Why do people freak out when the stock market hits and roars past previous highs?

In other aspects of our lives, we are constantly surpassing old peaks.

Think of our age, each second we continue to breathe we smash through our previous records of longevity.

The same goes for the planet we inhabit. Life did not cease to exist after the dinosaurs and cavemen fell by the wayside.

Unfortunately, for many of us, the same can be said for our weight and total surface area of baldness. Middle age can be cruel in some record-high categories.

We fold most other “life peaks” into our daily routine without blinking an eye.

There is something about investing in the stock market after a huge run-up that terrifies people. This is despite the fact that markets have continuously broken through their past records.

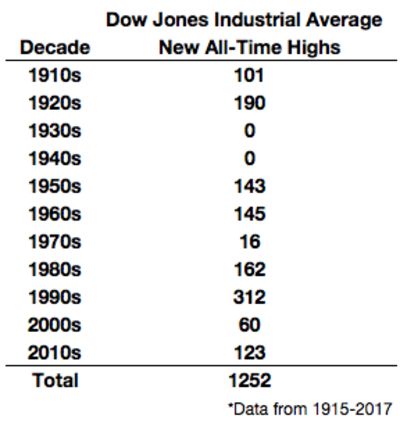

According to Ben Carlson, “The thinking is that any time stocks reach a new high it must mean that we are close to a peak that will surely bring the market crashing down. That is always a possibility, of course, but investors in stocks have to remind themselves that they will see many highs in a lifetime of investing. Generally speaking, stocks go up most of the time. A few of those highs will be temporary peaks but most will simply lead to even more highs down the road.”

Source: Ben Carlson

Like most other parts of our lives, a sound plan of action can alleviate much of this anxiety.

Here are four ways to protect your portfolio during a rampaging bull market:

- Lend money to the U.S. Government – A bad year in the Government bond market is equivalent to a few bad hours in the stock market. The beauty of an age-appropriate balanced portfolio is that it allows you to sleep at night. During bad times, bonds provide comfort. During good times they provide restraint.

- Invest across the world – From January 2000 to December 2009, the S&P 500 experienced a lost decade and was down 9%. This was not the case with a diversified global portfolio. This mix of various foreign and U.S. stocks and bonds returned about 7%. Currently, there are markets beyond our shores that are nowhere near record highs. Placing money in some of these areas can ease the daily Dow 24,000 headline stress. Diversification works, but not every year. Keep this in mind and act accordingly.

- Re-balance on a regular basis – The beauty of a globally diversified portfolio is the ability to consistently buy low and sell high with periodic re-balancing. The fear of holding stocks as they roar to records is countered by the fact that you are taking some profits along the way. This also works in the opposite direction. Having some dry ammo during bad times can be an investor’s best friend.

- Include a tactical model as part of your portfolio – A low-cost, rules-based momentum strategy can have many benefits for the individual investor. Some may call this market timing, but data and transparency combined with eliminating emotion-based decision-making can be an enormous benefit to investors. Few strategies offer the two-way strategy of getting out of the market with an evidence-based plan to get back in. Done properly, this can give you comfort to surf the upward wave of momentum. It can also help you avoid the waves that become too big and eventually crash — right on top of your portfolio.

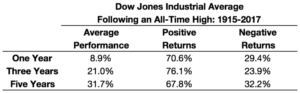

Many investors believe that when markets hit record highs, the next phase leads to a brutal crash. While sometimes this does happen, it often does not. Markets can stay in upward trends for a while.

Source: Ben Carlson

Markets do not necessarily have to crash when a rally’s run out of steam. They can go nowhere for long periods of time before the next bull ignites.

Don’t fear stock market highs. Have a plan for both good and bad times. Reactive (rather than proactive) decisions have destroyed more portfolios than the worst bear markets.

If stock markets did not continually reach new records, what would be the point of investing anyway?

Keep this in mind the next time someone tells you to sell your stocks because the market has gone up.

If you think this makes sense and would like to hear more, give us a shout out.

Source: Apollo Lupescu, Dimensional Fund Advisors