“Anyone who stops learning is old, whether at twenty or eighty. Anyone who keeps learning stays young.” – Henry Ford

We love to teach people about the markets and investing. We have nothing to hide. Free lunches and sales pitches are not our thing. On Thursday, Barry Ritholtz, Dina, and I visited Barry’s Alma mater, Stony Brook University.

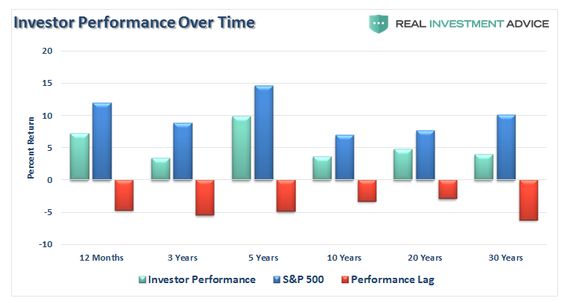

Our message was politics and investing don’t mix. (Stamp this into your brain.) Barry’s presentation included data proving human nature is our own worst enemy regarding money.

Our audience consisted of members Stony Brook’s Osher Lifelong Learning Institute. I am currently teaching an investment class in this program. Retired professionals who value continuing education more than early bird specials compose the student body.

We often focus on the crime scene that is our public school system’s financial literacy program. What about the adults? The train of compound interest has left the station for many older Americans, but their need to understand finance is urgent and important.

“I am seventy years old and I have no concerns about running out of money,” said no one ever.

Retirees can no longer count on their human capital, their jobs, to secure their future and counteract mistakes. Investments and pensions determine their standard of living.

Older adults suffer the same affliction as Millennials. Emotions take charge in times of stress. They are human beings, not robots.

Making decisions based on the words of financial prophets of doom, political partisans, and the daily noise of the media will devastate your portfolio.

Older Americans have the most to lose as the result of bad financial choices.

They risk their income stream and jeopardize money set aside for their daily needs. Capital that is permanently lost at this stage cannot be replaced.

Financial literacy is the one defense that stops this bloodletting.

Bad financial decisions have a dramatic effect on:

- A grandchild’s college education;

- Charitable donations;

- Health, in the form of monetary stress;

- Funding long-term care;

- A surviving spouse’s standard of living;

- Social Security checks;

- Working for need, not by choice;

- Your heir’s inheritance; and

- Tax bills.

Schools like Stony Brook University provide the venue to get the word out to older adults who many assume know this stuff; they don’t.

Just like Millennials, no one taught them either.

The beauty of evidence-based investing is never having to remember what you said or having to say you’re sorry. Our message is the same for everyone from 18-95: Emotions and high fees destroy returns; process over outcome.

Barry told a great story during the presentation. When he first started in the business as a trader he worked with veterans; military veterans, that is.

Their “war stories” were not about markets crashing. They involved people dying. Barry learned a tremendous lesson from these ex-soldiers on the importance of behavior control.

Before each mission, they would go through a detailed checklist of the logistics and all the other details of their mission. The most vital aspect of this exercise was their preparation for all unexpected contingencies.

- What would they do if their helicopter landed in the wrong location?

- How would they counteract a much larger than anticipated enemy force?

- What would happen if some of their equipment did not work?

These questions forced them to prepare BEFORE the bad stuff happened, not after. They were required to visualize their emotions during these stressful occurrences. They had to think, in advance, how they would react to a wide variety of stressful situations.

This story perfectly applies to investors and their reactive, rather than proactive, decision-making.

The point of Barry’s presentation was: there are plenty of murder holes out there that prevent you from controlling your emotions. Learning to control yourself and distinguishing signals from the noise are the keys to your survival in the market jungle.

Judging by the packed house and the intelligent questions at the end of our presentation, we accomplished our goal.

An attendee to our event said it best: “Some of the very few so called financial experts in the class may have been a bit humbled by the realization that they are not quite the fortune tellers they think they are.”

Financial literacy never has an ending, even for people who do it for a living.

Yeats once said, “Education is not the filling of a pail, but the lighting of a fire.”

No matter your age, keep the fire of learning ablaze.

If you are interested in learning more about our presentations, let us know.