VOTE is a four-letter word; especially when the House of Representatives is involved.

Our elected representatives have concocted something called The Financial Choice Act, A.K.A. “You Gotta Fight For Your Right To Party.” If this proposed bill is turned into law, the Dodd-Frank Act of 2010 would essentially be gutted.

No one is saying Dodd-Frank is perfect. The way small banks are treated, in relation to large ones, is an area that needs to be reformed. There are also fair arguments about how much capital banks should hold in reserve, instead of lending out to various folks.

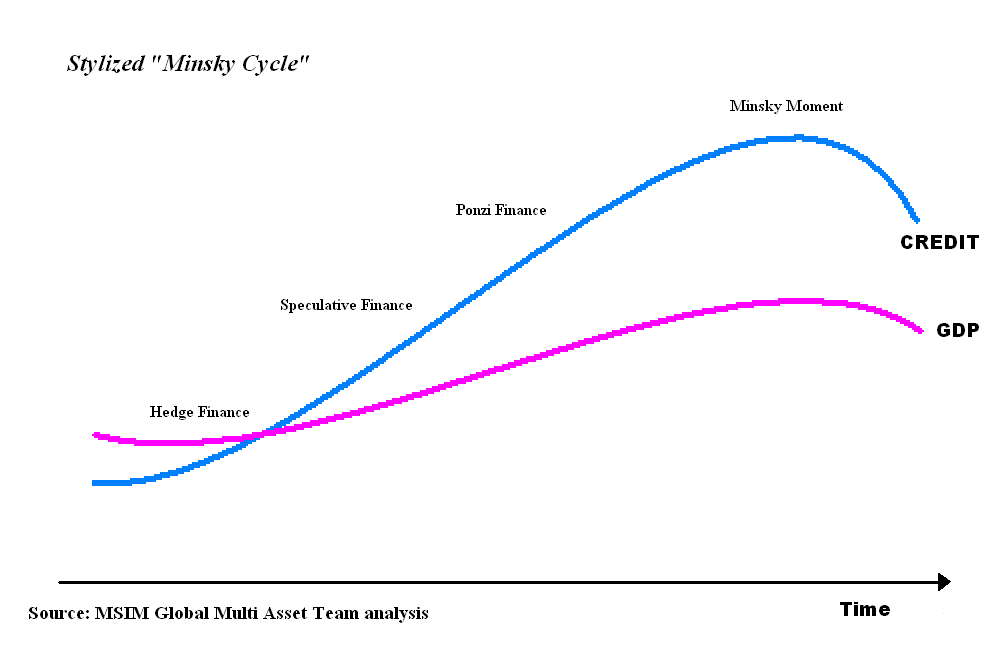

The problem is the House of Representatives seems to be hell-bent on creating its own version of a Minsky Moment. This occurs when people become too comfortable with economic stability and start to move further and further out on the risk scale. I don’t have to tell you where this usually ends. Encouraging speculation through deregulation and unsustainable growth led to the “Great Recession of 2007-2009.”

Here we go again! If these guys get their way we will have to deal with another yet-to-be identified catastrophe.

It seems that this gang that can’t shoot straight (affectionately referred to as Congress, among other censured terms) is very confused about what the word CHOICE actually means.

Let’s take a look at some off the “highlights” of this proposal:

- The Consumer Financial Protection Bureau (“C.F.P.B.”)would be dramatically changed. According to The New York Times, the House proposes to “strip the agency of its supervisory and examination authority. It would also remove the bureau’s authority to police “unfair, deceptive, or abusive acts and practices.” Under the plan, the agency would lose its oversight of the payday loans market and arbitration agreements — two areas where it has sought reforms. The bureau would be renamed the Consumer Law Enforcement Agency.” The C.F.P.B. uncovered one of the biggest frauds in recent years: The Wells Fargo fake account scandal. Some members of Congress believe the agency has outlived its usefulness. More likely, our elected representatives find financial lobbyists more useful. Americans can again have the “choice” of unknowingly being part of a mass identity theft scheme.

- Under this bill (a “gift” to the mainstream financial services industry) the Volcker and Fiduciary Rule would be vaporized. Americans would now again have the “choice” of watching big banks trade for their own gain with taxpayer-insured deposits. Let’s make Jon Corzine great again! The proposed bill would also give investors the “choice” of having their retirement accounts ravaged to the tune of about $17 billion a year. Why would anyone want to work with a financial advisor under these monopoly conditions? Choice would be eliminated if ALL advisors had to work in your best interests regarding retirement accounts.

- My personal favorite is a “new and improved” relationship between Congress and the Federal Reserve. According to The New York Times, “the legislation would limit the Fed’s independence by imposing a rules-based approach to monetary policy and opening the central bank up to annual audits.” This should give us all comfort. After all, it’s the Federal Reserve’s fault we have been experiencing sub-par economic growth over the past decade. Congress passed effective stimulus which upgraded our decrepit infrastructure, reformed our out-of-touch public education system, and tackled our country’s dangerous inequality problems. Of course Congress should have more control over our monetary policy since they have done such a wonderful job fulfilling their assigned duties. Extreme sarcasm aside, imagine the global chaos that would occur if these yahoos were allowed to fulfill their disturbing Allen Greenspan fantasies?

There are many more components to this 600-page legislation. When one takes a “fair and balanced” look at it, all the ingredients for our next financial crisis are included in this pot of economic insanity. Enjoy the good times while they last. Maybe flip a few houses, or do some cash-out mortgages to pay for a destination wedding to Tahiti.

Savor the good times while you can if this witch’s brew of deregulation is passed as is. Eventually, someone will have to pay the piper. If you don’t believe me, just ask Hyman Minsky.

Source: The New York Times, How House Bill Would Dismantle an Array of Dodd-Frank Reforms by Victoria Finkle