It is hard to get something out of your system that you did for twenty years.

Even though I could not stand annoying helicopter parents or attending dumb ass meetings, I really enjoyed teaching kids.

A lot of people said I was pretty good at it; maybe I was and I certainly had fun along the way.

Stony Brook University has given me an opportunity to teach an investing course in the Osher Lifelong Learning Institute.

While my students are several decades older than what I am used to, it is still pretty cool.

Friday was our first class.

My goals are two-fold: First, teach my students how to construct and maintain a portfolio based on a sound process, not crazed emotion. My second aim is to instruct students on “investor self-defense” or AKA “How to avoid financial predators.”

This is an especially acute problem among our elderly. At the end of these 11 weeks, I hope to deputize my students and entrust them not only to look after themselves but also their friends and family. Compound, and compound some more.

I wanted to start the class off with a bang. Investing success is determined by time in the market, not market timing. Sticking to a plan will often bring gargantuan rewards even though things can get very dicey along the way.

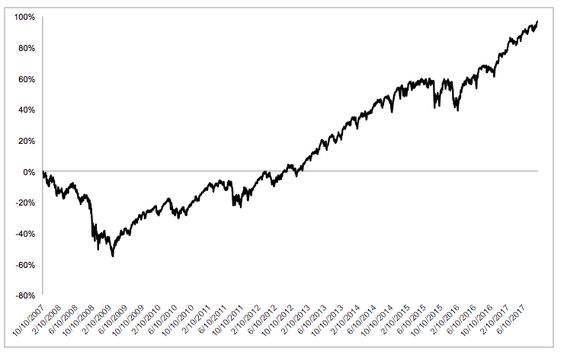

This chart from my friend and colleague, Michael Batnick, served as what those in the business call an “anticipatory set” (i.e., something to get their attention, big time).

This potent graphic displays how investors were rewarded for patience even if they were the world’s most unlucky or clueless investors (who invested all of their money in the S&P 500 at the market peak right before the great recession). In the end, their money doubled a decade later.

There is one big caveat to this: Only investors who held on for a violent ride straight out of Fury Road earned these returns (lots of market War Boy’s trying to take stuff)!

I next showed them this terrific article from The New York Times by Jeff Sommer, in which he notes that since 1926, 4% of all stocks accounted for 100% of the market’s gains. The majority of stocks performed worse than Treasury Bills.

They quickly realized we would not speak about individual stocks in this class; not because I am an arrogant jerk, but because the data speaks for itself.

I found it pretty interesting that many students could not tell me what an index fund was. One actually believed it was some sort of “a ladder, piling things on top of each other.” I’m not sure where that came from but I am always open to new ways of looking at things.

Before they left I gave them an assignment that I think would benefit any investor. I told them to go home and do three things:

- Ask the person who is managing your money if he/she is a fiduciary, legally obligated to look out for your best interests. Many students were shocked to discover this was not a prerequisite for financial advisors. They have so much to learn.

- Take out your statements and determine if you are diversified. Do you own a mixture of both stocks and high-quality bonds? Do you own some foreign stocks? Does the proportion of stock you own match your risk tolerance? I am frightened to see what they come back with.

- How much are you paying for your investments and advice? What do your individual mutual funds charge as annual expenses? If you are paying an annual fee, what is it? Most importantly if you are paying 1% or more for just investment management and no comprehensive financial planning, you need to really think about the value you are receiving for your money.

The students feverishly wrote this down. I am sure the list of financial salespeople who hate me will grow after some of the questions they are going to be presented with this week. Good!

Finally, when was class was over I was approached by an elderly Japanese-American gentleman. English was not his first language. He asked me, “If buying, holding, and occasionally re-balancing index funds were the secrets to investing, do I have to come to any more of the classes?”

I politely told him, “Sticking with a plan like that is easier said than done. There is much more to it.” I then said, “If you think you can do this through thick and thin, you can stay home.” He promised me he would come back next week. I hope he does.

Stay tuned, we have just begun. Next week, in another setting, I will have the opportunity to teach middle and high school kids again. As usual, I will most likely get more out of this experience than the students.

Teaching is still the best job in the world. Very few people get to be Rock Stars without the bad side effects.

Sources: New Highs Should Be Bought, Not Sold by Michael Batnick, and The Best Investment Since 1926, Apple by Jeff Sommer.