The misinformation spread by lobbyist groups in order to derail the fiduciary rule would make “Baghdad Bob” proud.

Just like Saddam Hussein’s delusional director of communications, they have cornered the market on fake news.

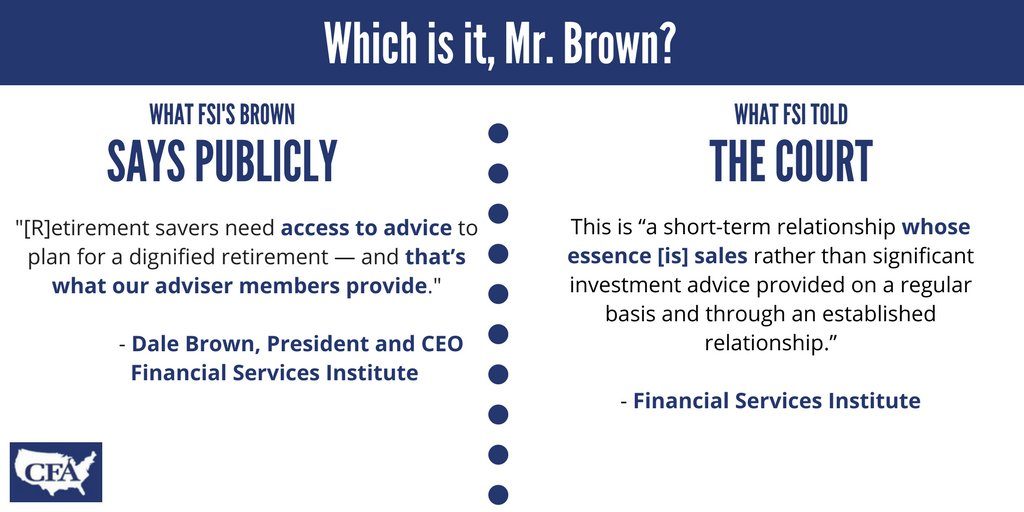

Organizations such as the U.S. Chamber of Commerce, Financial Markets Association (SIFMA) and the American Council of Life Insurers, among others, have deliberately repeated the tired mantra that this rule will price millions of small investors out of the market for financial advice.

Not to be denied, The Wall Street Journal (“WSJ“) decided to pile on in a recent editorial.

“Small investors may also find themselves at the mercy of robo advisers that may have a hard time discerning their client’s best interest. Want to know whether to boost your investment in health stocks if Obama Care is repealed? Ask Alexa. Robert Litan and Hal Singer have estimated that depriving small investors of human advice could cost clients $80 billion in a downturn. Mr. Trump ordered Labor to review and perhaps rewrite the rule that was scheduled to take effect in April.”

Perhaps these “facts” were provided by the investment companies that advertise in this periodical? It seems more likely that the WSJ is simply acting as a shill for their sponsors (as opposed to actually believing this nonsense).

This is the warm up act to the Lollapalooza of the industry’s big lie defense. “The rule requires brokers to act in the “best interest” of clients, though many investors will be harmed. The rule will make investment advice too expensive for many small investors as brokers eliminate commissions and instead charge fees.”

Pretty much every company under the sun now has a platform to service small investors; from industry behemoths, like Vanguard and Fidelity, to small start-ups like Stash and Acorns. Numerous forward-thinking firms are coming up with unique, low-cost platforms to service these individuals.

When a conflicted financial salesperson sells a product to a small investor, the costs are ridiculously high. Often the product is in the form of a Class A-share, which comes with a 5% upfront commission. Next, the mediocre, actively-managed fund expense ratio often exceeds 1% or more yearly. The costs are often higher if you include trading commissions and the negative tax consequences if the fund is placed in a non-retirement account.

This is actually the “good” scenario. Too often small investors are sold illiquid variable annuities or non-public REIT’s, which could cost four times as much!

Today, an investor with a small balance can have a portfolio managed by a firm, such as Betterment, for 0.25-0.50%. Add in fund fees of 0.20%, or so, and the all-in number is just 0.50% for a globally diversified portfolio; ideal for 99% of small investors. In addition, investors will also be able to speak to a human being, further destroying another myth generated by opponents of the fiduciary rule.

Better yet, small investors won’t be pressured to buy expensive banking or insurance products that are part of the conflicted “cross selling” culture of many of the firms that oppose this rule.

Our CEO, Josh Brown, appropriately labeled the day that the decision was made to scrap this rule as “Black Friday” for investors.

In the words of Paul Krugman, the main accomplishment of the fiduciary rule’s opponents will be to: “Make financial predators great again!”

Sadly, they are well on their way to achieving this.