satisfaction through consumerism.

This obituary/poem for Joseph Heller, published by The New Yorker in May of 2005, is a great start.

True story, Word of Honor:

Joseph Heller, an important and funny writer

now dead,

and I were at a party given by a billionaire

on Shelter Island.

I said, “Joe, how does it make you feel

to know that our host only yesterday

may have made more money

than your novel ‘Catch-22.’

has earned in its entire history?”

And Joe said, “I’ve got something he can never have.”

And I said, “What on earth could that be, Joe?”

And Joe said, “The knowledge that I’ve got enough.”

Not bad! Rest in peace!”

— Kurt Vonnegut

Getting more from what you don’t pay for is a terrific life hack.