If I didn’t love the RIA firm I work with, I would do this 24/7.

Last week, Dina, Matt, and I spent close to 25 hours over five days, teaching a personal finance mini-course to 10-12th graders at The Stony Brook School.

Personal finance can’t be taught in one day or period. It’s a lifetime journey. A full week, though not long enough, gives kids a fighting chance and sparks their interest for further independent study.

A big criticism of financial literacy programs is they need to be taught in a “just in time” method. Teaching someone how to apply for a mortgage is much more effective right before they are about to purchase their first home rather than when they’re in high school.

Our course was successful using this metric.

A group of kids set up Roth IRAs and funded them using low-cost index funds. “Knowledge without application is useless” we hammered at them; some actually listened.

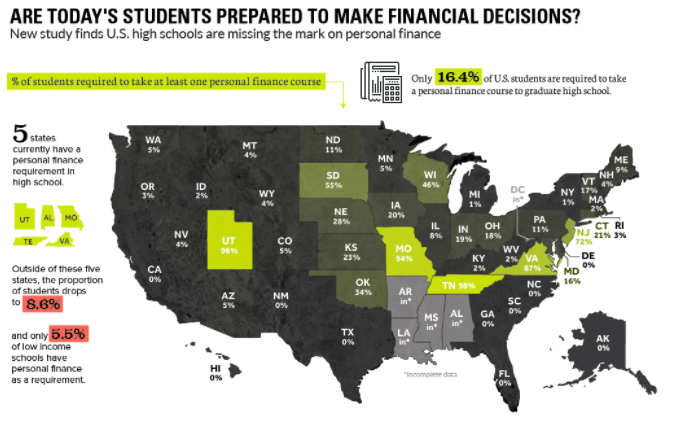

Teaching personal finance offers an inherent advantage over most other subjects; it is relevant to everyone. The dreaded “Why do we have to learn this?” is never applicable. It’s maddening that over 80% of U.S students are not required to take a personal finance course. About 95% of students attending low-income schools receive ZERO instruction. Teaching personal finance is the social justice issue of the 21st century.

It’s not rocket science to engage kids. Talking at them instead of to them is public enemy number one. We decided to motivate students by using group learning strategies, games, analyzing relatable blog posts, guest speakers, prizes, demonstrations and, most important, sincerity.

We set high standards – teaching over 90 terms to help build fluency in the unique language of money.

It worked.

Our strategy was attacking money issues they would immediately encounter as young people. No need for discussions on social security claiming strategies!

Credit Cards, Budgeting, Savings, College Planning, and Investing topped our list.

Mission critical was drilling into their brains the importance of earning compound interest instead of paying it. They now understand that no one has become rich by paying 23% interest and making the minimum payments on their credit cards.

We targeted budgeting using a pay yourself first strategy. Two terrific games drove home these points. One involved driving an Uber for a week to make a $1,000 mortgage payment. The other focused upon having a low paying job and struggling to get through the month with a positive balance and having to make the difficult choice of paying rent or eating. Learning empathy skills never hurt anyone.

