Simple beats complex in investing and life.

Real wealth is composed of a healthy body mixed with enough money covering basic needs and select wants.

The formula is simple. Don’t get sidetracked by daily noise.

The same goes for your health.

The most important factor in warding off disease and staying healthy is correct breathing.

The average person takes about 670 million breathes over their lifetime.

Breathing wrong has severe ramifications.

According to James Nestor: “No matter what we eat, how much we exercise, how resilient our genes are, how skinny or young or wise we are-none of it matters unless we’re breathing correctly…..The missing pillar of health is breath. It all starts here. “

It turns out 90% of us breathe incorrectly, leading to a chronic list of afflictions. Think sleep Apnea, bad breath, snoring, cavities, allergies, and asthma. Not to mention over and underbites, misaligned jaws, and snaggled teeth.

What’s the main culprit?

Mouth breathing is at the top of the charts.

Your mouth was designed to be a safety valve for breath. The nose is meant for this life-sustaining task.

Nasal breathing clears, heats, and moistens oxygen for more efficient absorption.

We absorb 18 percent more oxygen just by breathing through the nose.

Fifty percent of the population are habitual mouthbreathers.

Why is breathing through the mouth so bad for you?

Mouth breathing messes with both your airways and the physical body. Changing both for the worse. When you inhale through the mouth, pressure decreases. This causes tissues in the rear of the mouth to flex inward, leading to decreased space making breathing much harder. Mouth breathing leads to more mouth breathing, creating a vicious cycle.

Constant mouth breathing dehydrates the body and makes you dumber. A study done with rats showed rats with their nasal passages blocked generated fewer brain cells and took twice as long to make it through a maze than their nasal breathing cohorts.

What does this have to with investing?

Just like breathing, a simple habit change profoundly influences a positive outcome.

Saving more is the nasal breathing of wealth creation.

Lung capacity is the key to life expectancy. Saving capacity does something similiar for your retirement account.

So many of us worry about things that don’t matter. We often ask all the wrong questions.

What’s the best stock to pick?

Who is the best fund manager?

Should Bitcoin be a part of my plan?

What matters most is your savings rate.

Small tweaks to this number lead to monstrous changes in long term results.

My colleague, Ben Carlson, had some interesting things to say about this.

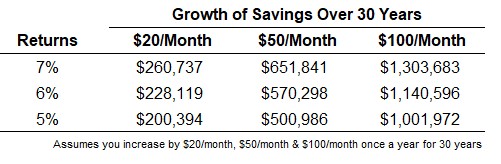

What if instead of saving the same amount every month of every year for 3 decades, you instead increased your savings by just $20 month each year. So in year one, you would save $500 a month. In year two, you would save $520 a month. In year three, you would save $540 a month, and so on.

Using a 7% return, $20 more a month, leads to an extra $260,000 over a thirty-year period.

It’s not easy for everyone to save $500 monthly, but Ben illustrates the miraculous effects of compounding with even a $20 increase.

Like breathing through your nose, the earlier you start the more efficient the long-term outcome.

For some, breathing may be much easier than saving.

What’s most important is understanding how to do both correctly.

It’s pretty simple, breathe through your nose and increase your savings.

Your body and retirement portfolio will thank you later.