Most schools do a horrible job of teaching kids about money. Why do our current presidential debate topics include such gems as which candidate wet his pants on stage? I have not heard one mention of the plague of financial illiteracy that afflicts our youth. The tune of one trillion dollars in student loan debt should be one massive wake up call to the urgency of this issue.

This has been a large contributor to the moribund economy. This debt has stifled entrepreneurship and contributed to a lackluster housing recovery due to low levels of new family formation. Financial literacy has the ability to add a point or so to our G.D.P., not to mention the effect it could have on our pending entitlement crisis!

I taught public school for over twenty years. I did my best to try to incorporate economics and finance in every unit. Being a history teacher made this easy. Why did Columbus come here in the first place? Gold! Why did the colonists rebel? Taxes! What started World War II? The Axis coveted land and resources. What started the clash in the Civil War? Different economic systems dominated the debate.

Are you seeing a pattern here? How can a student understand history without grasping economics? Admittedly, I had a huge advantage being a former economics major, currency trader, and current Certified Financial PlannerTM. This does not mean other teachers could not do the same thing with more professional development and some initiative.

The Wall Street Journal had a great article about how some teachers bring economics to life in their classroom. Newsflash, most kids love to talk about money. This is the one subject to silence any student chorus of “Why do we have to learn this?”

A prime motivational tool for learning is being able to apply the subject matter to your own unique circumstances. I used to tell my students, “Most of you will not become historians, writers, mathematicians or scientists, but all of you will need to know how to manage your money.”

I always had an enthusiastic audience, few behavioral issues, and tremendous parental support when I taught these lessons. It was the best type of business deal: everybody won. The students, district, and parents all enormously benefited from this endeavor. Not to mention myself, because I had a blast doing this!

Why is this not mandatory for all students nationally, instead of just being a grade 12 requirement in a few states? The big problem from my experience is teachers themselves are not knowledgeable on the subject manner. If they do not understand it, how can they teach it?

I am not blaming the teachers, but I do hold individual districts, states and the Department of Education accountable. Why are economics and personal finance courses not mandated subjects? Is there any sane person out there who could provide a reason for this omission?

During my teaching years, I had to attend 18 hours a year of “professional development.” Let’s just say much of this time was not optimally spent. This time could be spent training teachers how to creatively engage students in a subject most are already interested in.

There are many organizations that provide free creative lesson plans. I used to play financial football with my students, and always participated in the Stock Market Game at no financial cost.

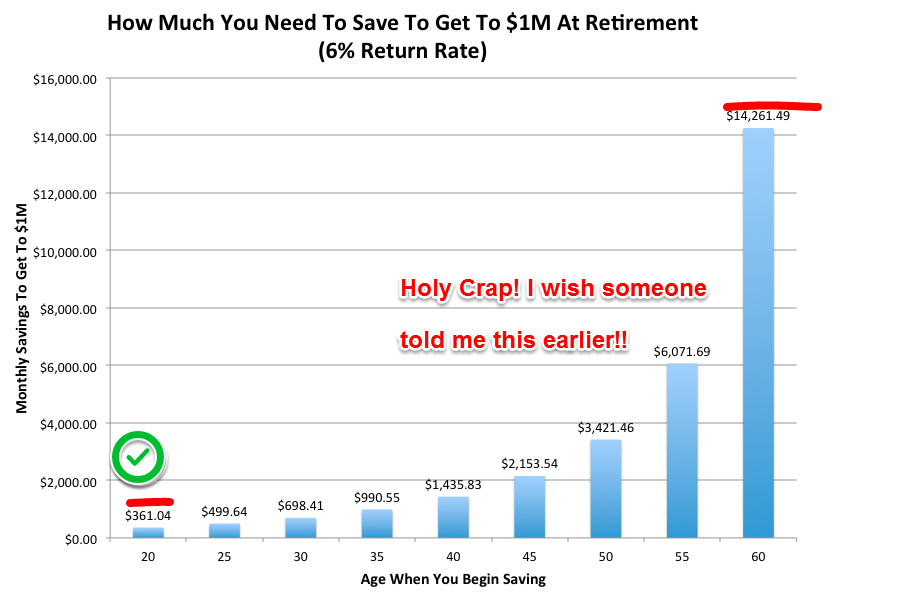

One of my favorite lessons was compound interest. I used this interactive calculator to amaze the students with the magic of compounding at an early age. I told them there are two types of people in this world, those who pay compounded interest (debtors) and those who take advantage of it (investors), and asked them which one they would rather be.

What a wasted opportunity for our country. Maybe if enough young people come out of college with six-figure debt, no job prospects, and take up permanent residence in their parents’ basements, things will change. School districts, local communities and the government need to reassess their educational priorities before it is too late.

Many of my former students have gone on to careers in finance. I hope I played a small part in this.

We owe it to our children to do better than this.