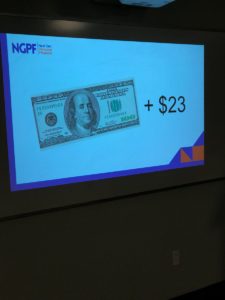

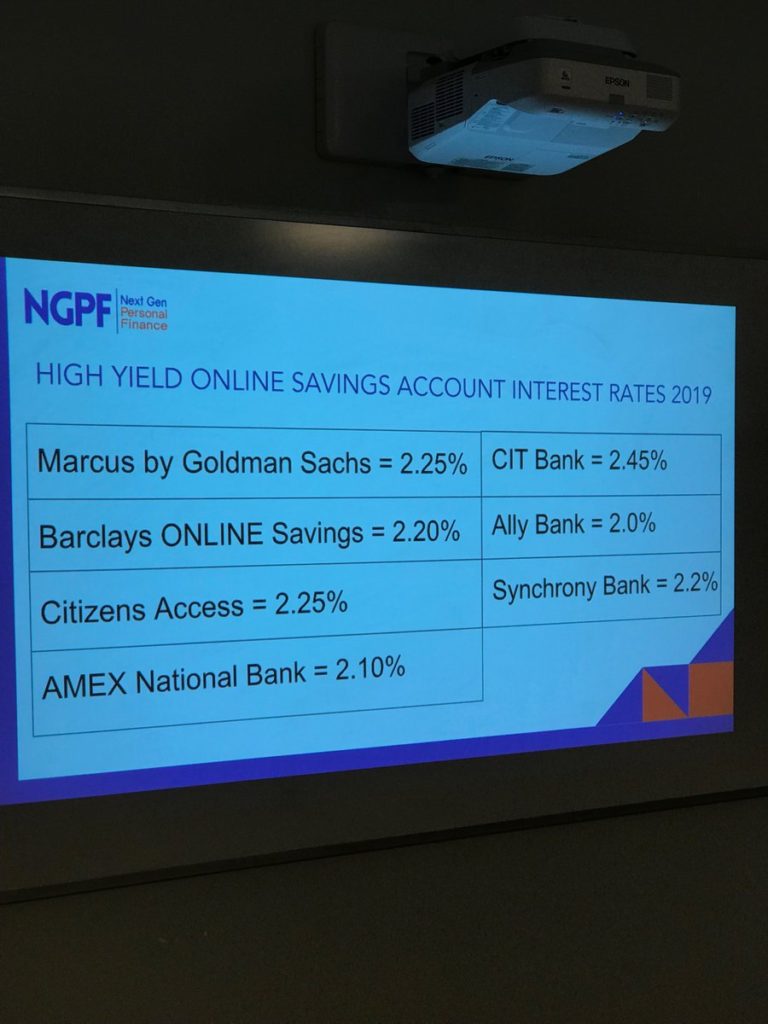

We assumed there was an excellent chance the money center bank they were using was gouging them on their savings accounts. We were correct. Many virtual banks pay much higher interest and have no minimums. Some kids switched their accounts that night!

Seniors were deeply involved in the college process. They were shocked to learn student loan debt surpasses credit card debt by a substantial amount. Our most important mission- explaining that all financial aid isn’t equal. There’s a huge gap between merit scholarships and work-study awards compared to debt.

We also showed them how to avoid the tricks “Instagram ready colleges” use to separate them from their money.

We played a game that taught them, tuition and room and board aren’t the only costs of college. Skipping the high-priced laptop and not having a car on campus will do wonders for their budget during their college years.

We dove into investing. Our mantra: Investing in capitalism over long periods of time always works. They didn’t need to listen to us. A video of Warren Buffett explaining this concept to LeBron James provided the clincher. We explained index funds using a real-time, interactive heat map. We spoke about international markets and how they are a huge part of the future and are key to proper portfolio diversification. Many of the students were foreign-born. Their eyes perked up when they heard this.

Our selling point was, “95% of the world’s population doesn’t live in the United States. Ignore these investment opportunities at your own risk.”

We explained if they wanted to be more aggressive investors, they could invest in small-cap stocks. The second best part of the class was when one of the students said he opened a Roth IRA and bought a small-cap value index fund!

Our finest hour occurred after a discussion of compound interest. We asked the class, “How much money do you think would result from starting with one penny and doubling it every day for 31 days?” Most adults struggle with this concept. One extremely bright girl got out her calculator and said “$10,737, 428.34.” Mic Drop!

Third place went to my son when he told me that I was a lot smarter than he thought I was. Teenagers are the best!

We played an investment game called STAX. Unlike the stock market game, this takes place over 20 years and gives students the opportunity to invest in index funds. The ability to trade stocks and commodities comes with the package. Soy beans destroyed more than one portfolio; lesson learned.

We brought in two engaging guest speakers: YouTube money sensation Yanely Espinal and CNBC reporter Darla Mercado. They provided youthful perspective on how teens should manage their finances. More important, they reinforced all the concepts we had emphasized all week. We can’t thank them enough.

We warned them about financial predators; showing them Dina’s testimony in Washington, D.C. got their attention and drove home our point.

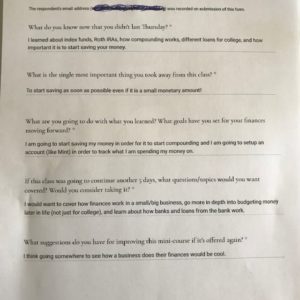

We spoke to 17 students and I think we made a huge impression. The completed evaluation sheets looked something like this.

Kids love this stuff. Many forfeited breaks to keep learning.

It’s a national travesty that financial literacy programs aren’t available and REQUIRED in ALL schools.

All of the software we used is free, thanks to NGPF.

Our speakers didn’t charge anything. We volunteered our time. The most expensive part is the opportunity cost of NOT doing this nationwide. The price of this tragic omission is incalculable. In the end, all of us pay more than we could ever imagine in future dollars for this educational epic fail. We can do so much better.

Start by clicking on the activity links and sharing them with a young person or two.

Teaching is much more productive than criticizing or complaining.

Who knows, if this works out, maybe one day our teacher classes will become a barbaric relic.

We’re not holding our breath.

A special thanks to economics teacher, Luke Trouwborst, and math teacher, Jackie Balchi, for their visionary approach to education. They are young and wise beyond their years.