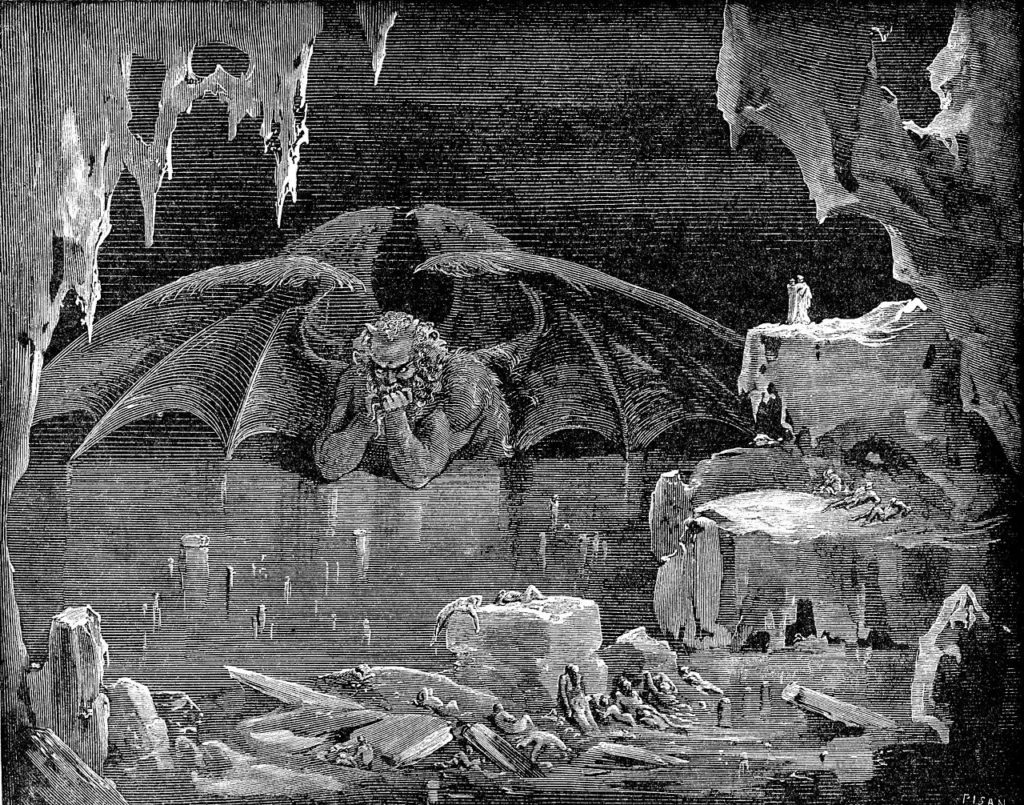

“There are many new sinners today but there are not any new sins, just the old ones clothed in different rags” – Billy Graham

Bad incentives cause bad behavior. The financial services industry is a prime breeding ground for this type of unethical behavior.

Excessive compensation will cause the average person to do, and justify, just about anything.

The sins found in financial services are nothing new and have been around since the beginning of recorded history.

The only thing that is different is the context in which they take place.

The seven deadly sins can be defined as abuses or excessive versions of one’s natural faculties or passions.

This is kind of like a financial advisor having the natural desire to make money, but abusing the position by placing clients into high-cost products in order to collect more compensation and win a trip to Tahiti.

That being said, we can look at these eternal human vices and easily place them into categories that abusive financial salespeople use to milk their clients.

- Pride. Many advisors believe they have the ability to forecast the future (e.g., stock price targets and yearly S&P 500 closing levels). This excessive pride attracts client assets, but leads to bitter disappointment in most cases.

- Greed. This one is too easy. Is there any other reason to put a variable annuity in a tax-sheltered account? Making clients pay for the privilege of tax deferral when they already get it for free defines greed. Greed is good for conflicted salespeople, but not their clients’ account balances.

- Lust. Selling recent performance to satisfy investors’ lust for not being left out of the latest fad is inexcusable. Unlike a reckless bartender, who keeps filling the glasses of drunken patrons, the job of a good advisor is to say no to the lustful urges of their clients. Adding more tech stocks to an already overweight portfolio in 1999 was no different than being an enabling bartender.

- Envy. The financial equivalent of keeping up with the Joneses would be taking part in the latest hot I.P.O. or buying condos in 2006. Too many advisors encourage clients to believe what happened recently will happen again (the recency effect), instead of heeding it as a cautionary tale.

- Gluttony. The sinners have clients load up during the bull market and liquidate during the bear. In both cases, financial salespeople collect their hefty commissions. Financial salespeople encourage clients to do the opposite of a sane investment strategy. Buy high, sell low, rinse and repeat is a financial sin of the highest magnitude. Good advisors go against the grain and force clients to do things they do not want to do with their money. This requires a system of rebalancing, which encourages gorging on low prices and dieting during times of excess market speculation.

- Wrath. The financial services industry is male dominated. Too many advisors direct all their attention to the man of the house and have little or no concern for his female partner. Their lack of concern for the differences in the way men and women process information infuriates women. No one appreciates being dismissed or feeling irrelevant.

- Sloth. Selling unpredictable returns instead of crafting a financial plan to help achieve clients’ financial goals is a mortal sin. To carelessly ignore things like tax implications, social security strategies, and college planning should be considered malpractice in the financial services industry. The lazy man’s version of picking last year’s top-performing fund and calling it a day is a very poor excuse for financial advice.

We are all sinners and this is nothing to be ashamed of. The problem arises when our sinful behavior has no constraints. These primal urges are unleashed in their full fury by obscene compensation structures. Things like 10% upfront commissions and sales contests are throwing kerosene into the fire of our worst intentions.

This is not to say that choosing a career in sales will guarantee a one-way ticket to eternal damnation.

In the words of my colleague, Ben Carlson, “There are perfectly acceptable forms of sales that don’t require you to rip someone off.”

Selling knowledge and educating others so they can make informed decisions is a noble profession.

Currently, we are trying to do this in the 403(b) space. Teachers have been misinformed by salespeople who were motivated by highly conflicted sales incentives instead of serving their clients’ best interests.

We are trying to give teachers enough information to make a knowledgeable choice regarding their retirement plans. This requires the “selling” of concepts like evidence based investing, and holistic financial planning, over stories and marketing gimmicks.

We are encouraged by the initial early reaction to our “sales” approach, as compared to the typical hard-sell techniques most are accustomed to.

Our sales pitch is based upon awareness and empowerment, rather than deception and fear.

In the end, we all have to choose how we wish to buy and sell the services that are constantly offered to us in a free market society.

Nothing is predetermined regarding our actions and everyone from the consumer to the sleaziest of salespeople has the ability to pivot and change their ways.

In the words of Oscar Wilde, “Every saint has a past, and every sinner has a future.”

This is true in finance, and in life, in general.

[…] ‘7 Deadly Sins of Financial Salespeople’ – Anthony Isola – A Teachable Momen… […]

[…] The seven deadly sins of financial salespeople. (tonyisola) […]

[…] Die sieben Todsünder von Verkäufern von Finanzdiensleistungen (Englisch, tonyisola) […]