“Fear is never a good counselor and victory over fear is the first spiritual duty of man.” – Nicolas Berdyaev, philosopher

11% of Americans suffer from unreasonable fears called phobias. Arachnophobia (fear of spiders) is very common. According to MedicineNet, “Sufferers experience undue anxiety even though they realize the risk of encountering a spider and being harmed by it is small or non-existent.”

Phobias hijack life and can destroy careers, ruin marriages, and cause bugged-out behavior. Tidal waves freak me out much more than plunging markets. Luckily, this only affects my beach visits and YouTube viewing.

Arachnophobia sufferers are known to:

- Pour bleach over their kitchen appliances each evening.

- Place masking tape over the small holes in their home.

- Inspect every inch of their beds before going to sleep.

Some believe spiders work in teams, conspiring with each other to create an insect version of Al-Qaeda.

In Britain, one million people suffer from spider phobias; this is the second most common affliction behind the fear of public speaking.

Fear of spiders is curable. One solution is to learn the facts. There are no spider-squads seeking ways to stalk human prey.

Can we connect those who fear spiders and investors who fear market volatility?

Like those terrified of spiders, investors need to know stocks are not out to get them. Despite what happened last week, stocks are an investor’s best long-term financial ally.

Sadly, those who benefit the most from stock ownership, young people, invest the least.

Imagine if people knew:

- Stocks will protect the most important asset – purchasing power.

- Wealth is built by participating in profits and collecting dividends, not by loaning money or parking it in the bank. Risk/Reward is a timeless philosophy.

- There has never been a twenty-year-period where investors lost money by owning the broad U.S. stock market.

- The market has gone up almost three out of every four years.

- Stocks average an 8-10% return over long periods but it’s rare to see these figures annually.

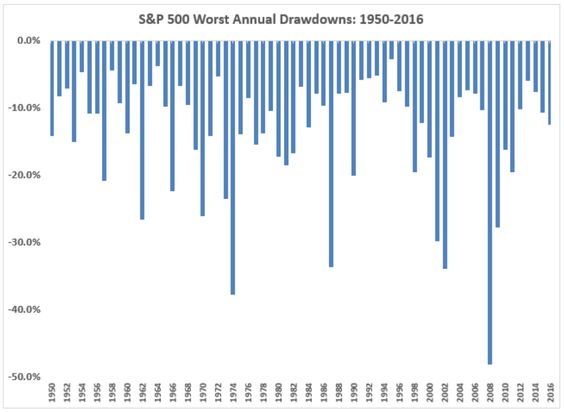

- Stocks fall double-digits on a fairly regular basis.

- The market declines by about 14% at some point during most years.

- Stocks tend to lose about 28% every five years or so.

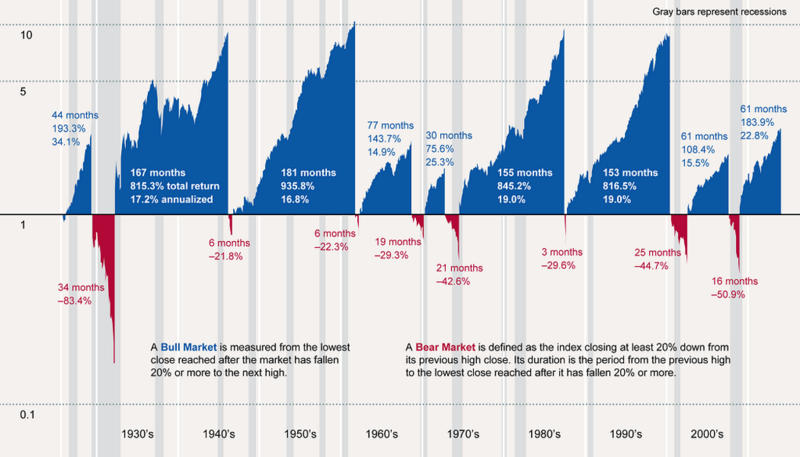

- Bull markets tend to last considerably longer than Bear Markets.

Data can change irrational behavior. Knowledge shifts the narrative from “stocks are extraordinarily risky” to “the real risk is not owning them at all.” Questions become much healthier.

“How much stock ownership is appropriate for my time frame and risk tolerance?”

Curing stock phobia doesn’t include drugs, devices, rewards, or threats.

The worst antidote is listening to horrible advice from conflicted and hysterical media pundits who cannot address any individual’s personal situation and are accountable to no one. Facts, not fear, do the trick.

Life, financial markets, and retirement plans become a better place with realistic, rather than irrational, expectations.

Being scared when stocks plunge 8% in a week is normal and forgivable; abandoning them for the long term is not.

Source: The Spiritual Brain by Mario Beauregard, and Denyse O’Leary, charts by Ben Carlson