The current Stock Market Game teaches kids all the wrong lessons.

Jason Zweig nailed it when he said: “If your own children are studying the stock market in school, you had better ask them what they have been learning. They might need to be deprogrammed.”

For many years my classes played and often won this contest. The banners still fly proudly in my old school.

Winning consistently due to leverage, triple inverse funds, and constant trading. For a three-month game, buying and holding Proctor and Gamble won’t cut it.

Coordinating the game forced me to violate all the investing principles I had painstakingly learned over the years. I was forced to guide the students into the dangerous world of short-term speculation, which I knew all about from my former days as a currency trader.

Finally, there’s a better way.

Introducing STAX, created by the non-profit financial literacy/technology company Next-Gen Personal Finance

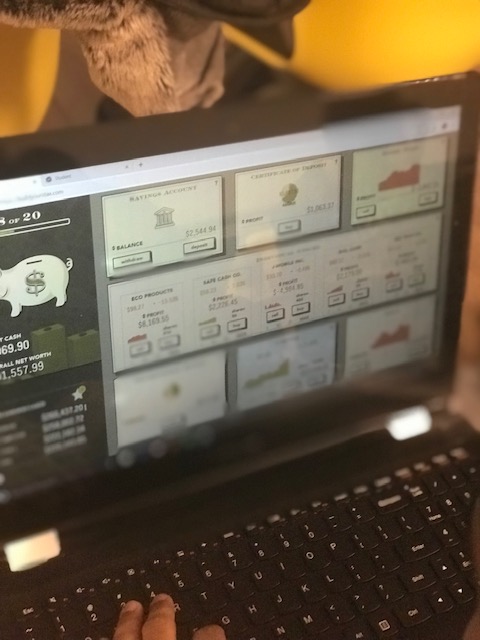

The game takes place over a 20 year period but takes just 20 minutes to play. Players get cash every 6 months and must decide how to invest it. They have a choice of savings accounts, C.D.’s, Bonds, Commodities, individual Stocks, and…….Index Funds!

The goal – building the most wealth over TIME. Students play against the computer or their classmates. Real 20-year interest rate and market returns are used and displayed at the end of the game. Don’t be surprised to see some 10% C.D.’s pop up.

Unexpected surprises like car accidents and hospital bills emerge. Students must come up with the cash to continue playing

At the end of the game, the next 20 years are compounded using the final dollar total. It’s a great way to show the kids millionaires aren’t made overnight. Forty years or so is more like it.

Before the game, descriptions are provided of all the asset classes. The students must check interest rates on the fixed securities to make sure they are beating the average inflation rate. Monitoring when C.D’s mature is essential.

The computer tends to do well. It uses index funds and doesn’t invest emotionally but the students can discipline themselves to triumph.

Real stocks with fake names are used during the game. At the conclusion, their identity’s are revealed.

We recently played this game with a group of 10-12th graders. The verdict was unanimous. They loved it.

In fact, during their 15-minute break, many refused to leave the room in order to continue playing.

All things considered, it’s a better game to get addicted to than Fortnite.

Our Observations from watching the kids play several games are:

Practice makes perfect. Play more, accumulate more wealth.

Diversification matters – a lot.

Stock and Commodity trading is not worth it. (What the hell are Soy Beans?)

Markets have different cycles.

Compounding works

High interest and inflation periods are possible – Adapt or die.

Unpredictable events are a feature not a bug regarding financial markets.

It’s fun to beat the teacher in a game.

Kids who get the highest grades in class might not be the best money managers.

The game is free and open to all. Thanks, Tim!

Being a former middle school teacher and the parent of 16-year-old twins, I know a little about moody teenagers.

Neutrality is considered a ringing endorsement during this wonderful age.

When a kid says they like something to a “lame” adult – something major is happening.

Try this game out with your own children if you don’t believe me.

You just might get addicted yourself.

I was yelling to myself at my desk today playing this. Pretty addicting

— Christopher Haigh (@iconocapital) April 2, 2019

If nothing else the requirement for winning isn’t shorting the Vix-Index with a triple inverse ETF. (Yes we did that in 2009)

Not everyone can go into schools and teach kids about investing.

What you can do is share this with a young person today.

You just might change their life.