Getting what we pay for is part of the American psyche.

The Pandemic brings us to the college dorm elephant in the room.

Will students receive a refund due to Coronavirus shutdowns?

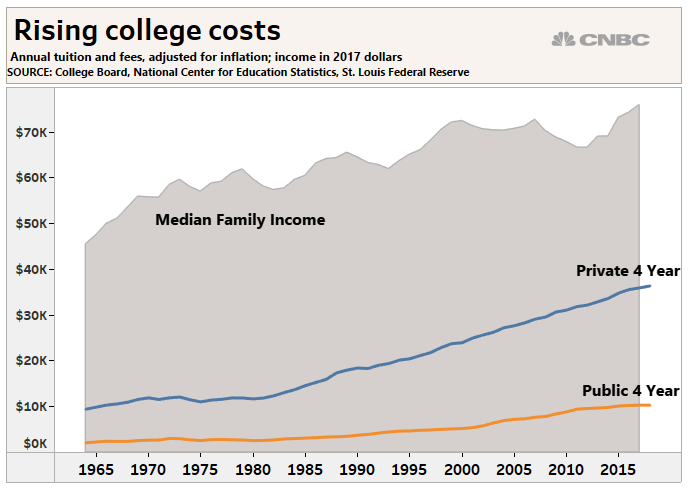

College is a massively expensive undertaking. $1.5 trillion of student debt attests to this.

Students shell out mega-bucks for room and board and tuition covering in person, not virtual instruction.

The Coronavirus broke this model when schools closed during March.

Schools made the correct call, but what happens next?

Will they do the right thing and refund room and board?

Where will they get the funds?

Some schools immediately made students whole.

According to INSIDE HIGHER ED,

Some colleges, such as Smith College, Harvard University, and Amherst College, announced almost immediately that students would receive prorated room and board refunds.

Others offered partial refunds, with mixed reactions, including lawsuits and petitions.

The University of Minnesota tried to pull a fast one. The school closed on March 11. The school calculated the refund based on the states’ stay at home order, which took place on March 28.

The students freaked and organized a petition which garnered more than 500 signatures resulting in a more equitable solution.

Michigan State decided to work with their students. Instead of following the lease agreement requiring students to buy out of their residence hall contracts by paying 60% of the full amount. Alternatively, a prorated cash refund or credit towards next year’s bill emerged as the new policy.

The same didn’t hold for Arizona, where a class-action suit reared its head.

The U.S.News reported:

A class-action lawsuit filed March 27 “on behalf of all people who paid fees and/or the cost of room and board for the Spring 2020 academic semester at The University of Arizona, Arizona State University, and/or Northern Arizona University,” lists the Arizona Board of Regents as the defendant.

“They feel as though the universities where they pay their hard-earned money haven’t been treating them remotely fairly,” says Adam J. Levitt, an attorney and co-founding partner at DiCello Levitt Gutzler in Chicago who is representing students in the lawsuit.

The University is offering a choice between a 10 percent refund at the end of the semester or a 20% credit added to next year’s account.

The wave of lawsuits, petitions, and negotiated settlements are spreading throughout the country. Parents in financial distress express little patience for the colleges’ excuses.

Compounding the issue, most students weren’t eligible for government checks as part of the CARES Act.

There are other factors to consider. Colleges worry if they pay more, many university employees will lose their jobs. Schools will need to make some tough choices. Should they fire cafeteria workers and other employees or refund money to students?

Students need to factor in their financial aid packages before accepting any refund money. For example, students receiving financial aid covering housing may not be eligible to receive a housing refund.

Something else to think about, if refunds were paid with 529 plans they need to be returned within 60 days to avoid a 10% penalty.

Finally, all off this may become a moot point if schools don’t reopen in the fall. Delayed openings are a distinct possibility.

The Wall Street Journal reports on some disturbing trends. Using course enrollment data, they found that during a given week, the average student shares a class with more than 500 other students—4% of the student body. But 87% of students are connected through two steps, and 98% are three steps removed via shared classmates. Keeping classes smaller slows the spread, they found, but only slightly.

More and more, 2019 seems like decades away.