Enduring boredom is the golden ticket for successful investing; the same holds true for most fields.

A famous Olympic weightlifting coach was once asked, “What’s the difference between the best athletes and everyone else?

He gave a surprising response: “At some point, it comes down to who can handle the boredom of training every day, doing the same lifts over, and over and over.”

Successful people are just like the rest of us. The big difference is they show up more in spite of how bored they may be with their daily training routine.

According to James Clear, the author of the terrific book, Atomic Habits: “The greatest threat to success is not a failure but boredom.”

When motivation dips, our natural inclination is shifting strategy. This also applies to things we do well. Boredom is a powerful change agent.

Machiavelli once said, “Men desire novelty to such an extent that those who are doing well wish for a change as much as those who are doing badly.”

The line between success and failure is defined by your tolerance for boredom. Endlessly repeating the same tasks breeds excellence but it’s not for everyone.

Nowhere is this more important than navigating financial markets. George Soros once stated, “If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring.”

Financial journalist Jason Zweig agrees. “In investing, only the survivors get paid.”

Never mind a CFA, good investors need a masters in IFOMO – Ignoring Fear of Missing Out.

There are several ways to grow wealth over time – none include having an Einstein-like I.Q., or the creativity of Michelangelo; in fact, it’s just the opposite.

Good investors need to:

- Give up hanging out with the Crypto and Pot Stock cool kids and learn to chill with nerdy Bogle Heads.

- Wait decades before realizing the fruits of their labor.

- Stay away from looking at their accounts during bull markets to see how much money they “made.”

- Stick with a few boring index funds and reject the allure of the latest and greatest hot fund manager.

- Contribute an equal amount to retirement accounts each paycheck. Missing out on the pleasure of stopping contributions when the market is plummeting and the joy of increasing them when the stocks are hitting new highs is the price of admission.

- Turn off financial media and instead read a good book or take a nap. (Both are better for health and wealth.)

- Spend more time discussing tax and insurance strategies than trying to figure out what company will be the next Apple.

- Understand doing nothing is a powerful strategy.

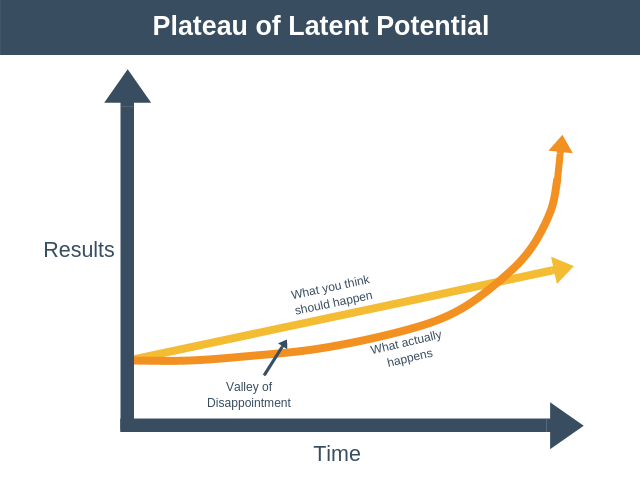

Overweighting excitement in an investment policy destroyed more portfolios than the worst bear markets. Compounding boredom is the ultimate wealth creator.

Investing sounds simple but it’s far from easy.

The ability to stick with a program that rivals the excitement of watching paint dry determines success or failure.

The number-one threat to investors is the inability to cope with boredom. Resist this urge and great rewards may be yours for the taking.

The question is can you wait for them?

Source: Atomic Habits by James Clear.