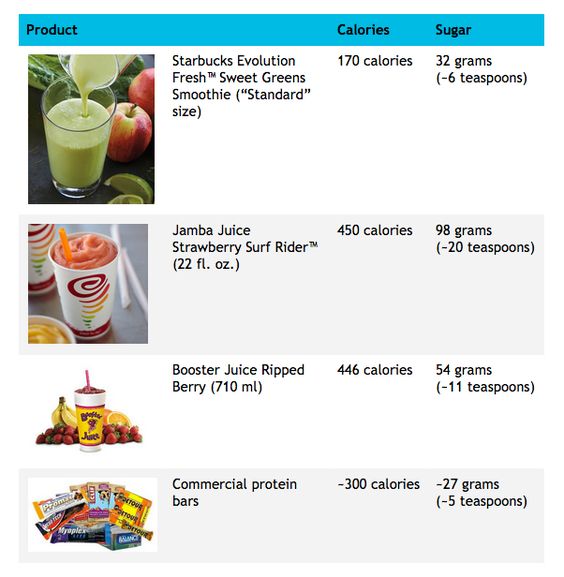

Some things “sound” good but are hazardous to your physical and financial health; for example, fitness foods and complicated insurance products.

According to Precise Nutrition, the popular sports drink Gatorade contains 32 grams of sugar. Combine this with a granola-based protein bar and your post-workout meal is equivalent to a deep-fried, jam-slathered Twinkie.

There is a subset of people that benefit from the energy/electrolyte infusion. Unless you are participating in things like 50-mile Sahara desert marathons, you are not one of them.

How does this relate to complex insurance products?

Most people (excluding Sahara desert marathon runners) would be perfectly fine with low-cost and simple-to-understand term life insurance.

Before the haters in the “Protection Business” start to hate (see below), there are exceptions.

Isn't the Mafia also in the "protection" business?

— Anthony Isola (@ATeachMoment) September 18, 2018

In a recent post, my colleague, Blair DuQuesnay, clearly showed who could benefit from permanent insurance (it’s a narrow list):

- You have an estate larger than the Federal (or State) estate tax exemption, and you want to provide your heirs with liquidity to pay the tax

- You have dependents who need more than the assets you can pass down to them to survive

- You are looking to shift assets outside of your taxable estate to pass to your heirs

- Your partners want to fund the purchase of your share of a privately-held business upon your death

Can you say (with a non-conflicted face) that the average Joe falls under most of these categories?

Why do so many of our friends and neighbors (teachers, police, firefighters and nurses) own these products?

Why were 62% of individual insurance policies purchased in 2015 in the permanent life category?

Maybe the percentage of high-net-worth individuals in our country is vastly understated.

Or, could it be the commission payouts are exponentially higher? Perverse sales incentives are terrific for clients (said no one, ever).

These policies have become the payday loans for the middle class; but not if you ask many insurance agents. They believe people need this stuff and fiduciaries are trying to confuse the public with “misinformed investment advice.”

Fee-only advisors aren’t ignorant about insurance products. They just don’t recommend the wrong ones to garner commissions.

A long, long time ago I had an interview with a large insurance company. They handed me a video and told me if I could sell five expensive policies to my friends and family, I would be hired to work with a “top producer.”

Insurers understand most trainees don’t pan out. After selling these policies to relatives and friends, many leave the business. The top producer gains sole possession of the client and commission stream. This is not an accident.

How else do you get an invite to the “Million Dollar Round Table?”

Sadly, this still goes on today.

If your insurance person gets very defensive about policy costs, understand one thing: fiduciary advisors are NOT the problem.

Conflicted agents have chosen a hill to die on. Questioning this model shakes their very foundation.

There is a direct positive correlation between agent anger and fee skepticism. Ask Blair about that.

As is the case with fitness foods — don’t believe the hype.

An inexpensive banana is a superior workout recovery food for 99% of us. Skip the prepackaged and heavily marketed fitness drink.

The same goes for your finances. Fee-laden financial products, like sugar-filled protein bars, often do more harm than good.

The recipe for financial success can’t be found in an investment because it “sounds good.”

Consume a heavy diet of low-cost index funds backed up by cheap term life insurance. Fee-only fiduciary advisors can design the right recipe for your particular situation.

Most of us don’t eat like a marathon runner or professional athlete.

Even fewer require complicated insurance policies they don’t understand or need, despite what the “experts” selling them might say.

Source: Precise Nutrition (Full Disclosure, I have a subscription to this site and would highly recommend it to anyone looking to create an evidence-based and easy-to-follow diet. And an added bonus is they don’t sell life insurance.)