Teachers in Pennsylvania and Texas are waking up screaming from a midsummer night’s 403(b) nightmare.

Traditionally, large insurers enjoy blasting teacher’s retirement accounts with high fees and unnecessary products. Two states are willing accomplices to mass financial exploitation.

Pennsylvania and Texas passed some of the most blatant anti-consumer 403(b) legislation in modern history.

Deciding it was a crime against humanity having a single low-cost vendor servicing teachers retirement accounts, Pennsylvania took action.

Leaving the insurers out in the cold is a no-no.

Hell hath no fury as insurance lobbyists scorned.

“I demand dozens of options in my retirement account to confuse me” – said no teacher ever.

Beginning July 1, school districts will need to have a minimum of four financial institutions or pension management organizations (i.e., record keepers) for 403(b) and 457 plans, which are defined-contribution plans for nonprofit and public-sector entities.

Republican State Senator Jake Corman sponsored this legislation.

Having at least 4 vendors to service a retirement plan benefits no one except the companies selling crappy products.

According to Joshua Schwartz, president of Retirement Plan Advisors, “Somebody convinced lawmakers to pass a law that makes retirement plans more expensive for teachers, You wouldn’t mandate a school district to have to buy their school buses from four different companies.”

A spokesperson for Senator Corman dug out the typical lame, and data deficient response.

“We don’t just pick one company, for one thing, We require different bids and different options.”

As Dan Otter rightly points out. “Pennsylvania school districts who did the right thing and reduced their vendor lists to one or two low-cost providers are now scrambling to add vendors to comply with this absurd law. All of this will lead to more participant confusion and more money flowing from teachers to the insurance industry.”

Speaking of disgusting and egregious anti-teacher legislation, let’s take a trip to the Lone Star State.

Everything’s bigger in Texas, including investment fees.

Texas eliminated this provision putting a laughable cap on 403(b) expenses.

- Must register products with TRS

- Max front end and/or back end charge of 6%

- Surrender charges cannot exceed 10 years.

- Annual fees cannot exceed 2.75% per year.

These limits are finito, thanks to Republican State Representative Dan Flynn.

According to Flynn, paying greater than 2.75% annual fees and having a surrender fee of 10 years is too restrictive to offer a full range of “products.”

“limiting fees may not only reduce product offerings but also limits a company’s ability to offer services that provide valuable advice and educational tools that can assist teachers in making appropriate choices for their retirement income. Further, focusing only on fees ignores product performance and could deny teachers access to products that may have higher returns.”

Rep. Flynn refuses to acknowledge simple mathematics. High fees obliterate returns. The Paradox of Choice proves less choice in investing is more.

Why is Flynn such a Luddite?

His top campaign contributors aggressively flow from finance and banking – $286,000 buys lots of votes.

HB2820 is an early Christmas present for market index annuities. These dubious products are sold to teachers complete with false promises and high fees.

Many have surrender charges GREATER than the previously allowed, and already excessive, 6 years.

Scott Dauenhauer gets it.

“It also helps the variable annuity companies because their surrender charges usually exceed 6%, but it really helps indexed annuities. We are about to witness a dramatic increase in the number of indexed annuities sold in Texas K-12 403(b) plans. The original provisions were abusive, but not abusive enough for the insurance industry.”

According to the industry, eliminating “price controls” interfering in a “free” market is great for capitalism.

This argument couldn’t be more hypocritical. Many of these same companies don’t mind privatizing profits and socializing losses. Counting their money in good times but begging teachers and other taxpayers bail them out after making bad bets.

The Non-ERISA 403(b) space has no resemblance to a free market. It’s dominated by asymmetrical information. Financial salespeople holding all the cards while teachers are lead like lambs to the slaughterhouse.

Teachers, paying in excess of $10 Billion is unnecessary investment fees annually are these companies cash cows.

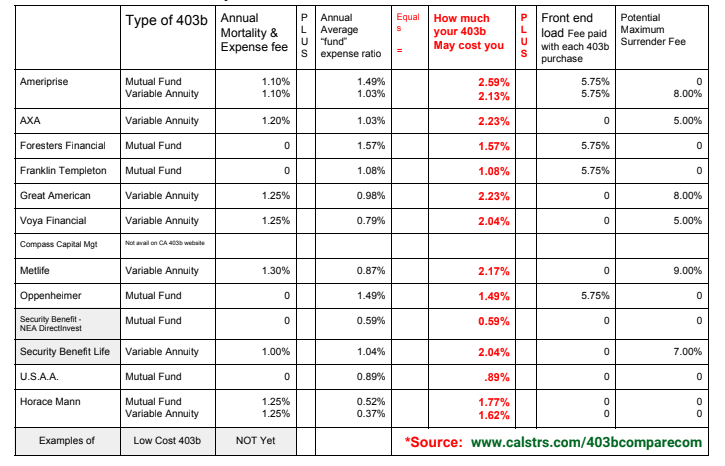

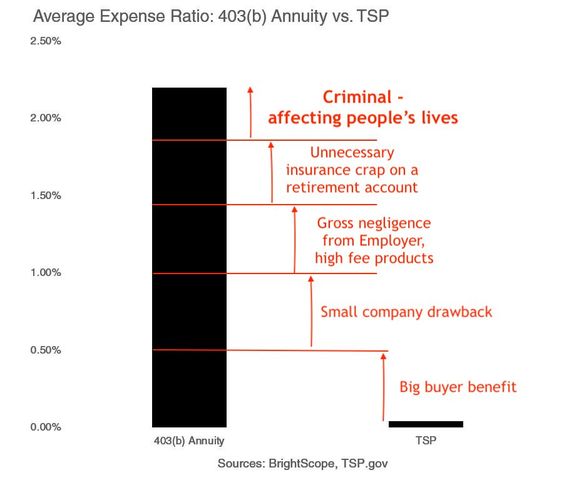

Many pay 2% or more for their 403(b)s.

Federal employees, i.e. the politicians who are supposed to be protecting teachers and their rest of us from financial predators, pay some of the lowest fees on the planet.

Unlike 401(k) plans, public school teacher’s 403(b)’s aren’t covered by ERISA rules.

Greg Iacurci describes the devastating effects of this oversight

“457 plans and the majority of 403(b) plans aren’t covered by ERISA, meaning plan sponsors aren’t beholden to the same fiduciary standards. These plans, especially those of school districts for kindergarten through 12th grade, are largely decentralized structures in which there are minimal oversight and multiple record keepers that offer their proprietary annuities and mutual funds, advisers said.”

Many products in teacher’s 403(b)’s are illegal in 401(k)’s.

“There are products available in 403(b) that would never pass muster in the 401(k) realm, and if they did, the plan sponsor would be sued into oblivion,” said Mike Cochran,

Is it a wonder that teachers are financially exploited on a massive scale and less than 1/3 contribute to plans?

Teachers act as the data predicts when given too many investment choices. They don’t contribute or grab whatever attracts their immediate attention. There’s a good reason why annuity peddlers hand out free Pizza in the faculty room.

“Ever get the feeling you’ve been cheated?” asked a weary Johnny Rotten at the conclusion of the Sex Pistols‘ only U.S. tour.

Sadly, teachers feel exactly the same way regarding their retirement plans.