Dina, here…

In a world where women continue to earn just $0.79 for every $1 earned by men, there is another inequity at work that seems to threaten their financial security when they will need it most, in retirement.

Designed to be a “benefit,” their retirement plans may do more to secure the financial future of the sales guy peddling high-priced annuities, and at their expense. This is the conflicted and tainted world of the 403(b), which is a retirement plan offered to employees of non-profit employees, such as teachers and nurses/healthcare professionals (77% of whom are women, according to the Department of Labor).

For years, Tony and I have worked with teachers, sorting through their 403(b) options to assist them in making the most appropriate choice. Over the last few years we have noticed a very disturbing trend: the list of viable options has shrunk and/or is non-existent in some cases.

Low-cost mutual fund options have been replaced by high-cost loaded funds and a plethora of high-cost annuity products, which have the shackles of “surrender fees.” We have done the unimaginable and actually dissuaded some from even participating in their plans. A Roth IRA or Traditional IRA invested in good, low-cost options trumps a basket of over-priced, awful investments every time (even taking into consideration the benefits of salary deferral).

Why are these poor options even permitted in the 403(b) plans? At the risk of over-simplifying, 403(b) plans do not follow the same rules (ERISA) as the private-sector retirement plan, the 401(k). Employers do not have a fiduciary responsibility to educate their employees about the options, nor are they required to ensure that the products offered are in the best interests of their employees (translation: reasonable fees, diverse offerings, and transparent).

Unfortunately, 403(b) retirement plans aside, women already have a deck stacked against them when it comes to personal finance. For starters, they are less informed when it comes to financial matters than men.

A financial literacy study conducted by the Global Financial Literacy Excellence Center showed that 16% more men correctly answered questions relating to inflation, interest rates and the stock market versus the women participants. Does this make women more qualified to slog through a 500-page prospectus, which typically accompanies a complex annuity investment? And, more important, does this make them easy prey for slick-talking insurance reps hocking annuities (coincidentally, a field dominated by men)? Wink. Wink.

The data is compelling: According to the Spectrum Group, 76% of 403(b) assets are invested in annuities. The remaining 24% is in mutual funds but, unfortunately there is no way of knowing what percentage is in low-cost funds versus loaded funds, nor how this data breaks out by gender.

Fees cut into performance, plain and simple. Higher fees equal lower returns; and yet women need all the help they can get in preparing for retirement. Consider these facts:

- Between 80-90% of women will be responsible for their household finances at some point in their lives be it due to divorce or the death of a spouse.

- Retirement funds will need to last longer for women due to their longer life expectancies.

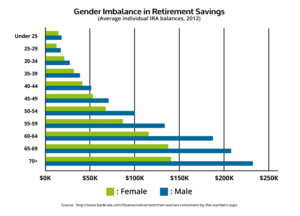

- Women have less saved for retirement for a number of reasons: they are more apt to have taken time off from work to start a family or care for a loved one. This not only translates to less savings (see chart below); but lower social security benefits.

I don’t believe anyone should have a lackluster retirement plan, but it particularly bothers me to see a vulnerable population being slapped, instead of offered a helping hand.

What would it cost, really, to grow a conscience? What would it cost to educate women so that they could safely navigate these foreign waters and gain a position of strength instead of being exploited due to their ignorance? Why can’t good options be had, simply because it is the right thing to do?

As a two-person independent firm, Tony and I knew that we couldn’t move this needle on our own. So, almost one year ago, we joined Ritholtz Wealth Management (“RWM”) hoping to correct this wrong. We are pleased to have the opportunity to work with Aspire to offer RWM portfolios as an option in 403(b) plans. Of course, there are school districts where Aspire is not an option; we are working hard to change that, too.

Our focus is to educate and empower teachers (especially women) so that they can rest assured that their financial plan is adhering to fiduciary standards (that is, it serves their best interests; is low-cost, diversified, and transparent). If you are interested in learning more about this program, please hit the contact button and drop us a line. In addition, my blog at Real$martica is designed to help educate women, children and families about personal finance matters. Please feel free to contact me with any questions or suggestions for future blog topics.

Ladies, don’t despair. Chivalry may be hard to find; but it’s not dead.

[…] ‘The World’s Most Sexist Investment’ – Anthony Isola – A Teachable Mom… […]

[…] The World’s Most Sexist Investment? – This is the conflicted and tainted world of the 403(b), which is a retirement plan offered to employees of non-profit employees, such as teachers and nurses/healthcare professionals … […]