Investing is simple, but not easy. Warren Buffett coined this phrase and made billions by sticking to it.

Recently, I finished teaching my first-semester investment class through Osher Lifelong Learning Institute at Stony Brook University. Leaving my students something “Buffettonian” was a priority upon their departure back into the investment jungle.

Successful investing requires more common sense than A Beautiful Mind.

Your 140 I.Q. is more likely to hurt you, rather than help, when choosing when to buy and sell investments.

How could I dispense this counter-intuitive concept to my students in an applicable and understandable way?

Here is what I came up with.

Behavior.

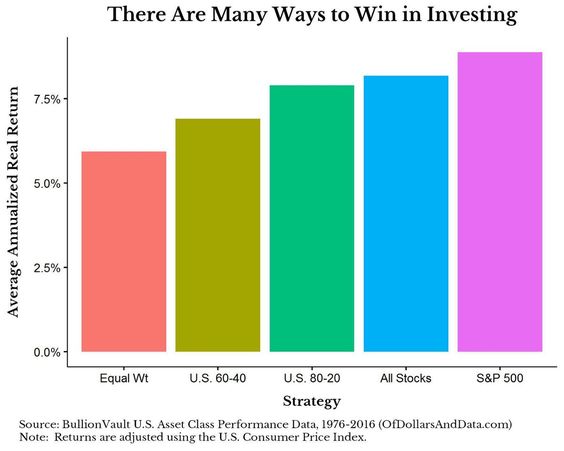

Most investment strategies work, as long as investors stick with them.

The problem is we don’t. Buying high and selling low is the most common result of our behavioral follies.

We rely too much on what recently happened to predict the future. We often seek out opinions to confirm our existing beliefs. We sell our winning investments and place more money into the losers. We love to invest in our home country and ignore diversification. There are dozens of other cognitive defects but I am sure you get the point.

How do we combat this propensity to self-sabotage our portfolios?

The simplest answer is to be aware of them. Thinking about your own behavioral imperfections before selling your stocks (based what you read in today’s newspaper) is a start.

Remember, YOU are your own worst enemy. The rest will take care of itself.

Costs

In the words of Vanguard’s founder, Jack Bogle, “In investing, you get what you don’t pay for.”

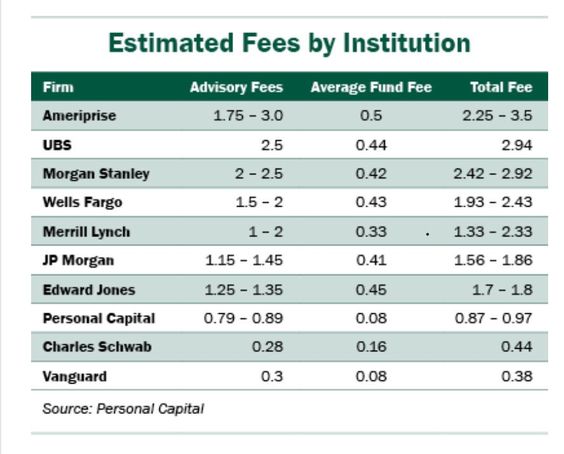

Morningstar determined the number one determinant of a mutual fund’s performance is fees. Avoiding high costs and conflicted financial salespeople posing as investment advisors will do more for your portfolio than anything else. This is something you can control. Market returns do not fall under this category.

Throw in limiting other investment frictions, like taxes and frequent trading, and your recipe for investment success becomes a gourmet meal.

Diversification

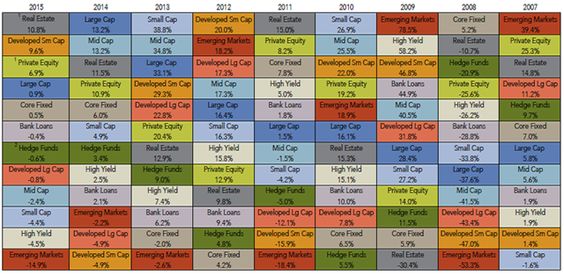

Proper diversification will not keep you from losing money in a down market; you will just lose less of it. It also does not work every year; it does work over time. There are very few “free lunches” regarding investing. This is one of them.

Unless you believe that you can predict the future (you can’t), spreading your hard-earned money among a globally-diversified portfolio of stocks and bonds IS the only sane strategy to employ.

Two additional components need to be utilized to realize the full potential of diversification: Dollar-cost averaging (investing a set amount of money on a regular basis) and periodic re-balancing back to your predetermined allocations.

This simple strategy is not easy. The siren songs of emotions, conflicted financial salespeople, and inertia keep many from achieving their financial dreams.

Warren Buffett once said, “There seems to be some perverse human characteristic that likes to make easy things difficult.”

I hope my students remember this the next time they think about doing something crazy with their money.

If you would like to explore these strategies in greater detail, we would love to hear from you.

Keeping it simple is much harder than you think.