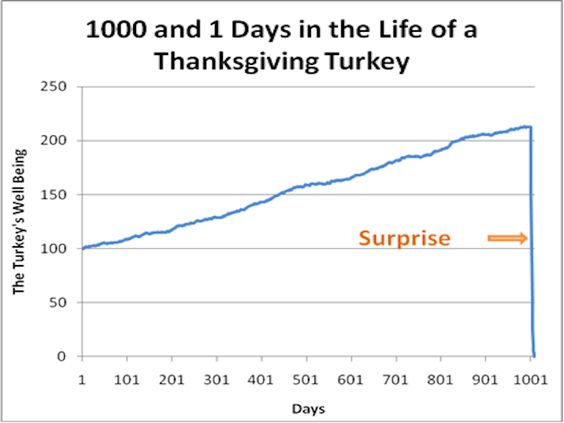

Investors fear violent market crashes; those that would vaporize years of wealth accumulation in a matter of days or weeks.

Many pay too little attention to slow failure. Risk aversion is a stealth assassin. This silent threat has none of the drama of plummeting markets. The carnage left behind is worse.

Justin Sibears wrote an amazing post, “Failing Slow, Failing Fast, and Failing Very Fast.” He analytically defines three methods of long-term failure and provides examples of different risk-adjusted portfolios to prevent disaster.

Failing slowly is overshadowed by daily market hyperbole.

We encounter many prospects who express a desire for perceived safety. It’s our job to make sure they understand its proper definition.

Justin states, “Taking less risk than is optimal is not safer; it just locks in a worse outcome.”

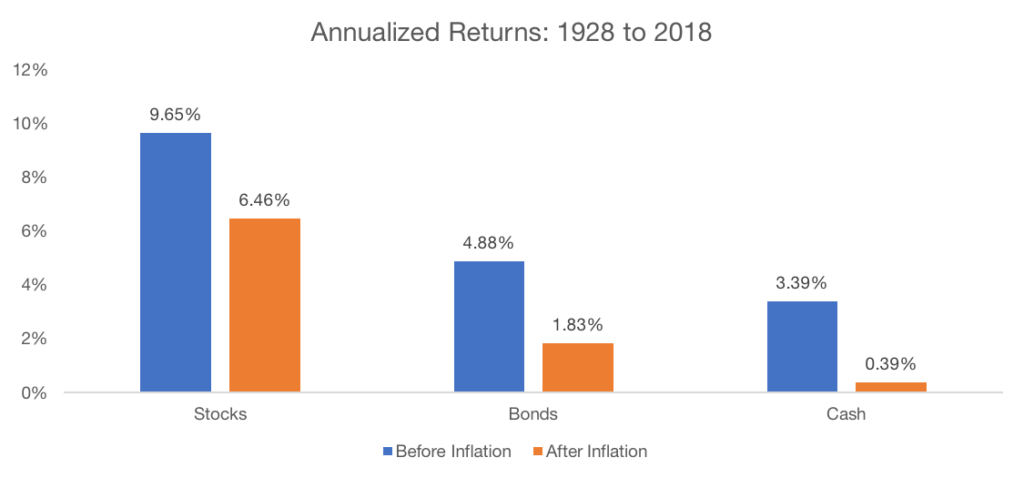

We see this all the time; most don’t understand their greatest risk is not keeping up with inflation. Purchasing power erodes like a Cape Cod beach after a strong Nor’easter. Choosing cash as a long-term investment option guarantees this result.

“In the investing context, failing slowly happens when portfolio returns are insufficient to generate the growth needed to meet one’s objectives. No one event causes this type of failure. Rather, it slowly builds over time. Think death by a thousand paper cuts or your home slowly being destroyed from the inside by termites.”

Data Source: http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html. Calculations by Newfound Research. Past performance does not guarantee future results.

Conservative investors: Burn this chart into your brain! Inflation, not market volatility, is the mortal enemy.

65-year-olds who plan on living for a couple of decades or more — take note!

Three ways to fail slow are:

- Failing to allocate money to stocks – Most don’t realize the biggest threat to their retirement is not the stock market; it’s not participating in it. Saving for thirty years (or more) in retirement will fail if your portfolio is heavily weighted toward “safe” investments, like cash and high-quality bonds. The seeds of compounding will not be watered and your retirement tree will eventually wither and die.

- Taking Social Security early – Slow fail exists here in epidemic proportions; one-third take their payments at age 62 to cash-in before the system “goes bankrupt.” Only 3% wait until age 70. This might feel comfortable but the long-term ramifications are deadly. Hundreds of thousands of dollars are sacrificed by retiring too soon and collecting too early.

- Thinking pensions will cover everything – People often grossly misuse the enormous benefit of a guaranteed pension and believe this gives them license to ignore investing in stocks through their 403(b) or 401(k) employer-sponsored plans. They shut their eyes to the fact the long-term average inflation rate of 3% will cut their purchasing power in half after twenty years. Many public pensioners have the option of retiring at 55. Having real income decimated by age 75 is a less-than-ideal situation, especially since the strong possibility exists of living two more decades in retirement.

To recap, here is the perfect plan for a slow fail:

- Not investing in stocks;

- Retiring early and collecting Social Security checks as soon as possible; and

- Letting someone else take care of you with a guaranteed pension.

Slow fail will eventually rear its dormant head. Sudden illness, severe inflation, or pension default changes things quickly. “Slow” suddenly can become quite fast.

“Feel good” investing is usually the wrong thing to do.

Remember this when you ponder “safe investments” as the prescription for long-term financial health.

Source: “Failing Slow, Failing Fast, and Failing Very Fast” by Justin Sibears