Despite what you think, time isn’t your most valuable asset.

Attention supersedes all.

You’re as free as your attention span permits.

For example, living to a hundred doesn’t guarantee happiness.

Focusing on every perceived slight, both real and imagined, wastes precious attentional bandwidth. Plotting revenge on your enemies plunders the cash flow of attention.

It’s a similar result regarding rumination, envy, and regret.

Creating negative emotional cash flow is an epic fail.

How does this affect your finances?

What’s worth paying attention to?

Are setting monetary goals the best use of your time?

How you deploy your financial attention provides much more bang for your buck.

Carl Richards makes a terrific point.

Goals = Guesses.

As a financial planning practitioner, I couldn’t agree more.

Anything can happen at any time. So the idea of certainty decades into the future is laughable.

Richards states:

As the self-declared King of Permission Granting, I’m permitting you to relax when it comes to goals. Just guess! No one knows exactly what you’re going to be doing 17.5 years from now—so no sense in laboring over a false sense of precision. Just guess.

This doesn’t mean we shouldn’t set goals. But, instead, realizing their limitations is the holy grail.

Having goals keeps the fire burning. But, daily attentional span means much more.

Too many of my clients are scared of spending their nest eggs.

Is saving for thirty years and then living the next thirty in an incessant state of fear of losing it productive?

Is giving your riches away at 95 to your 70-year-old children the best way to maximize your almost century of living?

Is watching your portfolio grow more important than taming your mind, eating properly, and exercising?

I love Bill Perkins’s take.

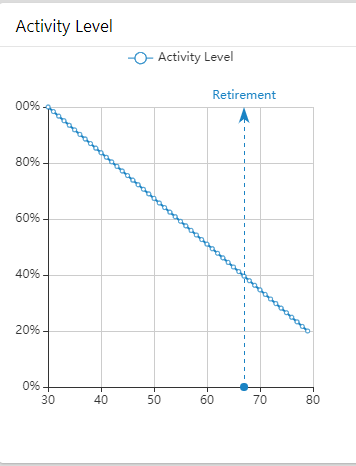

The utility of money changes over time. It does so in a fairly predictable way: Starting sometime in your twenties, your health very subtly starts to decline, causing a corresponding decline in your ability to enjoy the money.

This fact of nature accelerates as you age.

For example, because $100,000 has more value in your fifties than it does in your eighties, and your goal is to maximize your enjoyment of your income and life, it’s in your best interest to shift at least some of that money from your eighties into your fifties.

My colleague Michael Batnick asked me the other day, “Should young people live paycheck to paycheck?”

A few years ago, I would’ve been horrified by the mere suggestion of such financial heresy.

Today my answer is a resounding Yes!

In fact, some can make the argument adding some leverage to the spending pie might also make sense.

Perkins had a friend who quit his job in his early twenties, borrowed some money and toured Europe. To this day, he fondly remembers his invaluable experiences.

Who are we to judge?

If you understand the maximum utility of money peaks at 30, this answer doesn’t seem as preposterous as it sounds.

For those fifty and older, the urgency compounds.

Use it or lose it. Net Worth is no match for Net Fulfillment.

(If want to learn more, Perkins developed a formula matching his thinking.)

Spend your attention wisely. Don’t waste the gift of longevity.

Focus on building a healthy body and mind.

Follow my friend Phil Pearlman.

Give to charity and enjoy invaluable experiences with friends and family.

According to InvestmentNews, this is starting to sink in.

Current retirees reflecting on the keys to a successful retirement say the financial and non-financial aspects are equally important, including how to live a healthy life (95%); how to maintain or improve family relationships (94%); how to find activities that impart a sense of purpose (94%); and how to save enough money to last through retirement (93%).

Alternatively, devoting attention to figuring out what your social security check will look like in thirty years is on the table.

The choice is yours.

Dying rich isn’t what you think.