Concentrate on improving the lifespan and healthspan of your money. The same principles will exponentially increase the quality of your life.

Dr. Peter Attia has a clinical interest in human longevity.

How can we extend our lives without destroying quality? Living to 100, but relying on a feeding tube doesn’t cut it. Just like the markets, longevity is complex and nonlinear; fraught with millions of unpredictable variables. The best health and wealth habits are no match for a drunken driver.

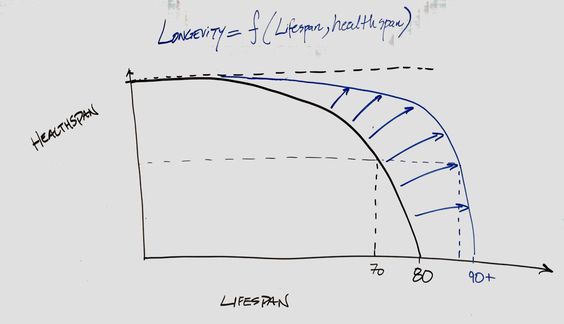

Dr. Attia created this graph to display his objective.

He came up with three elements, which, in his words, he defines as:

- Brain — namely, how long can you preserve cognition (i.e., executive function, processing speed, short-term memory);

- Body — specifically, how long can you maintain muscle mass, functional movement and strength, flexibility, and freedom from pain; and

- Spirit — how robust is your social support network and your sense of purpose.

How does this relate to our retirement goals?

Think of lifespan as how long your money needs to last, based on your time frame. Healthspan is the return needed to achieve your goals.

Investors need to control their worst behavioral instincts; specifically, our amygdala; the part of the brain that regulates emotional responses. The best financial plan cannot withstand our emotional attraction to short-term events.

Selling your entire stock portfolio during a 10-15% typical yearly drawdown fits nicely into this category. This behavior is fatal to the longevity of retirement accounts.

Humans need to stay active in order to improve their healthspan. Weight lifting and stretching are two ways most can delay the aging process. Too much activity can also be damaging. There is no need to complete a weekly marathon to achieve the benefits of exercise.

The same goes for your portfolio. Periodically rebalancing a diversified global portfolio will do the job. Less is usually more for investors.

Sleep is a major ingredient for a healthy body and your investments.

This doesn’t mean you shouldn’t be active in other financial areas.

Consistent and increased annual savings will offset periods of market stagnation. Consistently monitoring taxes, insurance, budgeting, and debt management are good ways to be financially active.

Focusing on the difference between needs vs. wants is a great use of weekly energy.

Finally, studies have shown people with active and healthy social networks have a longer and healthier quality of life. Good friends and family are riches that no amount of money can purchase. Quality over quantity matters most.

Limiting caloric intake leads to increased longevity. Follow the same advice regarding your consumption of financial news. Avoid screaming media types who over exaggerate market noise to enrich themselves, not you. Few on Twitter or Facebook know you well enough to give sound financial advice.

Make friends with great books. They provide knowledge that will last decades, not a daily news cycle. Ignore co-workers who espouse “common” knowledge about money matters that is neither common nor knowledge.

Stay away from salespeople who push products. Find yourself a trusted fiduciary advisor to get you where you want to go. We can certainly help you with that.

Good health and lasting wealth have much in common.

Source: “How You Move Defines How You Live”, Peter Attia, MD