Getting married produces innumerable benefits.

Add building a heftier nest egg to the list.

Married people are 77% wealthier than singles.

According to the Journal of Sociology:

Married respondents experience per person net worth increases by 77 percent over single respondents. Additionally, their wealth increases on average 16 percent for each year of marriage. Divorced respondents’ wealth starts falling four years before the divorce, and they experience an average wealth drop of 77 percent.

Money is peanuts without good health.

Marriage plays a whopping role in creating irrefutable wealth.

Harvard Health Publishing uncovered the following data points.

Married couples tend to:

- live longer

- have fewer strokes and heart attacks

- have a lower chance of becoming depressed

- be less likely to have advanced cancer at the time of diagnosis and more likely to survive cancer for a more extended period

- survive a major operation more often.

A study in England determined that married individuals were 14% more likely to survive and leave the hospital sooner than their single counterparts among heart attack victims.

What about all the marital discord, the surly mothers-in-law, and other assorted knife fights associated with wedding bliss?

The data proves couples tend to be happier than single people.

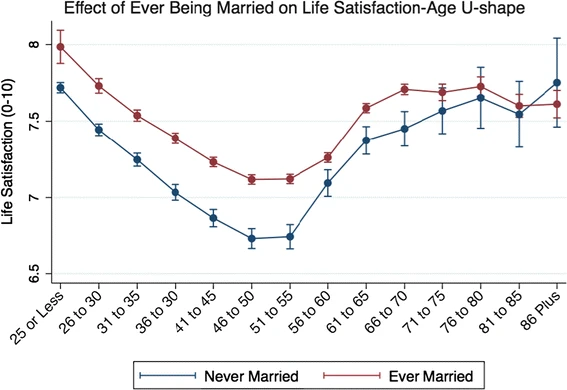

Source: Springer Link

The married have a less deep U-shape in life satisfaction across age groups than do the unmarried, indicating that marriage may help ease the causes of the mid-life dip in life satisfaction and that the benefits of marriage are unlikely to be short-lived.

Being a married financial planner, I strongly endorse matrimony as a wealth creation vehicle for most people.

Coupling for the sole reason of building assets is an absurd idea. Not that it hasn’t stopped people from trying.

Provided couples unite for the right reasons; there’s a world of wealth-creating opportunities ripe for the picking.

- Save more, spend less. Couples often live more economically. Housing and medical costs are the chief beneficiaries. The savings windfall from this arrangement is a game-changer.

- Better access to credit. Two credit scores are better than one. Possessing one high credit score provides thousands of dollars of savings over a lifetime due to lower interest rates.

- Social security benefits. One spouse claiming benefits at Full Retirement Age, while the other delays until age 70 deserve consideration. Implementing this strategy creates a form of life insurance. The lower-earning spouse collects a more extensive check if the higher-earning spouse dies first.

- Gifting money. Married couples are eligible to disburse up to $15,000 each without filing a gift tax return. Doubling to $30,000 when granted to the same individual. Translating into more money for a home down payment or a grandchild’s college education.

- Wage insurance. Two incomes are a valuable asset in the event of job loss. Foreclosure and high-interest credit card debt are often preventable if one income is uninterrupted.

All isn’t puppies and sunflowers.

Scott Galloway throws cold water on this rosy scene.

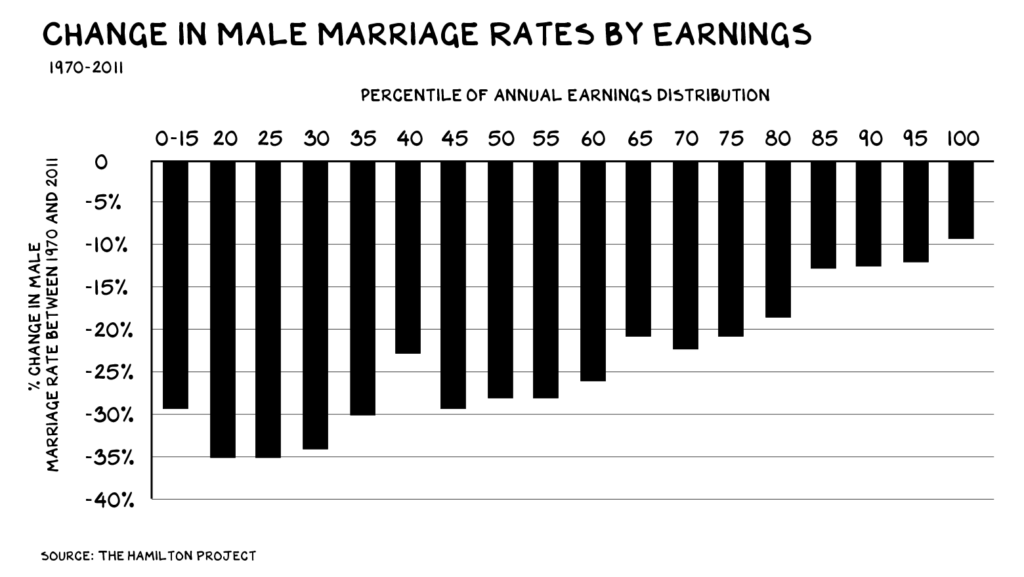

Marriage rates in the U.S. have been on the decline for decades. The group that’s seen the sharpest decline? Poor men.

I strongly suggest reading his terrific post. The potential societal implications are disturbing.

Despite this ominous warning, marriage is still a great deal.

Not tying the knot due to concerns over wealth destruction isn’t advisable.

Divorce yourself from this concept.

Financial stability is a terrific side effect of a happy marriage.