There is one thing even Democrats and Republicans can agree on. Most Americans are financially illiterate.

The InvestmentNews recently pointed out the extent of this epic fail.

From student loans to credit cards and retirement savings. We are a mess.

In one study, “researchers found in 2015 that only 30% of Americans were able to answer three simple financial questions about inflation, interest compounding and risk diversification”

The U.S. ranks only slightly higher than Botswana in adult financial literacy.

George Barany of the Consumer Federation of America points out the gravity of the situation.

“Americans are struggling and at times they’re clueless — and that’s a disaster recipe right there,”

We need to take a deeper dive into our current public education system to find the causes of this pandemic.

Ignoring reality, Let’s assume every district was mandated to teach financial literacy.

Would it really change things?

Working in the public school system for over 20 years makes me very skeptical.

Most school environments don’t resemble the real world. There’s a reason why many average students excel once they depart our public school system.

Things that matter that aren't taught in school

+ Outcomes over ego (change your mind, don't take things personally, etc)

+ If you want to go fast, go alone. If you want to go far, go together.

+ seek wealth (assets that earn)

+ Not all leverage is financialWhat am I missing?

— Shane Parrish (@ShaneAParrish) March 8, 2019

The Medium’s Bernie Bleske nails it.

Little is normal or natural about the classroom experience: the sitting, the listening, the testing, the vague activity, the writing, even the reading. A classroom does not mirror the kind of learning that takes place everywhere else. Learning outside the classroom involves deeply embedded context and direct experience bred first of need and then, when needs are satisfied, individualized curiosity and play and wants. People don’t learn to drive in a classroom; they learn by driving. On roads. And, as they achieve mastery, that learning gradually becomes a more complex and nuanced activity. Sometimes it’s even fun.

Few are compensated by a test grade once hired. The best way to learn is by making mistakes. In public schools, this leads to a concerned call to a parent or a poor test grade. Neither encourages behaviour which leads to real progress is made. Markets are an open system filled with unpredictable variables. Entropy rules. Schools are the antithesis of this.

Bleske continues:

Everything that can be mechanized, standardized or mass produced along a consistent, uniform, universal pattern of action or thought can be done more efficiently by machines than humans. We have applied that efficiency principle to the classroom and then denied any of the fundamental issues that arose as a result. The fundamental issue is that every student is different, and many resist mechanization.

Order and predictability need not apply to the world of investing.

Many schools defy all scientific evidence in designing the structure of their day.

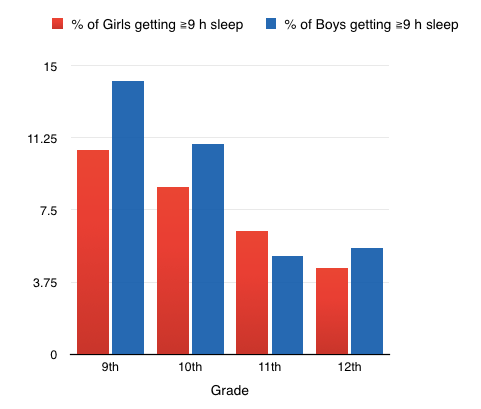

Both the American Academy of Pediatrics and the CDC issued a policy statement calling for middle and high schools to begin their day no earlier than 8:30 a.m. Teenagers natural body rhythms induce them to stay up and wake up earlier than adults. Violating this principle leads to severe consequences.

According to the Journal of Pediatrics, “Adolescents who get less sleep are at higher risk for depression, suicide, substance abuse, and car crashes.” Lack of sleep is also associated with obesity and a weakened immune system.

Despite the overwhelming evidence, only 20% of middle and high schools begin at 8:30 or later.

How do you think that 7:15 AM personal finance class is going to work out?

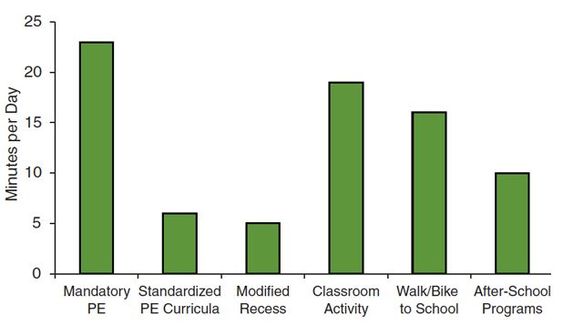

In keeping with the ignoring evidence trend, 40% of schools have eliminated recess or combined it with lunch. Daniel Pink points out, “Kids who have recess work harder, fidget less and focus more intently. They often earn better grades than those with fewer recesses. They develop better social skills, show greater empathy and cause fewer disruptions. They even eat healthier food.”

Finland has one of the world’s highest performing school systems. Students get a fifteen-minute break every hour.

We are doing just the opposite. Would a financial literacy course be effective if a student was taking it while missing lunch?

Teachers do the best they can in a system that hasn’t changed much from a century ago. School Boards and administrations often decree outdated or politicized policies. Schools were originally designed to mass produce assembly line workers. In an age of Netflix like customization, how do they justify 500 eighth graders all having the same textbooks?

Financial literacy is a major problem in this country. Schools can be part of the solution.

I’m not sure they can handle this challenge.

Sources: The Problem Isn’t the Students. It’s the Classroom. by Bernie Bleske, When The Scientific Secrets Of Perfect Timing by Daniel Pink Financial Literacy: An epic fail in America, by Greg Iacurci, InvestmentNews.